Question: examination paper. DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO 1 SECTION C - 75 MARKS Instructions: This section contains Four

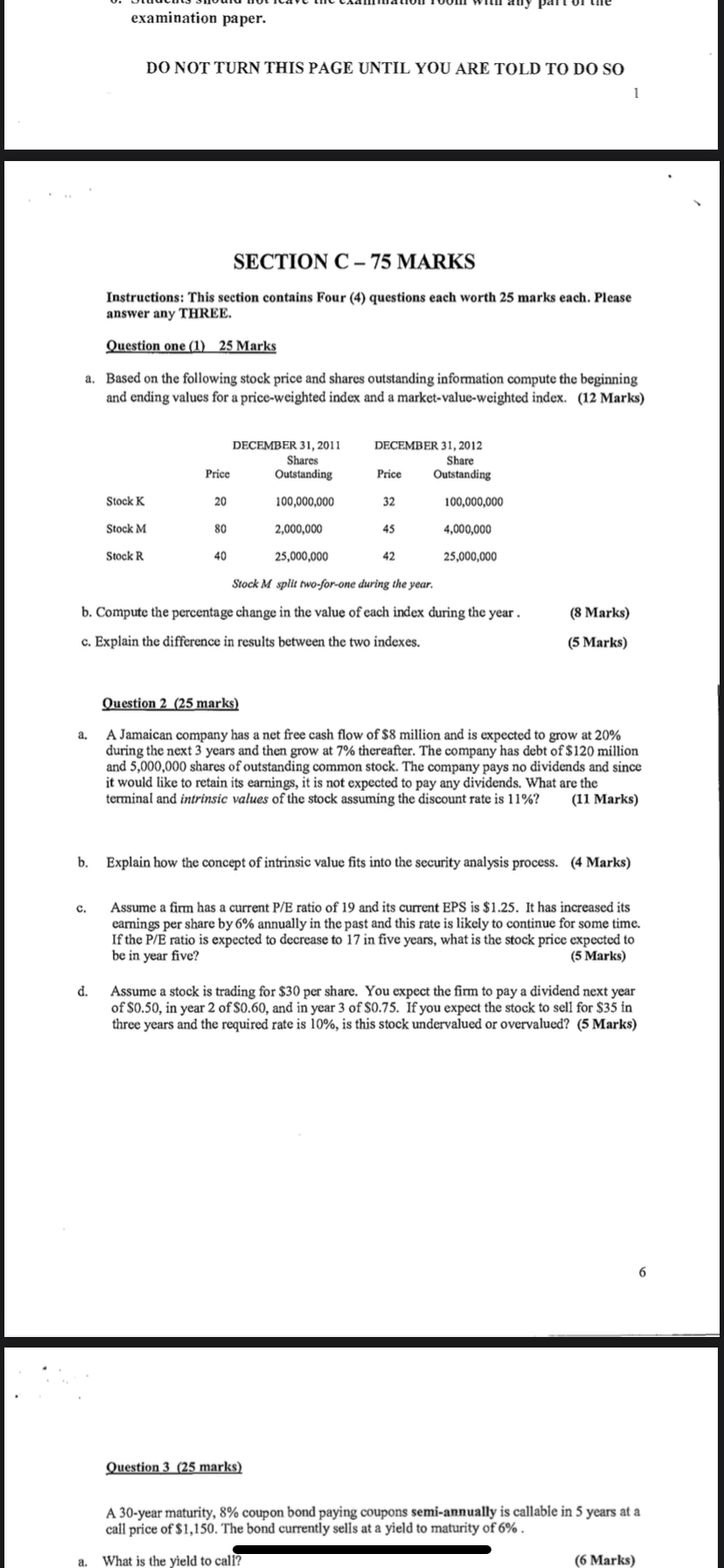

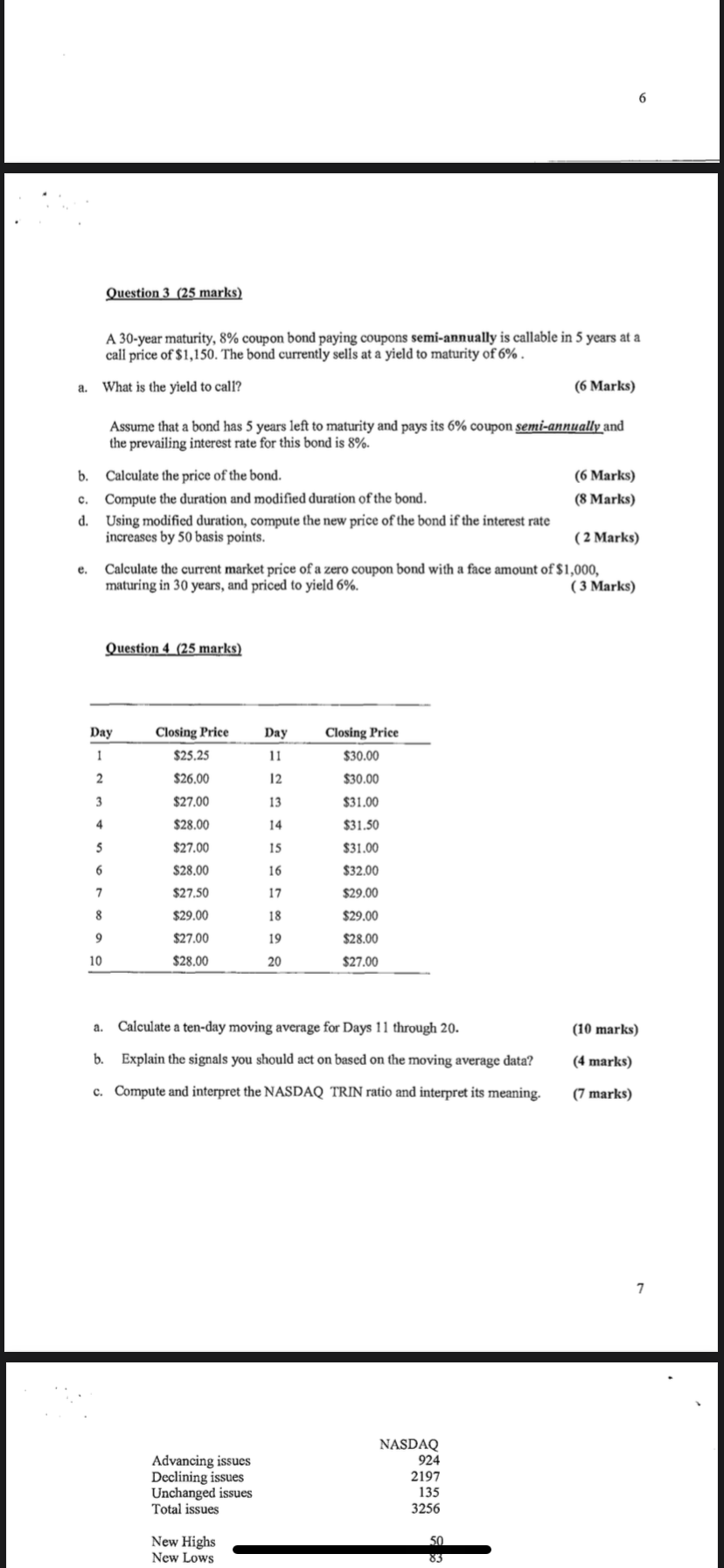

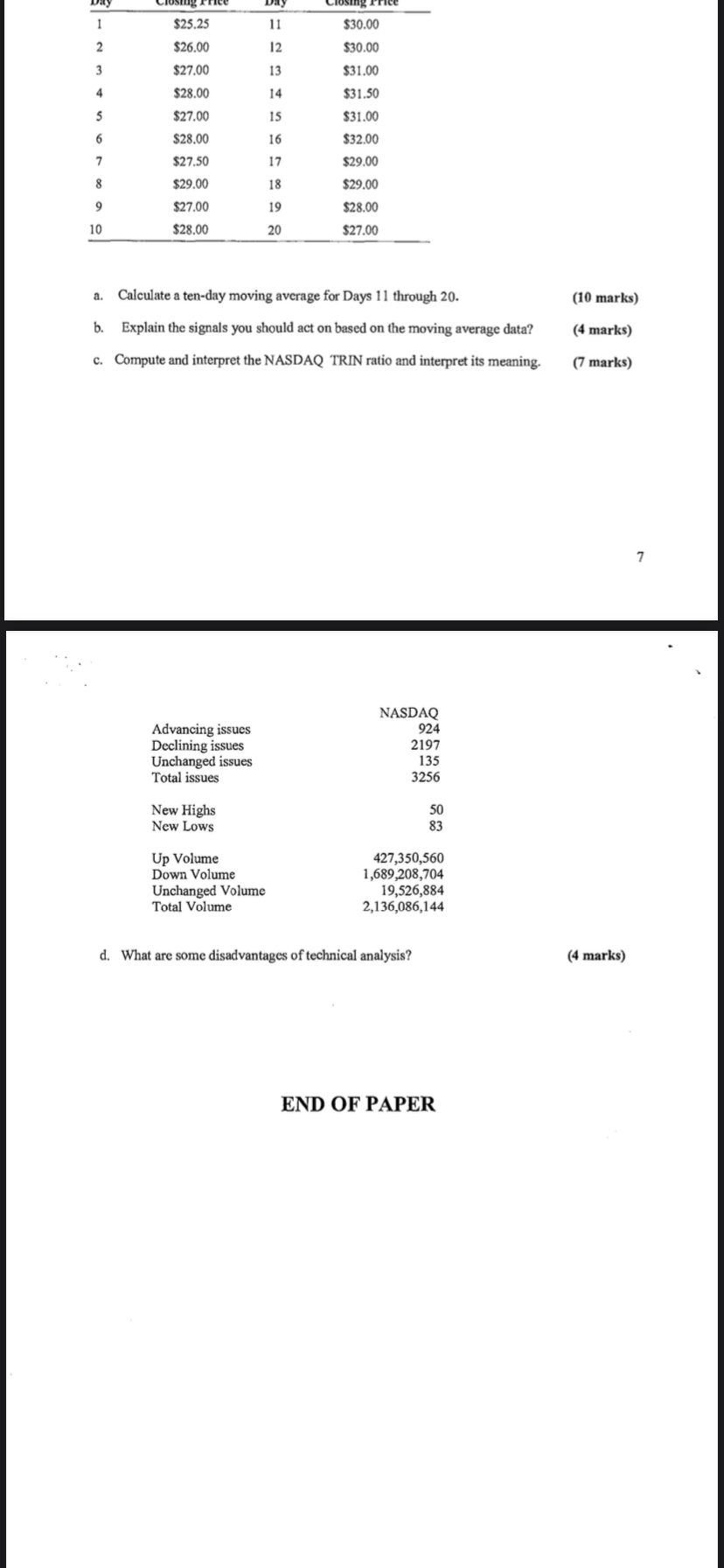

examination paper. DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO 1 SECTION C - 75 MARKS Instructions: This section contains Four (4) questions each worth 25 marks each. Please answer any THREE. Question one (1) 25 Marks a. Based on the following stock price and shares outstanding information compute the beginning and ending values for a price-weighted index and a market-value-weighted index. (12 Marks) Stock M split two-for-one during the year. b. Compute the percentage change in the value of each index during the year . (8 Marks) c. Explain the difference in results between the two indexes. (5 Marks) Question 2 (25 marks) a. A Jamaican company has a net free cash flow of $8 miltion and is expected to grow at 20% during the next 3 years and then grow at 7% thereafter. The company has debt of $120 million and 5,000,000 shares of outstanding common stock. The company pays no dividends and since it would like to retain its earnings, it is not expected to pay any dividends. What are the terminal and intrinsic values of the stock assuming the discount rate is 11% ? (11 Marks) b. Explain how the concept of intrinsic value fits into the security analysis process. (4 Marks) c. Assume a firm has a current P/E ratio of 19 and its current EPS is $1.25. It has increased its earnings per share by 6% annually in the past and this rate is likely to continue for some time. If the P/E ratio is expected to decrease to 17 in five years, what is the stock price expected to be in year five? (5 Marks) d. Assume a stock is trading for $30 per share. You expect the firm to pay a dividend next year of $0.50, in year 2 of $0.60, and in year 3 of $0.75. If you expect the stock to sell for $35 in three years and the required rate is 10%, is this stock undervalued or overvalued? (5 Marks) 6 Question 3 (25 marks) A 30-year maturity, 8% coupon bond paying coupons semi-annually is callable in 5 years at a call price of $1,150. The bond currently sells at a yield to maturity of 6%. a. What is the yield to call? (6 Marks) Assume that a bond has 5 years left to maturity and pays its 6% coupon semi-annually and the prevailing interest rate for this bond is 8%. b. Calculate the price of the bond. (6 Marks) c. Compute the duration and modified duration of the bond. (8 Marks) d. Using modified duration, compute the new price of the bond if the interest rate increases by 50 basis points. ( 2 Marks) e. Calculate the current market price of a zero coupon bond with a face amount of $1,000, maturing in 30 years, and priced to yield 6%. ( 3 Marks) Question 4 (25 marks) a. Calculate a ten-day moving average for Days 11 through 20 . b. Explain the signals you should act on based on the moving average data? c. Compute and interpret the NASDAQ TRIN ratio and interpret its meaning. (10 marks) (4 marks) (7 marks) a. Calculate a ten-day moving average for Days 11 through 20 . b. Explain the signals you should act on based on the moving average data? c. Compute and interpret the NASDAQ TRIN ratio and interpret its meaning. (10 marks) (4 marks) (7 marks) 7 d. What are some disadvantages of technical analysis? (4 marks) examination paper. DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO 1 SECTION C - 75 MARKS Instructions: This section contains Four (4) questions each worth 25 marks each. Please answer any THREE. Question one (1) 25 Marks a. Based on the following stock price and shares outstanding information compute the beginning and ending values for a price-weighted index and a market-value-weighted index. (12 Marks) Stock M split two-for-one during the year. b. Compute the percentage change in the value of each index during the year . (8 Marks) c. Explain the difference in results between the two indexes. (5 Marks) Question 2 (25 marks) a. A Jamaican company has a net free cash flow of $8 miltion and is expected to grow at 20% during the next 3 years and then grow at 7% thereafter. The company has debt of $120 million and 5,000,000 shares of outstanding common stock. The company pays no dividends and since it would like to retain its earnings, it is not expected to pay any dividends. What are the terminal and intrinsic values of the stock assuming the discount rate is 11% ? (11 Marks) b. Explain how the concept of intrinsic value fits into the security analysis process. (4 Marks) c. Assume a firm has a current P/E ratio of 19 and its current EPS is $1.25. It has increased its earnings per share by 6% annually in the past and this rate is likely to continue for some time. If the P/E ratio is expected to decrease to 17 in five years, what is the stock price expected to be in year five? (5 Marks) d. Assume a stock is trading for $30 per share. You expect the firm to pay a dividend next year of $0.50, in year 2 of $0.60, and in year 3 of $0.75. If you expect the stock to sell for $35 in three years and the required rate is 10%, is this stock undervalued or overvalued? (5 Marks) 6 Question 3 (25 marks) A 30-year maturity, 8% coupon bond paying coupons semi-annually is callable in 5 years at a call price of $1,150. The bond currently sells at a yield to maturity of 6%. a. What is the yield to call? (6 Marks) Assume that a bond has 5 years left to maturity and pays its 6% coupon semi-annually and the prevailing interest rate for this bond is 8%. b. Calculate the price of the bond. (6 Marks) c. Compute the duration and modified duration of the bond. (8 Marks) d. Using modified duration, compute the new price of the bond if the interest rate increases by 50 basis points. ( 2 Marks) e. Calculate the current market price of a zero coupon bond with a face amount of $1,000, maturing in 30 years, and priced to yield 6%. ( 3 Marks) Question 4 (25 marks) a. Calculate a ten-day moving average for Days 11 through 20 . b. Explain the signals you should act on based on the moving average data? c. Compute and interpret the NASDAQ TRIN ratio and interpret its meaning. (10 marks) (4 marks) (7 marks) a. Calculate a ten-day moving average for Days 11 through 20 . b. Explain the signals you should act on based on the moving average data? c. Compute and interpret the NASDAQ TRIN ratio and interpret its meaning. (10 marks) (4 marks) (7 marks) 7 d. What are some disadvantages of technical analysis? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts