Question: Examine data on spreadsheet Reflect on data and determine: What is the dollar amount of the total merit pool for this incentive bonus? Who should

Examine data on spreadsheet

Reflect on data and determine:

- What is the dollar amount of the total merit pool for this incentive bonus?

- Who should receive incentive bonuses and why?

- How much should each qualifying individual receive? (display percentages and dollar amount)

- What are the current compa-ratiosfor each individual? Why does this matter?

Copy data sheet and add additional columns:

- Compa-ratio

- % increase

- $ increase

- New Salaries

Generate Word doc "memos" to each of your employees - NOT to your manager justifying your decision.

- If he/she received a bonus, explain why

- If he/she did not receive a bonus, explain why and explain how you will help them improve to be a part of next year's bonus program

- Use their scores and go over strengths / weaknesses

chart:

| Employee | Employee # | Wage Rate | Annual $ | Total Appraisal | Knowledge | Initiative | Teamwork | Quality | Quantity | Customer Svc |

| Chaney, Ronald | 12 | 12.25 | 25,480 | 3.8 | 3 | 4 | 3.5 | 4 | 4 | 4 |

| Soto, Sandra | 11 | 12.5 | 26,000 | 3.4 | 3.5 | 3 | 4 | 4 | 3 | 3 |

| Bush, Gary | 10 | 13.25 | 27,560 | 2.7 | 3 | 2 | 3 | 3 | 2 | 3 |

| Clinton, Marilyn | 9 | 13 | 27,040 | 2.8 | 3 | 3 | 2 | 3 | 3 | 3 |

| Perry, Rhonda | 8 | 13.5 | 28,080 | 3.5 | 4 | 3.5 | 4 | 3.5 | 3 | 3 |

| Gibson, Christine | 7 | 13.75 | 28,600 | 3.2 | 4 | 3 | 3 | 3 | 3 | 3 |

| Ahmed, Janel | 6 | 14 | 29,120 | 3.8 | 3 | 4 | 3 | 4 | 4 | 5 |

| Lozano, Tina | 5 | 14.25 | 29,640 | 4.2 | 5 | 4.5 | 4 | 4 | 3.5 | 4 |

| Porter, Henry | 4 | 14.5 | 30,160 | 3.3 | 4 | 4 | 3 | 3 | 3 | 3 |

| Blanco, Maria | 3 | 14.75 | 30,680 | 2.7 | 3 | 3 | 2 | 2 | 3 | 3 |

| Linares, Patricia | 2 | 15 | 31,200 | 3.2 | 3.5 | 3 | 3.5 | 3 | 3 | 3 |

| Elsbery, Christine | 1 | 15.5 | 32,240 | 3.0 | 3 | 3 | 3 | 3 | 3 | 3 |

| | | | | | | | | | | |

| | | | | 5 = Excellent | | | | | | |

| | | | | 4 = Outstanding | | | | | | |

| | | | | 3 = Meets Standards | | | | | | |

| | | | | 2 = Needs Improvement | | | | | | |

| | | | | 1 = Poor | | | | | | |

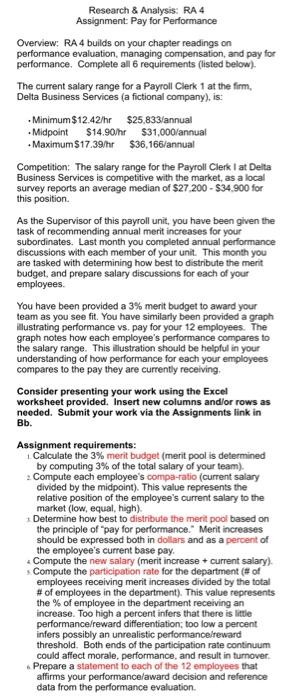

Research & Analysis: RA 4 Assignment: Pay for Performance Overview: RA4 builds on your chapter readings on performance evaluation, managing compensation, and pay for performance. Complete all 6 requirements (listed below). The current salary range for a Payroll Clerk 1 at the firm, Delta Business Services (a fictional company), is: - Minimum $12.42/hr $25,833/annual . Midpoint $14.90/hr $31,000/annual - Maximum $17.39/hr $36,166/annual Competition: The salary range for the Payroll Clerk at Deita Business Services is competitive with the market, as a local survey reports an average median of $27.200 - $34.900 for this position As the Supervisor of this payroll unit, you have been given the task of recommending annual merit increases for your subordinates. Last month you completed annual performance discussions with each member of your unit. This month you are tasked with determining how best to distribute the merit budget and prepare salary discussions for each of your employees You have been provided a 3% merit budget to award your team as you see fit. You have similarly been provided a graph illustrating performance vs. pay for your 12 employees. The graph notes how each employee's performance compares to the salary range. This illustration should be helpful in your understanding of how performance for each your employees compares to the pay they are currently receiving, Consider presenting your work using the Excel worksheet provided. Insert new columns and/or rows as needed. Submit your work via the Assignments link in Bb. Assignment requirements: Calculate the 3% merit budget (merit pool is determined by computing 3% of the total salary of your team). Compute each employee's compa-ratio (current salary divided by the midpoint). This value represents the relative position of the employee's current salary to the market (low, equal, high) Determine how best to distribute the merit pool based on the principle of "pay for performance." Merit increases should be expressed both in dollars and as a percent of the employee's current base pay. Compute the new salary (merit increase + current salary) Compute the participation rate for the department (# of employees receiving menit increases divided by the total # of employees in the department). This value represents the % of employee in the department receiving an increase. Too high a percent infers that there is little performance/reward differentiation, too low a percent infers possibly an unrealistic performance reward threshold. Both ends of the participation rate continuum could affect morale, performance, and result in turnover Prepare a statement to each of the 12 employees that affirms your performance award decision and reference data from the performance evaluation Research & Analysis: RA 4 Assignment: Pay for Performance Overview: RA4 builds on your chapter readings on performance evaluation, managing compensation, and pay for performance. Complete all 6 requirements (listed below). The current salary range for a Payroll Clerk 1 at the firm, Delta Business Services (a fictional company), is: - Minimum $12.42/hr $25,833/annual . Midpoint $14.90/hr $31,000/annual - Maximum $17.39/hr $36,166/annual Competition: The salary range for the Payroll Clerk at Deita Business Services is competitive with the market, as a local survey reports an average median of $27.200 - $34.900 for this position As the Supervisor of this payroll unit, you have been given the task of recommending annual merit increases for your subordinates. Last month you completed annual performance discussions with each member of your unit. This month you are tasked with determining how best to distribute the merit budget and prepare salary discussions for each of your employees You have been provided a 3% merit budget to award your team as you see fit. You have similarly been provided a graph illustrating performance vs. pay for your 12 employees. The graph notes how each employee's performance compares to the salary range. This illustration should be helpful in your understanding of how performance for each your employees compares to the pay they are currently receiving, Consider presenting your work using the Excel worksheet provided. Insert new columns and/or rows as needed. Submit your work via the Assignments link in Bb. Assignment requirements: Calculate the 3% merit budget (merit pool is determined by computing 3% of the total salary of your team). Compute each employee's compa-ratio (current salary divided by the midpoint). This value represents the relative position of the employee's current salary to the market (low, equal, high) Determine how best to distribute the merit pool based on the principle of "pay for performance." Merit increases should be expressed both in dollars and as a percent of the employee's current base pay. Compute the new salary (merit increase + current salary) Compute the participation rate for the department (# of employees receiving menit increases divided by the total # of employees in the department). This value represents the % of employee in the department receiving an increase. Too high a percent infers that there is little performance/reward differentiation, too low a percent infers possibly an unrealistic performance reward threshold. Both ends of the participation rate continuum could affect morale, performance, and result in turnover Prepare a statement to each of the 12 employees that affirms your performance award decision and reference data from the performance evaluation