Question: Examine the balance sheet statement. And based on the assets account, the liabilities account and the equity account, evaluate the performance of this company based

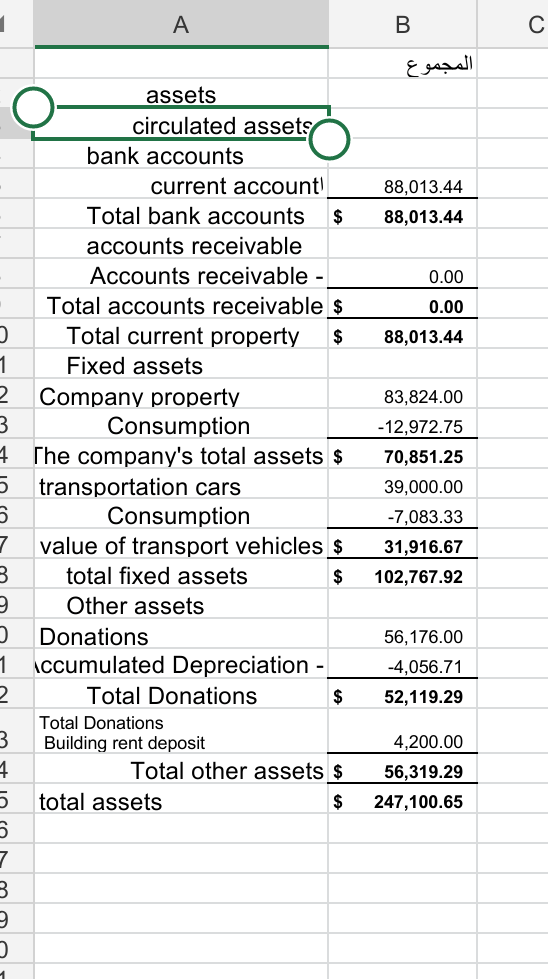

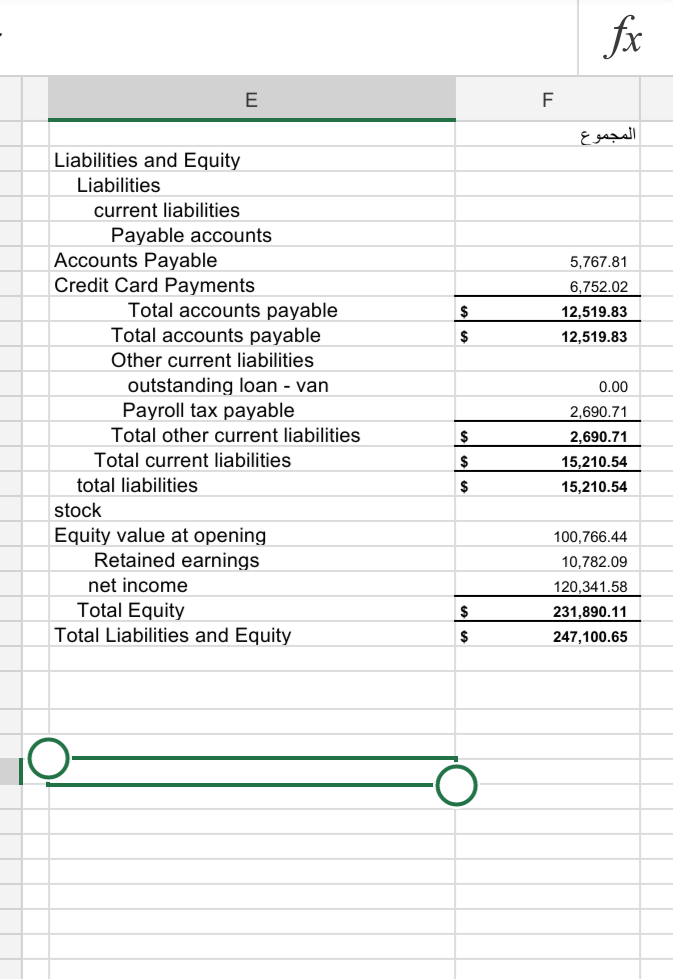

Examine the balance sheet statement. And based on the assets account, the liabilities account and the equity account, evaluate the performance of this company based on the existing statement of accounts and is it advisable to invest in this company? And why?

A B 88,013.44 88,013.44 0.00 0.00 88,013.44 83,824.00 assets circulated assets bank accounts current account Total bank accounts $ accounts receivable Accounts receivable - Total accounts receivable $ Total current property $ 1. Fixed assets 2 Company property 3 Consumption 4 The company's total assets $ 5 transportation cars 5 Consumption 7 value of transport vehicles $ 3 total fixed assets $ 3 Other assets Donations 1 Accumulated Depreciation - 2 Total Donations $ Total Donations 3 Building rent deposit 7 Total other assets $ 5 total assets $ 3 7 3 -12,972.75 70,851.25 39,000.00 -7,083.33 31,916.67 102,767.92 56,176.00 -4,056.71 52,119.29 4,200.00 56,319.29 247,100.65 1 fx E F 5,767.81 6,752.02 12,519.83 12,519.83 $ $ 0.00 Liabilities and Equity Liabilities current liabilities Payable accounts Accounts Payable Credit Card Payments Total accounts payable Total accounts payable Other current liabilities outstanding loan - van Payroll tax payable Total other current liabilities Total current liabilities total liabilities stock Equity value at opening Retained earnings net income Total Equity Total Liabilities and Equity $ $ 2,690.71 2,690.71 15,210.54 15,210.54 $ 100,766.44 10.782.09 $ $ 120,341.58 231,890.11 247,100.65

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts