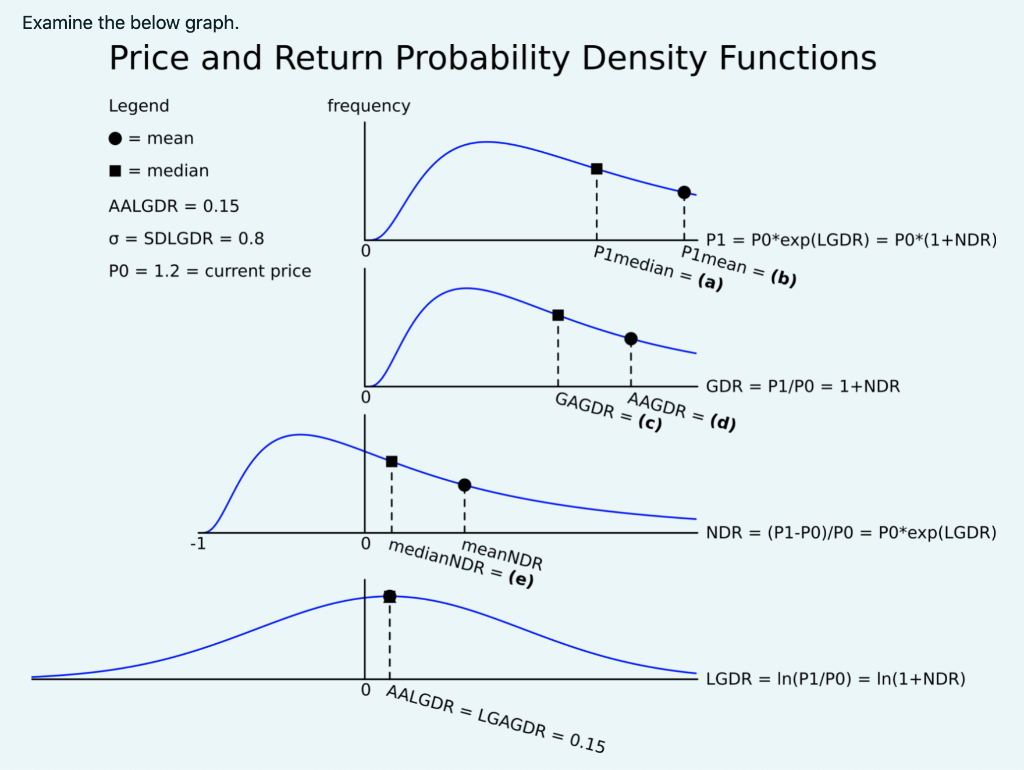

Question: Examine the below graph. Price and Return Probability Density Functions Legend frequency = mean I = median AALGDR = 0.15 O = SDLGDR = 0.8

Examine the below graph. Price and Return Probability Density Functions Legend frequency = mean I = median AALGDR = 0.15 O = SDLGDR = 0.8 Plmean = (b) Plmedian = (a) P1 = PO*exp(LGDR) = PO*(1+NDR) 0 PO = 1.2 = current price AAGDR = (d) GAGDR = (c) GDR = P1/PO = 1+NDR 0 meanNDR o medianNDR = (e) NDR = (P1-PO)/PO = PO*exp(LGDR) LGDR = In(P1/PO) = In(1+NDR) AALGDR = LGAGDR = 0.15 The arithmetic log gross discrete return (AALGDR) is 15% pa. The standard deviation of the log gross discrete returns (SDLGDR) is 80% pa. The current stock price is $1.20. Some labelled numbers have been deliberately replaced with letters in brackets corresponding to the answer choices below. Which of the below statements is NOT correct? All numbers are rounded to 6 decimal places. The expected future: Select one: a. Median price in one year is $1.394201. O b. Mean price in one year is $1.919993. C. The arithmetic average gross discrete return (AAGDR) over the next year is 1.417293. d. The geometric average gross discrete return (GAGDR) over the next year is 1.161834. e. The median net discrete return (NDR) over the next year is 0.161834. Examine the below graph. Price and Return Probability Density Functions Legend frequency = mean I = median AALGDR = 0.15 O = SDLGDR = 0.8 Plmean = (b) Plmedian = (a) P1 = PO*exp(LGDR) = PO*(1+NDR) 0 PO = 1.2 = current price AAGDR = (d) GAGDR = (c) GDR = P1/PO = 1+NDR 0 meanNDR o medianNDR = (e) NDR = (P1-PO)/PO = PO*exp(LGDR) LGDR = In(P1/PO) = In(1+NDR) AALGDR = LGAGDR = 0.15 The arithmetic log gross discrete return (AALGDR) is 15% pa. The standard deviation of the log gross discrete returns (SDLGDR) is 80% pa. The current stock price is $1.20. Some labelled numbers have been deliberately replaced with letters in brackets corresponding to the answer choices below. Which of the below statements is NOT correct? All numbers are rounded to 6 decimal places. The expected future: Select one: a. Median price in one year is $1.394201. O b. Mean price in one year is $1.919993. C. The arithmetic average gross discrete return (AAGDR) over the next year is 1.417293. d. The geometric average gross discrete return (GAGDR) over the next year is 1.161834. e. The median net discrete return (NDR) over the next year is 0.161834

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts