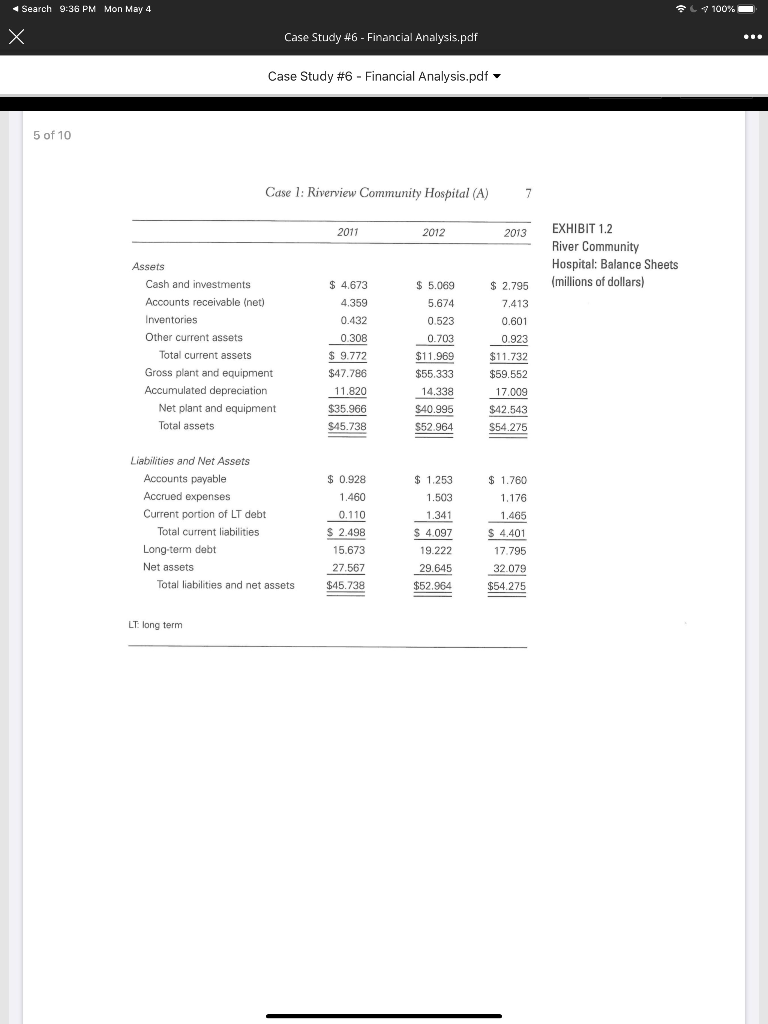

Question: Examine the hospitals statement of cash flows. What information do they provide regarding the hospitals sources and uses of cash over the past two years?

-

Examine the hospitals statement of cash flows. What information do they provide regarding the hospitals sources and uses of cash over the past two years?

-

List five or more financial strengths of the hospital? (Hint: Do not provide a list of ratios. Make a statement and then justify it with information from the financial statements and ratios.)

-

The board chair has asked management to develop some strategies to improve profitability and estimate the impact of the strategies on the hospitals ROE. By how much would the 2013 ROE change from each of these strategies?

-

Vacant land is sold and total assets decreases by $2.0 million. Net income would not be affected

and the board wants to maintain the 2013 debt ratio.

-

Debt is substituted for equity and the debt ratio increases to 48 percent. Total assets would not be

affected. Interest expense would increase but better cost controls would offset the higher interest

expense and thus net income would not change.

-

LEAN management is implemented and total expenses decrease by $0.5 million. Total revenue,

total assets, and total liabilities & net assets would not change.

-

Whatever strategy Melissa chooses, she is under pressure from the board to increase return on

equity to at least 10 percent. What total margin would be needed to achieve the 10 percent ROE, holding everything else constant?

- a.

-

and the board wants to maintain the 2013 debt ratio.

-

Debt is substituted for equity and the debt ratio increases to 48 percent. Total assets would not be

-

affected. Interest expense would increase but better cost controls would offset the higher interest

expense and thus net income would not change.

-

LEAN management is implemented and total expenses decrease by $0.5 million. Total revenue,

total assets, and total liabilities & net assets would not change.

-

Whatever strategy Melissa chooses, she is under pressure from the board to increase return on

equity to at least 10 percent. What total margin would be needed to achieve the 10 percent ROE, holding everything else constant?

-

-

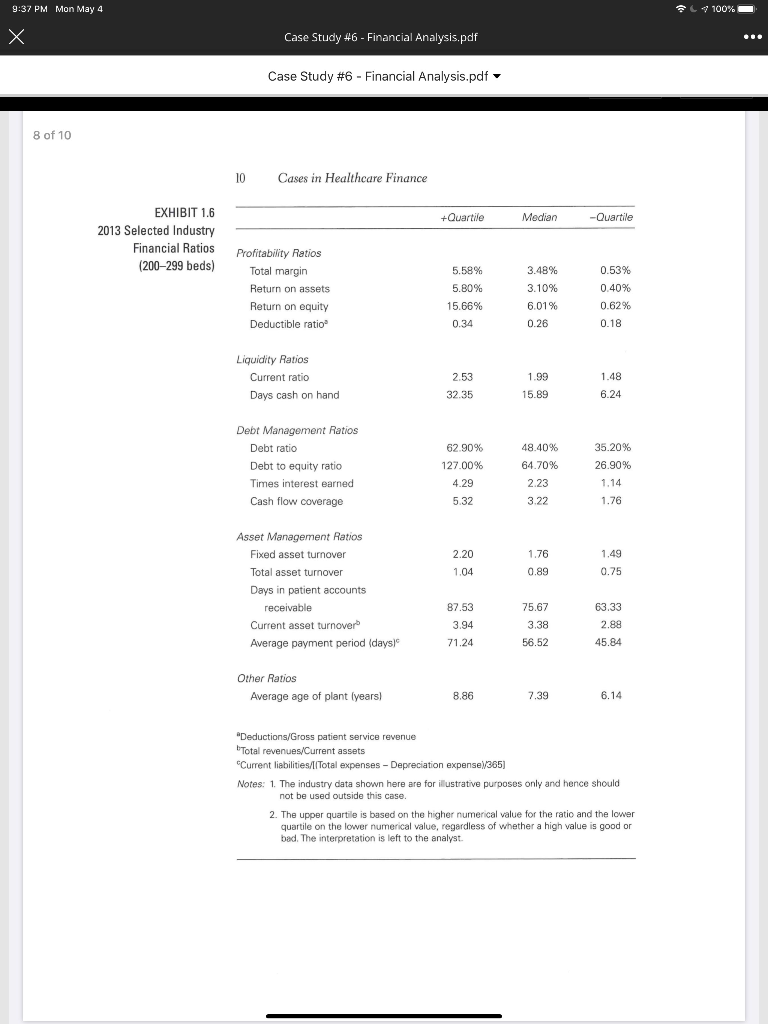

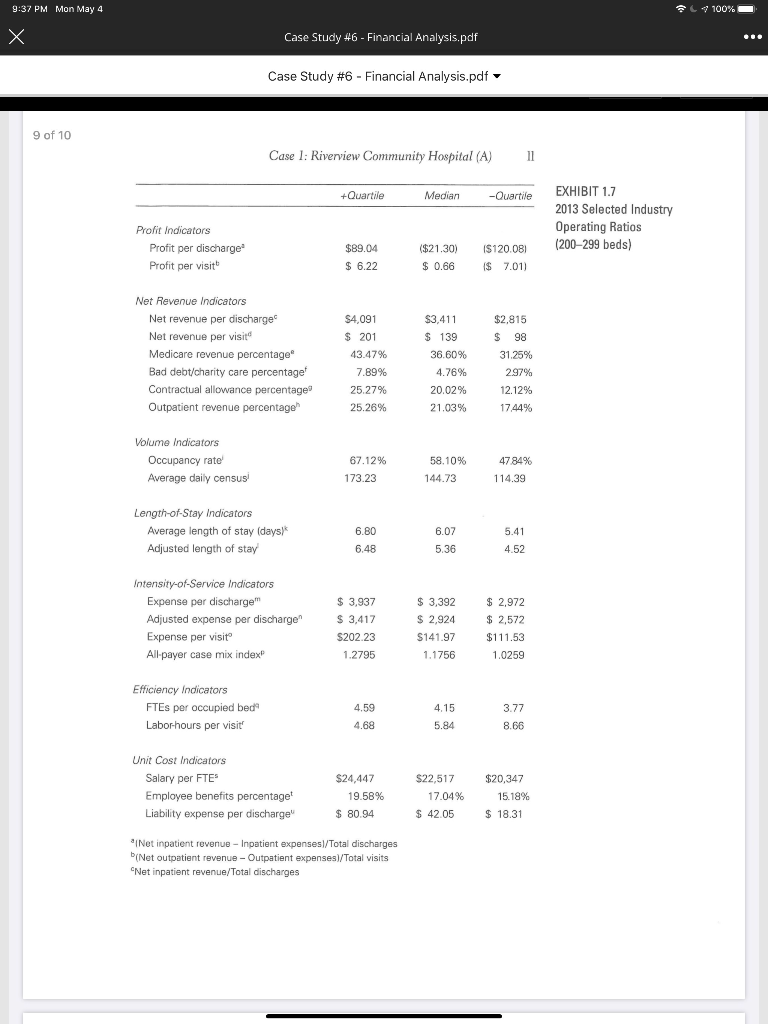

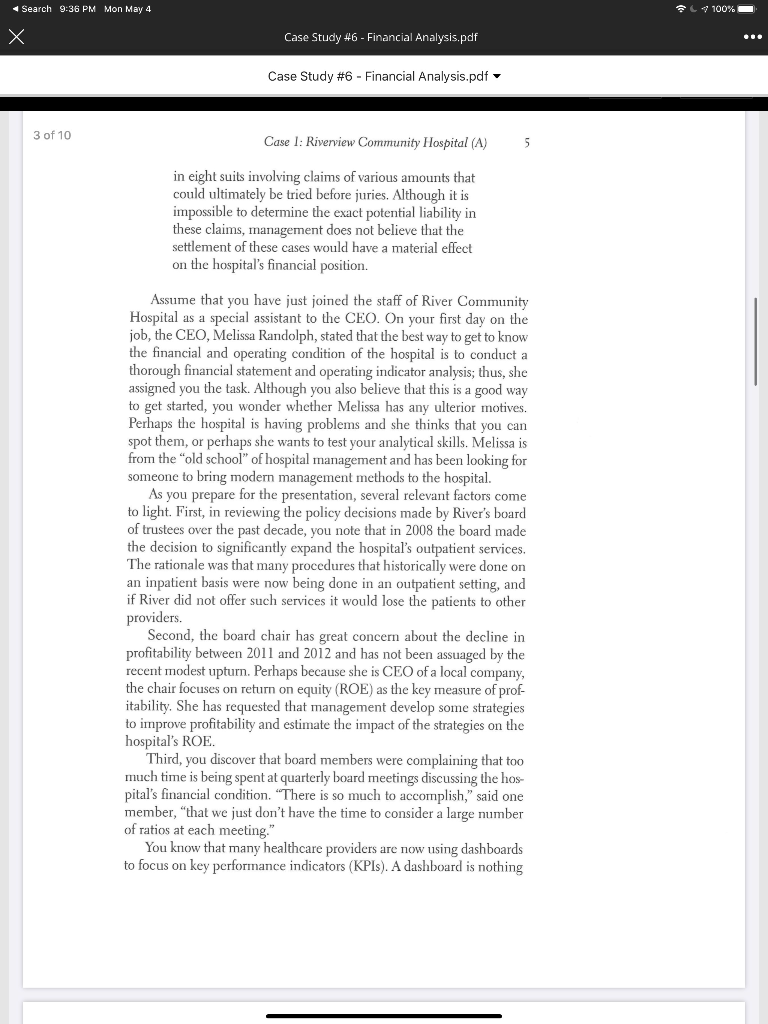

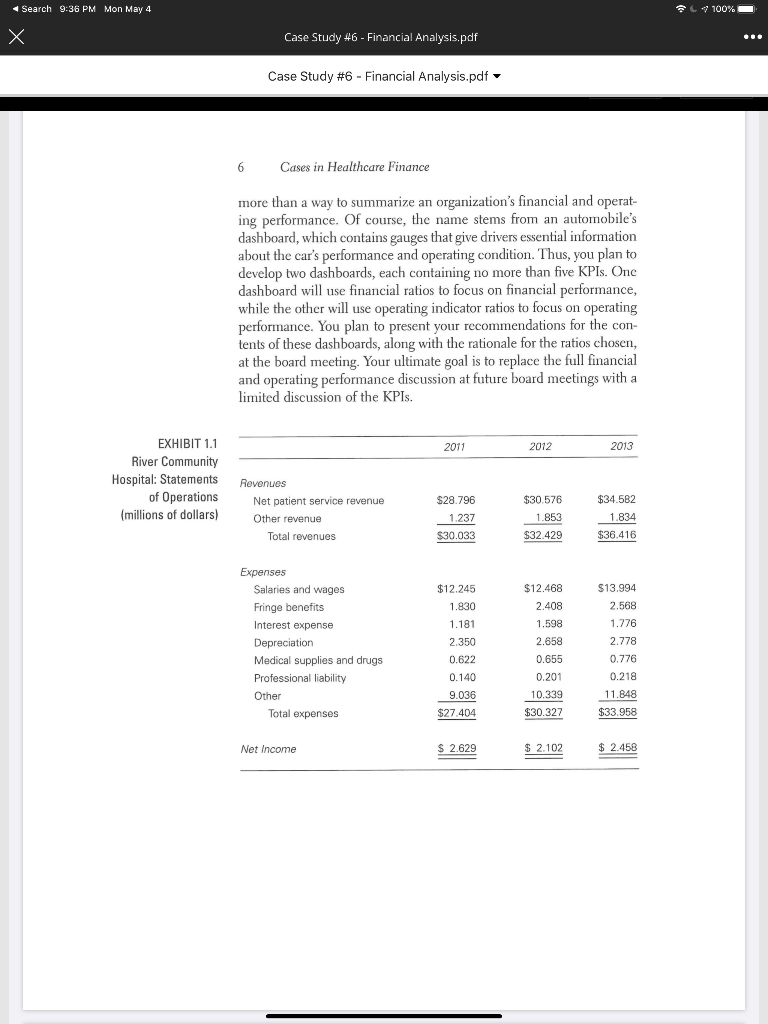

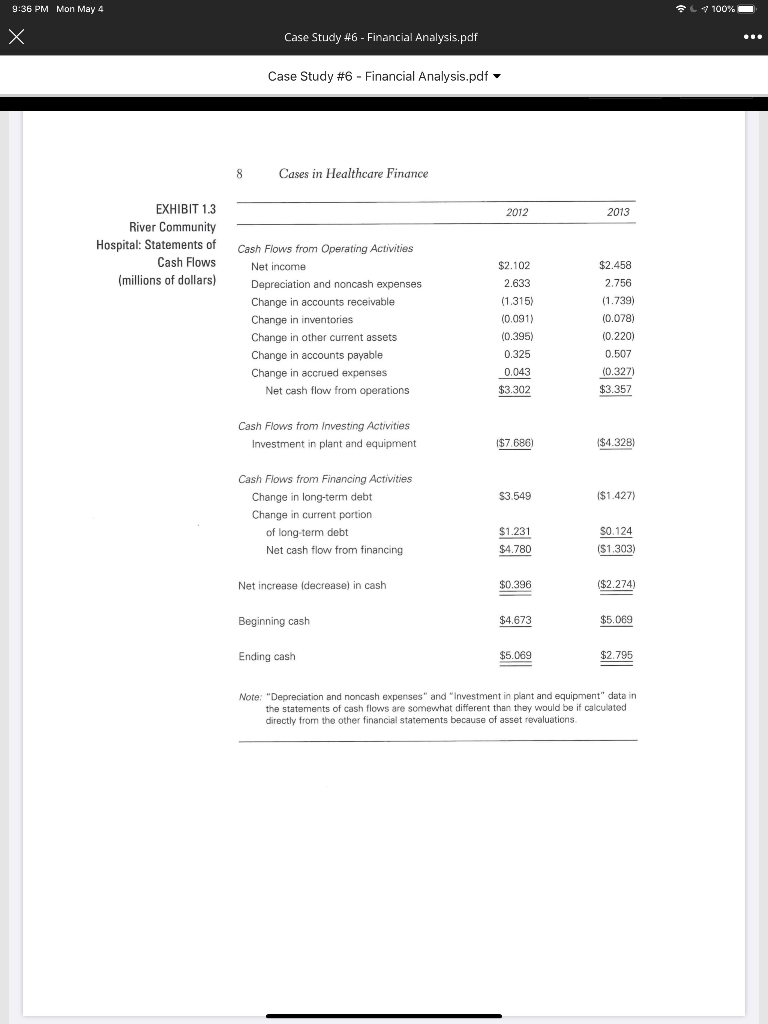

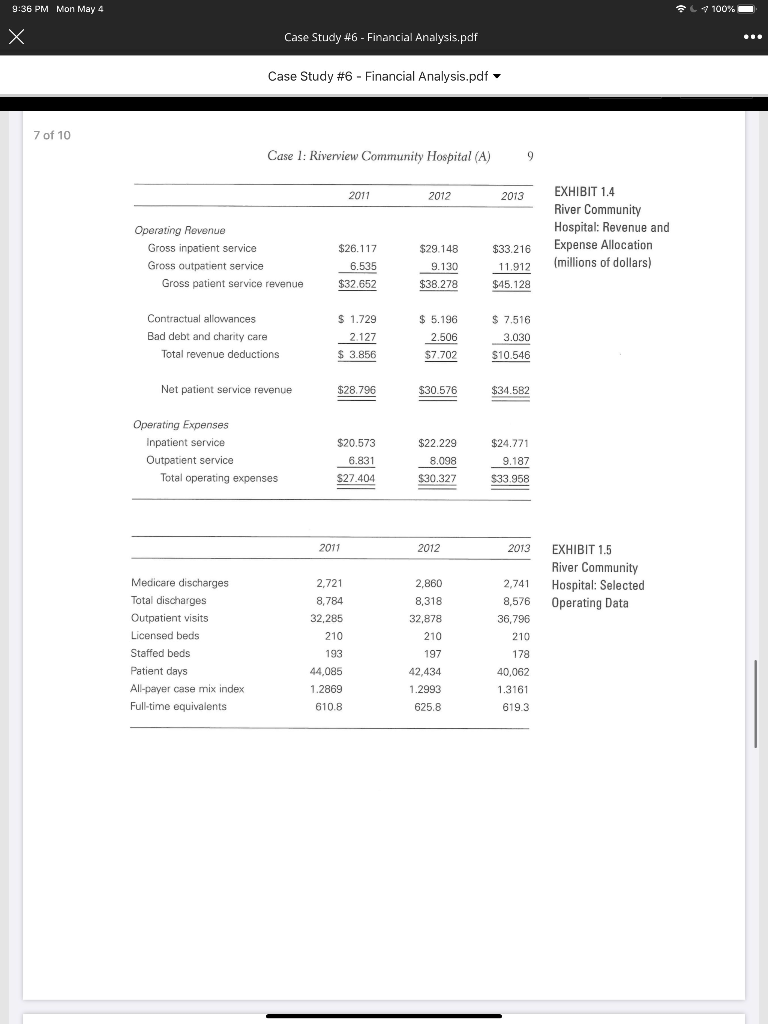

9:37 PM Mon May 4 100% Case Study #6 - Financial Analysis.pdf Case Study #6 - Financial Analysis.pdf 8 of 10 10 Cases in Healthcare Finance +Quartile Median -Quartile EXHIBIT 1.6 2013 Selected Industry Financial Ratios (200-299 beds) Profitability Ratios Total margin Return on assets Return on equity Deductible ratio 5.58% 5.80% 15.66% 0.34 3.48% 3.10% 6.01% 0.26 0.53% 0.40% 0.62% 0.18 Liquidity Ratios Current ratio Days cash on hand 2.53 32.35 1.99 15.89 1.48 6.24 Debt Management Ratios Debt ratio Debt to equity ratio Times interest earned Cash flow coverage 62.90% 127.00% 4.29 5.32 48.40% 64.70% 2.23 3.22 35.20% 26.90% 1.14 1.76 2.20 1.04 1.76 0.89 1.49 0.75 Asset Management Ratios Fixed asset turnover Total asset turnover Days in patient accounts receivable Current asset turnover Average payment period (days) 87.53 3.94 71.24 75.67 3.38 56.52 63.33 2.88 45.84 Other Ratios Average age of plant (years) 8.86 7.39 6.14 "Deductions/Gross patient service revenue Total revenues/Current assets Current liabilities/[/Total expenses - Depreciation expense)/365) Notes: 1. The industry data shown here are for illustrative purposes only and hence should not be used outside this case. 2. The upper quartile is based on the higher numerical value for the ratio and the lower quartile on the lower numerical value, regardless of whether a high value is good or bad. The interpretation is left to the analyst. 9:37 PM Mon May 4 100% Case Study #6 - Financial Analysis.pdf Case Study #6 - Financial Analysis.pdf 9 of 10 Case 1: Riverview Community Hospital (A) 11 +Quartile Median -Quartile EXHIBIT 1.7 2013 Selected Industry Operating Ratios (200-299 beds) Profit Indicators Profit per discharge Profit per visit $89.04 $ 6.22 ($21.30) $ 0.66 $120.08) $ 7.01) Net Revenue Indicators Net revenue per discharge Net revenue per visit Medicare revenue percentage Bad debt/charity care percentage Contractual allowance percentage Outpatient revenue percentage $4,091 $ 201 43.47% 7.89% 25.27% 25.26% $3,411 $ 139 36.60% 4.76% 20.02% 21.03% $2,815 $ 98 31.25% 297% 12.12% 17.44% Volume Indicators Occupancy rate Average daily census' 67.12% 173.23 58.10% 144.73 47 84% 114.39 Length-of-Stay Indicators Average length of stay (days) Adjusted length of stay 6.80 6.48 5.41 6.07 5.36 4.52 Intensity-of-Service Indicators Expense per discharge Adjusted expense per discharge Expense per visit All-payer case mix index $ 3,937 $ 3,417 $202.23 1.2795 $ 3,392 $ 2,924 $141.97 1.1756 $ 2,972 $ 2,572 $111.53 1.0259 Efficiency Indicators FTES per occupied bed Labor-hours per visit 4.59 4.68 4.15 5.84 3.77 8.66 Unit Cost Indicators Salary per FTE Employee benefits percentaget Liability expense per discharge $24,447 19.58% $ 80.94 $22,517 17.04% $ 42.05 $20,347 15.18% $ 18.31 Net inpatient revenue - Inpatient expenses/Total discharges (Net outpatient revenue - Outpatient expenses/Total Visits "Net inpatient revenue/Total discharges Search 9:36 PM Mon May 4 100% Case Study #6 - Financial Analysis.pdf Case Study #6 - Financial Analysis.pdf 2 of 10 4 Cases in Healthcare Finance Exhibits 1.6 and 1.7. (Note that the industry data given in the case are for illustrative purposes only and do not represent actual data for the years specified. For a better idea of the type of comparative data actu- ally available for hospitals, see the Optum" website at www.hospital benchmarks.com.) In addition to the data in the exhibits, the following information was extracted from the notes section of River's 2013 Annual Report 1. A significant portion of the hospital's net patient service revenue was generated by patients who are covered either by Medicare, Medicaid, or other government programs or by various private plans, including managed care plans, that have contracts with the hospital that specify discounts from charges. In general, the proportional amount of deductions is similar between inpatients and outpatients. The gross and net patient service revenue and operating expenses breakdown for both inpatient and outpatient services is given in Exhibit 1.4. 2. River has a contributory money accumulation (defined contribution) pension plan that covers substantially all of its employees. Participants can contribute up to 20 percent of earnings to the pension plan. The hospital matches, on a dollar-for-dollar basis, employee contributions of up to 2 percent of wages and pays 50 cents on the dollar for contributions over 2 percent and up to 4 percent. Because the plan is a defined contribution plan (as opposed to a defined benefit plan), River has no unfunded pension liabilities. Pension expense was approximately $0.543 million in 2012 and $0.588 million in 2013. 3. The hospital is a member of the State Hospital Trust Fund, under which it purchases professional liability insurance coverage for individual claims up to $1 million (subject to a deductible of $100,000 per claim). River is self-insured for amounts above $1 million but less than $5 million. Any liability award in excess of $5 million is covered by a commercial liability policy; for example, the policy pays $2 million on a $7 million award. The hospital is currently involved Search 9:36 PM Mon May 4 100% Case Study #6 - Financial Analysis.pdf Case Study #6 - Financial Analysis.pdf 3 of 10 Case 1: Riverview Community Hospital (A) 5 in eight suits involving claims of various amounts that could ultimately be tried before juries. Although it is impossible to determine the exact potential liability in these claims, management does not believe that the settlement of these cases would have a material effect on the hospital's financial position. Assume that you have just joined the staff of River Community Hospital as a special assistant to the CEO. On your first day on the job, the CEO, Melissa Randolph, stated that the best way to get to know the financial and operating condition of the hospital is to conduct a thorough financial statement and operating indicator analysis; thus, she assigned you the task. Although you also believe that this is a good way to get started, you wonder whether Melissa has any ulterior motives. Perhaps the hospital is having problems and she thinks that you can spot them, or perhaps she wants to test your analytical skills. Melissa is from the "old school" of hospital management and has been looking for someone to bring modern management methods to the hospital. As you prepare for the presentation, several relevant factors come to light. First, in reviewing the policy decisions made by River's board of trustees over the past decade, you note that in 2008 the board made the decision to significantly expand the hospital's outpatient services. The rationale was that many procedures that historically were done on an inpatient basis were now being done in an outpatient setting, and if River did not offer such services it would lose the patients to other providers. Second, the board chair has great concern about the decline in profitability between 2011 and 2012 and has not been assuaged by the recent modest upturn. Perhaps because she is CEO of a local company, the chair focuses on return on equity (ROE) as the key measure of prof- itability. She has requested that management develop some strategies to improve profitability and estimate the impact of the strategies on the hospital's ROE. Third, you discover that board members were complaining that too much time is being spent at quarterly board meetings discussing the hos- pital's financial condition. "There is so much to accomplish," said one member, that we just don't have the time to consider a large number of ratios at each meeting." You know that many healthcare providers are now using dashboards to focus on key performance indicators (KPIs). A dashboard is nothing Search 9:36 PM Mon May 4 100% Case Study #6 - Financial Analysis.pdf Case Study #6 - Financial Analysis.pdf 6 Cases in Healthcare Finance more than a way to summarize an organization's financial and operat- ing performance. Of course, the name stems from an automobile's dashboard, which contains gauges that give drivers essential information about the car's performance and operating condition. Thus, you plan to develop two dashboards, each containing no more than five KPIs. One dashboard will use financial ratios to focus on financial performance, while the other will use operating indicator ratios to focus on operating performance. You plan to present your recommendations for the con- tents of these dashboards, along with the rationale for the ratios chosen, at the board meeting. Your ultimate goal is to replace the full financial and operating performance discussion at future board meetings with a limited discussion of the KPIs. 2011 2012 2013 EXHIBIT 1.1 River Community Hospital: Statements of Operations (millions of dollars) Revenues Net patient service revenue Other revenue Total revenues $28.796 1.237 $30.033 $30,576 1.853 $32.429 $34.582 1.834 $36.416 Expenses Salaries and wages Fringe benefits Interest expense Depreciation Medical supplies and drugs Professional liability Other Total expenses $12.245 1.830 1.181 2.350 0.622 0.140 9.036 $27.404 $12.468 2.408 1.598 2.658 0.655 0.201 10.339 $30.327 $13.994 2,568 1.776 2.778 0.776 0.218 11.848 $33.958 Net Income $ 2.629 $ 2.102 $ 2.458 Search 9:36 PM Mon May 4 100% Case Study #6 - Financial Analysis.pdf Case Study #6 - Financial Analysis.pdf 5 of 10 Case 1: Riverview Community Hospital (A) 2011 2012 2013 EXHIBIT 1.2 River Community Hospital: Balance Sheets (millions of dollars) Assets Cash and investments Accounts receivable (net) Inventories Other current assets Total current assets Gross plant and equipment Accumulated depreciation Net plant and equipment Total assets $ 4.673 4.359 0.432 0.308 $ 9.772 $47.786 11.820 $35.966 $45.738 $ 5.069 5.674 0.523 0.703 $11.969 $55.333 14.338 $40.995 $52.964 $ 2.795 7,413 0.601 0.923 $11.732 $59.552 17.009 $42.543 S54.275 Liabilities and Net Assets Accounts payable Accrued expenses Current portion of LT debt Total current liabilities Long-term debt Net assets Total liabilities and net assets $ 0.928 1.460 0.110 $ 2.498 15.673 27.567 $45.738 $ 1.253 1.503 1.341 $ 4.097 19.222 29.645 $52.964 $ 1.760 1.176 1.465 $ 4.401 17.795 32.079 $54.275 LT: long term 9:36 PM Mon May 4 100% X Case Study #6 - Financial Analysis.pdf Case Study #6 - Financial Analysis.pdf 8 Cases in Healthcare Finance 2012 2013 EXHIBIT 1.3 River Community Hospital: Statements of Cash Flows (millions of dollars) Cash Flows from Operating Activities Net income Depreciation and noncash expenses Change in accounts receivable Change in inventories Change in other current assets Change in accounts payable Change in accrued expenses Net cash flow from operations $2.102 2.633 (1.315) (0.091) (0.395) 0.325 0.043 $3.302 $2.458 2.756 (1.739) (0.078) (0.220) 0.507 (0.327) $3.357 Cash Flows from Investing Activities Investment in plant and equipment $7.686) $4.328) $3.549 ($1.427) Cash Flows from Financing Activities Change in long-term debt Change in current portion of long-term debt Net cash flow from financing $1.231 $4.780 SO.124 ($1.303) Net increase (decrease) in cash $0.396 ($2.274) Beginning cash $4.673 $5.069 Ending cash $5.069 $2.795 Note: "Depreciation and noncash expenses" and Investment in plant and equipment" data in the statements of cash flows are somewhat different than they would be if calculated directly from the other financial statements because of asset revaluations 9:36 PM Mon May 4 100% Case Study #6 - Financial Analysis.pdf Case Study #6 - Financial Analysis.pdf 7 of 10 Case 1: Riverview Community Hospital (A) 2 2011 2012 2013 Operating Revenue Gross inpatient service Gross outpatient service Gross patient service revenue EXHIBIT 1.4 River Community Hospital: Revenue and Expense Allocation (millions of dollars) $26.117 6.535 $32.652 $29.148 9.130 $38.278 $33.216 11.912 $45.128 Contractual allowances Bad debt and charity care Total revenue deductions $ 1.729 2.127 $ 3.856 $ 5.196 2.506 $7.702 $ 7,516 3.030 $10.546 Net patient service revenue $28.796 $30.576 $34.5B2 Operating Expenses Inpatient service Outpatient service Total operating expenses $20.573 6.831 $27.404 $22.229 8.098 $30.327 $24.771 9.187 $33.958 2011 2012 2013 EXHIBIT 1.5 River Community Hospital: Selected Operating Data Medicare discharges Total discharges Outpatient visits Licensed beds Staffed beds Patient days All-payer case mix index Full-time equivalents 2,721 8,784 32,285 210 193 44,085 1.2869 610.8 2,860 8,318 32,878 210 197 42,434 1.2993 625.8 2,741 8,576 36,796 210 178 40,062 1.3161 619.3 9:37 PM Mon May 4 100% Case Study #6 - Financial Analysis.pdf Case Study #6 - Financial Analysis.pdf 8 of 10 10 Cases in Healthcare Finance +Quartile Median -Quartile EXHIBIT 1.6 2013 Selected Industry Financial Ratios (200-299 beds) Profitability Ratios Total margin Return on assets Return on equity Deductible ratio 5.58% 5.80% 15.66% 0.34 3.48% 3.10% 6.01% 0.26 0.53% 0.40% 0.62% 0.18 Liquidity Ratios Current ratio Days cash on hand 2.53 32.35 1.99 15.89 1.48 6.24 Debt Management Ratios Debt ratio Debt to equity ratio Times interest earned Cash flow coverage 62.90% 127.00% 4.29 5.32 48.40% 64.70% 2.23 3.22 35.20% 26.90% 1.14 1.76 2.20 1.04 1.76 0.89 1.49 0.75 Asset Management Ratios Fixed asset turnover Total asset turnover Days in patient accounts receivable Current asset turnover Average payment period (days) 87.53 3.94 71.24 75.67 3.38 56.52 63.33 2.88 45.84 Other Ratios Average age of plant (years) 8.86 7.39 6.14 "Deductions/Gross patient service revenue Total revenues/Current assets Current liabilities/[/Total expenses - Depreciation expense)/365) Notes: 1. The industry data shown here are for illustrative purposes only and hence should not be used outside this case. 2. The upper quartile is based on the higher numerical value for the ratio and the lower quartile on the lower numerical value, regardless of whether a high value is good or bad. The interpretation is left to the analyst. 9:37 PM Mon May 4 100% Case Study #6 - Financial Analysis.pdf Case Study #6 - Financial Analysis.pdf 9 of 10 Case 1: Riverview Community Hospital (A) 11 +Quartile Median -Quartile EXHIBIT 1.7 2013 Selected Industry Operating Ratios (200-299 beds) Profit Indicators Profit per discharge Profit per visit $89.04 $ 6.22 ($21.30) $ 0.66 $120.08) $ 7.01) Net Revenue Indicators Net revenue per discharge Net revenue per visit Medicare revenue percentage Bad debt/charity care percentage Contractual allowance percentage Outpatient revenue percentage $4,091 $ 201 43.47% 7.89% 25.27% 25.26% $3,411 $ 139 36.60% 4.76% 20.02% 21.03% $2,815 $ 98 31.25% 297% 12.12% 17.44% Volume Indicators Occupancy rate Average daily census' 67.12% 173.23 58.10% 144.73 47 84% 114.39 Length-of-Stay Indicators Average length of stay (days) Adjusted length of stay 6.80 6.48 5.41 6.07 5.36 4.52 Intensity-of-Service Indicators Expense per discharge Adjusted expense per discharge Expense per visit All-payer case mix index $ 3,937 $ 3,417 $202.23 1.2795 $ 3,392 $ 2,924 $141.97 1.1756 $ 2,972 $ 2,572 $111.53 1.0259 Efficiency Indicators FTES per occupied bed Labor-hours per visit 4.59 4.68 4.15 5.84 3.77 8.66 Unit Cost Indicators Salary per FTE Employee benefits percentaget Liability expense per discharge $24,447 19.58% $ 80.94 $22,517 17.04% $ 42.05 $20,347 15.18% $ 18.31 Net inpatient revenue - Inpatient expenses/Total discharges (Net outpatient revenue - Outpatient expenses/Total Visits "Net inpatient revenue/Total discharges Search 9:36 PM Mon May 4 100% Case Study #6 - Financial Analysis.pdf Case Study #6 - Financial Analysis.pdf 2 of 10 4 Cases in Healthcare Finance Exhibits 1.6 and 1.7. (Note that the industry data given in the case are for illustrative purposes only and do not represent actual data for the years specified. For a better idea of the type of comparative data actu- ally available for hospitals, see the Optum" website at www.hospital benchmarks.com.) In addition to the data in the exhibits, the following information was extracted from the notes section of River's 2013 Annual Report 1. A significant portion of the hospital's net patient service revenue was generated by patients who are covered either by Medicare, Medicaid, or other government programs or by various private plans, including managed care plans, that have contracts with the hospital that specify discounts from charges. In general, the proportional amount of deductions is similar between inpatients and outpatients. The gross and net patient service revenue and operating expenses breakdown for both inpatient and outpatient services is given in Exhibit 1.4. 2. River has a contributory money accumulation (defined contribution) pension plan that covers substantially all of its employees. Participants can contribute up to 20 percent of earnings to the pension plan. The hospital matches, on a dollar-for-dollar basis, employee contributions of up to 2 percent of wages and pays 50 cents on the dollar for contributions over 2 percent and up to 4 percent. Because the plan is a defined contribution plan (as opposed to a defined benefit plan), River has no unfunded pension liabilities. Pension expense was approximately $0.543 million in 2012 and $0.588 million in 2013. 3. The hospital is a member of the State Hospital Trust Fund, under which it purchases professional liability insurance coverage for individual claims up to $1 million (subject to a deductible of $100,000 per claim). River is self-insured for amounts above $1 million but less than $5 million. Any liability award in excess of $5 million is covered by a commercial liability policy; for example, the policy pays $2 million on a $7 million award. The hospital is currently involved Search 9:36 PM Mon May 4 100% Case Study #6 - Financial Analysis.pdf Case Study #6 - Financial Analysis.pdf 3 of 10 Case 1: Riverview Community Hospital (A) 5 in eight suits involving claims of various amounts that could ultimately be tried before juries. Although it is impossible to determine the exact potential liability in these claims, management does not believe that the settlement of these cases would have a material effect on the hospital's financial position. Assume that you have just joined the staff of River Community Hospital as a special assistant to the CEO. On your first day on the job, the CEO, Melissa Randolph, stated that the best way to get to know the financial and operating condition of the hospital is to conduct a thorough financial statement and operating indicator analysis; thus, she assigned you the task. Although you also believe that this is a good way to get started, you wonder whether Melissa has any ulterior motives. Perhaps the hospital is having problems and she thinks that you can spot them, or perhaps she wants to test your analytical skills. Melissa is from the "old school" of hospital management and has been looking for someone to bring modern management methods to the hospital. As you prepare for the presentation, several relevant factors come to light. First, in reviewing the policy decisions made by River's board of trustees over the past decade, you note that in 2008 the board made the decision to significantly expand the hospital's outpatient services. The rationale was that many procedures that historically were done on an inpatient basis were now being done in an outpatient setting, and if River did not offer such services it would lose the patients to other providers. Second, the board chair has great concern about the decline in profitability between 2011 and 2012 and has not been assuaged by the recent modest upturn. Perhaps because she is CEO of a local company, the chair focuses on return on equity (ROE) as the key measure of prof- itability. She has requested that management develop some strategies to improve profitability and estimate the impact of the strategies on the hospital's ROE. Third, you discover that board members were complaining that too much time is being spent at quarterly board meetings discussing the hos- pital's financial condition. "There is so much to accomplish," said one member, that we just don't have the time to consider a large number of ratios at each meeting." You know that many healthcare providers are now using dashboards to focus on key performance indicators (KPIs). A dashboard is nothing Search 9:36 PM Mon May 4 100% Case Study #6 - Financial Analysis.pdf Case Study #6 - Financial Analysis.pdf 6 Cases in Healthcare Finance more than a way to summarize an organization's financial and operat- ing performance. Of course, the name stems from an automobile's dashboard, which contains gauges that give drivers essential information about the car's performance and operating condition. Thus, you plan to develop two dashboards, each containing no more than five KPIs. One dashboard will use financial ratios to focus on financial performance, while the other will use operating indicator ratios to focus on operating performance. You plan to present your recommendations for the con- tents of these dashboards, along with the rationale for the ratios chosen, at the board meeting. Your ultimate goal is to replace the full financial and operating performance discussion at future board meetings with a limited discussion of the KPIs. 2011 2012 2013 EXHIBIT 1.1 River Community Hospital: Statements of Operations (millions of dollars) Revenues Net patient service revenue Other revenue Total revenues $28.796 1.237 $30.033 $30,576 1.853 $32.429 $34.582 1.834 $36.416 Expenses Salaries and wages Fringe benefits Interest expense Depreciation Medical supplies and drugs Professional liability Other Total expenses $12.245 1.830 1.181 2.350 0.622 0.140 9.036 $27.404 $12.468 2.408 1.598 2.658 0.655 0.201 10.339 $30.327 $13.994 2,568 1.776 2.778 0.776 0.218 11.848 $33.958 Net Income $ 2.629 $ 2.102 $ 2.458 Search 9:36 PM Mon May 4 100% Case Study #6 - Financial Analysis.pdf Case Study #6 - Financial Analysis.pdf 5 of 10 Case 1: Riverview Community Hospital (A) 2011 2012 2013 EXHIBIT 1.2 River Community Hospital: Balance Sheets (millions of dollars) Assets Cash and investments Accounts receivable (net) Inventories Other current assets Total current assets Gross plant and equipment Accumulated depreciation Net plant and equipment Total assets $ 4.673 4.359 0.432 0.308 $ 9.772 $47.786 11.820 $35.966 $45.738 $ 5.069 5.674 0.523 0.703 $11.969 $55.333 14.338 $40.995 $52.964 $ 2.795 7,413 0.601 0.923 $11.732 $59.552 17.009 $42.543 S54.275 Liabilities and Net Assets Accounts payable Accrued expenses Current portion of LT debt Total current liabilities Long-term debt Net assets Total liabilities and net assets $ 0.928 1.460 0.110 $ 2.498 15.673 27.567 $45.738 $ 1.253 1.503 1.341 $ 4.097 19.222 29.645 $52.964 $ 1.760 1.176 1.465 $ 4.401 17.795 32.079 $54.275 LT: long term 9:36 PM Mon May 4 100% X Case Study #6 - Financial Analysis.pdf Case Study #6 - Financial Analysis.pdf 8 Cases in Healthcare Finance 2012 2013 EXHIBIT 1.3 River Community Hospital: Statements of Cash Flows (millions of dollars) Cash Flows from Operating Activities Net income Depreciation and noncash expenses Change in accounts receivable Change in inventories Change in other current assets Change in accounts payable Change in accrued expenses Net cash flow from operations $2.102 2.633 (1.315) (0.091) (0.395) 0.325 0.043 $3.302 $2.458 2.756 (1.739) (0.078) (0.220) 0.507 (0.327) $3.357 Cash Flows from Investing Activities Investment in plant and equipment $7.686) $4.328) $3.549 ($1.427) Cash Flows from Financing Activities Change in long-term debt Change in current portion of long-term debt Net cash flow from financing $1.231 $4.780 SO.124 ($1.303) Net increase (decrease) in cash $0.396 ($2.274) Beginning cash $4.673 $5.069 Ending cash $5.069 $2.795 Note: "Depreciation and noncash expenses" and Investment in plant and equipment" data in the statements of cash flows are somewhat different than they would be if calculated directly from the other financial statements because of asset revaluations 9:36 PM Mon May 4 100% Case Study #6 - Financial Analysis.pdf Case Study #6 - Financial Analysis.pdf 7 of 10 Case 1: Riverview Community Hospital (A) 2 2011 2012 2013 Operating Revenue Gross inpatient service Gross outpatient service Gross patient service revenue EXHIBIT 1.4 River Community Hospital: Revenue and Expense Allocation (millions of dollars) $26.117 6.535 $32.652 $29.148 9.130 $38.278 $33.216 11.912 $45.128 Contractual allowances Bad debt and charity care Total revenue deductions $ 1.729 2.127 $ 3.856 $ 5.196 2.506 $7.702 $ 7,516 3.030 $10.546 Net patient service revenue $28.796 $30.576 $34.5B2 Operating Expenses Inpatient service Outpatient service Total operating expenses $20.573 6.831 $27.404 $22.229 8.098 $30.327 $24.771 9.187 $33.958 2011 2012 2013 EXHIBIT 1.5 River Community Hospital: Selected Operating Data Medicare discharges Total discharges Outpatient visits Licensed beds Staffed beds Patient days All-payer case mix index Full-time equivalents 2,721 8,784 32,285 210 193 44,085 1.2869 610.8 2,860 8,318 32,878 210 197 42,434 1.2993 625.8 2,741 8,576 36,796 210 178 40,062 1.3161 619.3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts