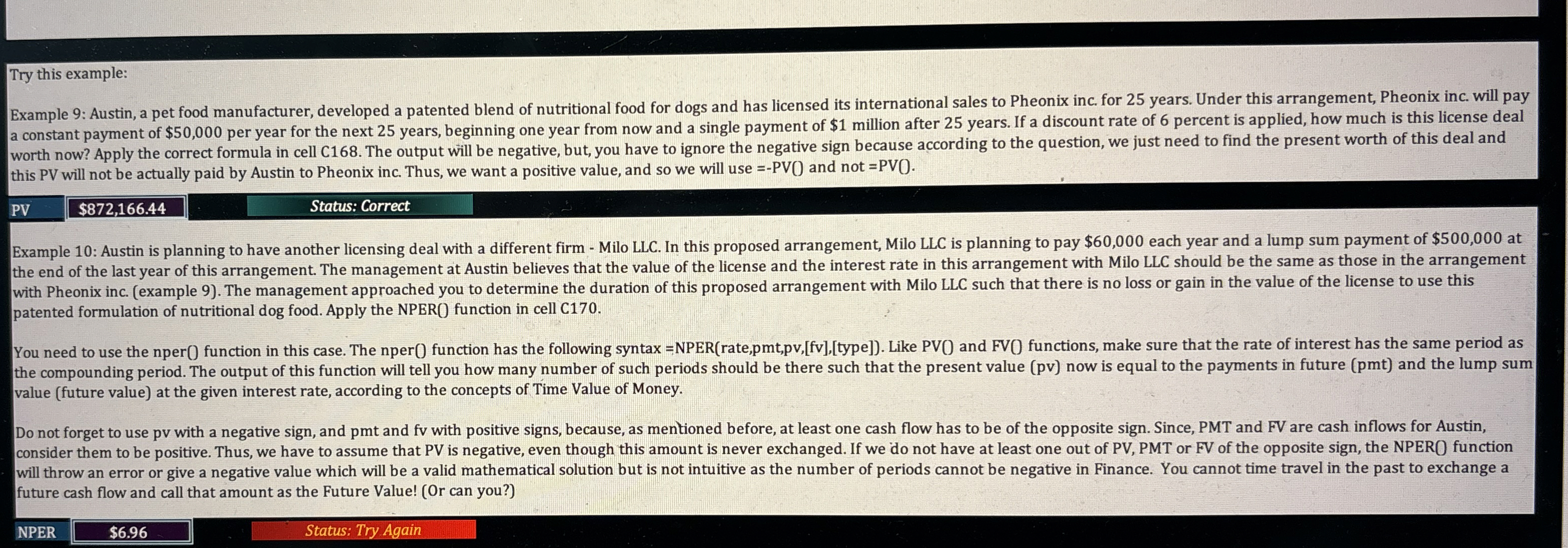

Question: Example 1 0 : Austin is planning to have another licensing deal with a different firm - Milo LLC . In this proposed arrangement, Milo

Example : Austin is planning to have another licensing deal with a different firm Milo LLC In this proposed arrangement, Milo LLC is planning to pay $ each year and a sument of s $ at

the end of the last year of this arrangement. The management at Austin believes that the value of the license and the interest rate in this arrangement with Milo LLC should be the same as those in the arrangement

with Pheonix inc. example The management approached you to determine the duration of this proposed arrangement with Milo LLC such that there is no loss or gain in the value of the license to use this

patented formulation of nutritional dog food. Apply the NPER function in cell C

You need to use the nper function in this case. The nper function has the following syntax

the compounding period. The output of this function will tell you how many number of such periods should be there such that the present value pv now is equal to the payments in future pmt and the lump sum

value future value at the given interest rate, according to the concepts of Time Value of Money.

Do not forget to use pv with a negative sign, and pmt and fv with positive signs, because, as mentioned before, at least one cash flow has to be of the opposite sign. Since, PMT and FV are cash inflows for Austin,

consider them to be positive. Thus, we have to assume that PV is negative, even though this amount is never exchanged. If we do not have at least one out of PV PMT or FV of the opposite sign, the NPERO function

will throw an error or give a negative value which will be a valid mathematical solution but is not intuitive as the number of periods cannot be negative in Finance. You cannot time travel in the past to exchange a

future cash flow and call that amount as the Future Value! Or can you?

please helpppp

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock