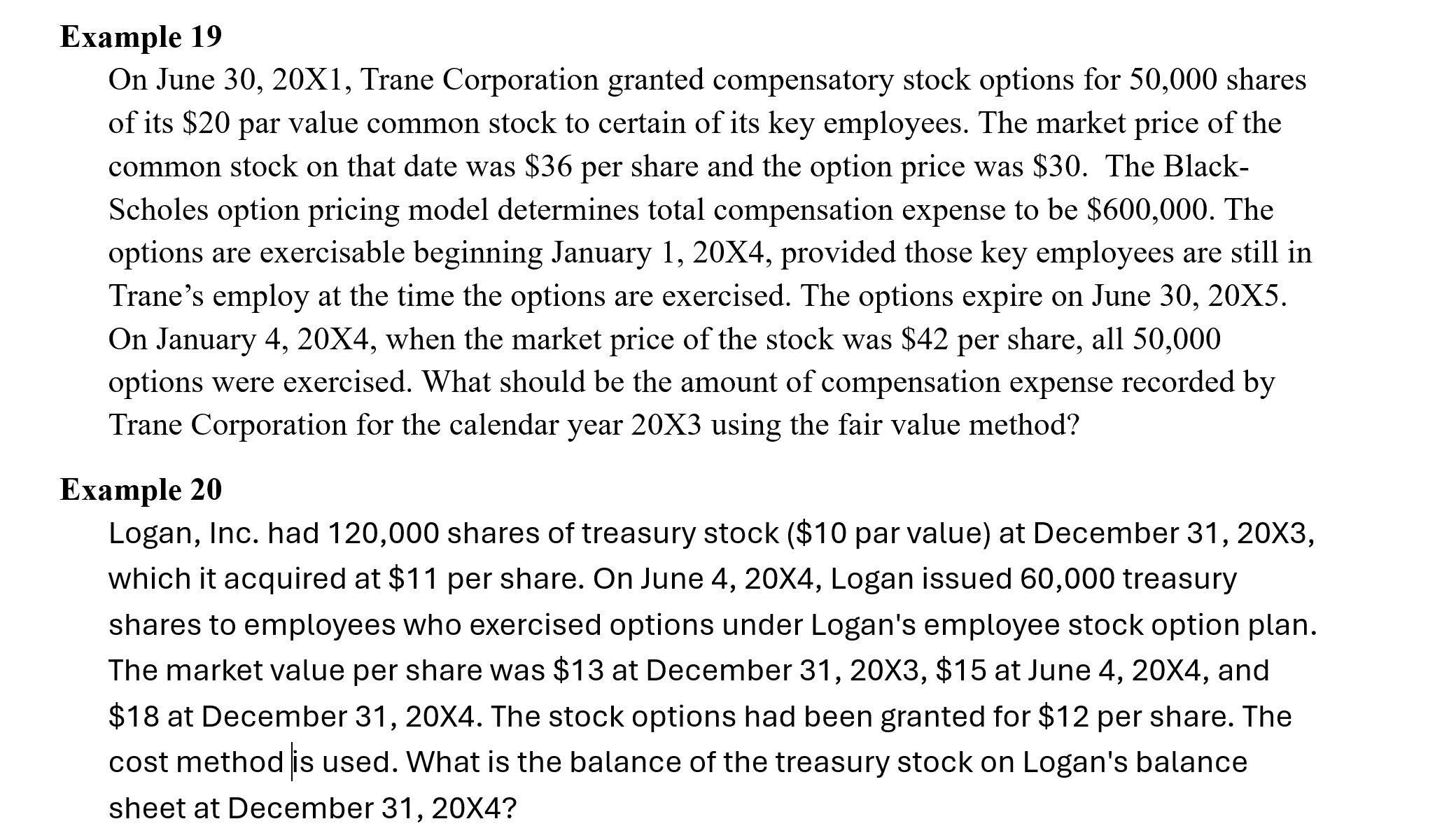

Question: Example 1 9 On June 3 0 , 2 0 X 1 , Trane Corporation granted compensatory stock options for 5 0 , 0 0

Example On June X Trane Corporation granted compensatory stock options for shares of its $ par value common stock to certain of its key employees. The market price of the common stock on that date was $ per share and the option price was $ The BlackScholes option pricing model determines total compensation expense to be $ The options are exercisable beginning January X provided those key employees are still in Trane's employ at the time the options are exercised. The options expire on June X On January X when the market price of the stock was $ per share, all options were exercised. What should be the amount of compensation expense recorded by Trane Corporation for the calendar year X using the fair value method? Example Logan, Inc. had shares of treasury stock $ par value at December X which it acquired at $ per share. On June mathrmX Logan issued treasury shares to employees who exercised options under Logan's employee stock option plan. The market value per share was $ at December X$ at June X and $ at December X The stock options had been granted for $ per share. The cost method is used. What is the balance of the treasury stock on Logan's balance sheet at December X

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock