Question: Example 1 Chris and John Trogner are considering building a new brewery to meet expected future demand for their line of beers. They are considering

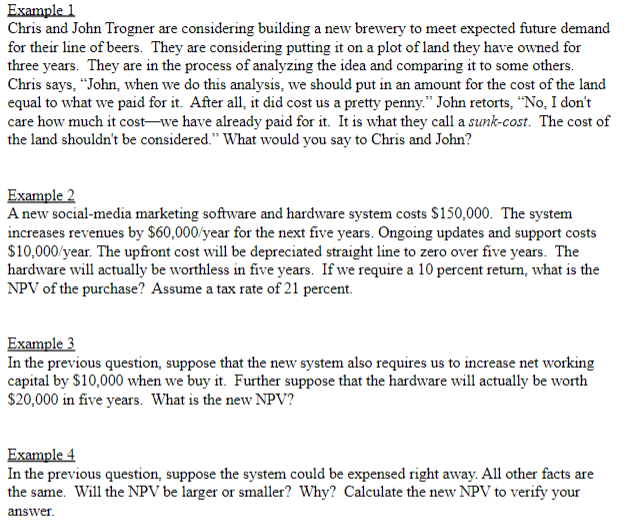

Example 1 Chris and John Trogner are considering building a new brewery to meet expected future demand for their line of beers. They are considering putting it on a plot of land they have owned for three years. They are in the process of analyzing the idea and comparing it to some others. Chris says, "John, when we do this analysis, we should put in an amount for the cost of the land equal to what we paid for it. After all, it did cost us a pretty penny." John retorts, "No, I don't care how much it cost-we have already paid for it. It is what they call a sunk-cost. The cost of the land shouldn't be considered. "What would you say to Chris and John? Example 2 A new social-media marketing software and hardware system costs $150,000. The system increases revenues by $60,000/ year for the next five years. Ongoing updates and support costs $10,000 year. The upfront cost will be depreciated straight line to zero over five years. The hardware will actually be worthless in five years. If we require a 10 percent return, what is the NPV of the purchase? Assume a tax rate of 21 percent. Example 3 In the previous question, suppose that the new system also requires us to increase net working capital by $10,000 when we buy it. Further suppose that the hardware will actually be worth $20,000 in five years. What is the new NPV? Example 4 In the previous question, suppose the system could be expensed right away. All other facts are the same. Will the NPV be larger or smaller? Why? Calculate the new NPV to verify your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts