Question: Example 1: Consider an IS project has initial costs equal to $100,000, and yields $27,000 in gross sales for five years. At the end of

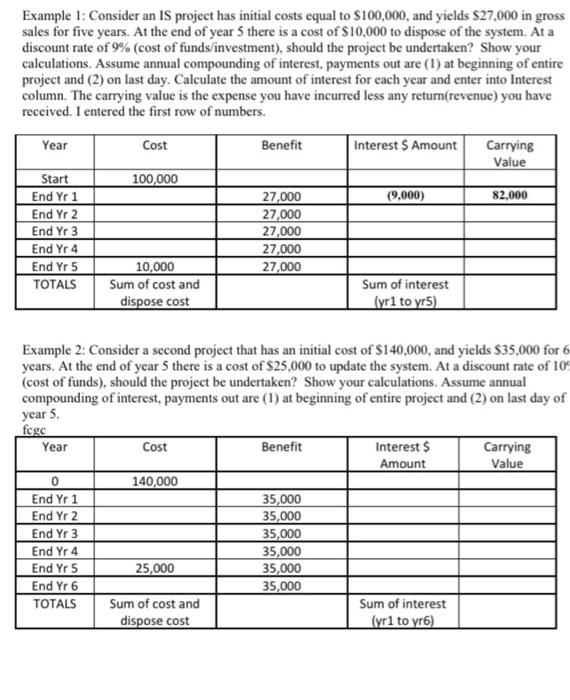

Example 1: Consider an IS project has initial costs equal to $100,000, and yields $27,000 in gross sales for five years. At the end of year 5 there is a cost of $10,000 to dispose of the system. At a discount rate of 9% (cost of funds/investment), should the project be undertaken? Show your calculations. Assume annual compounding of interest, payments out are (1) at beginning of entire project and (2) on last day. Calculate the amount of interest for each year and enter into Interest column. The carrying value is the expense you have incurred less any retum(revenue) you have received. I entered the first row of numbers. Year Cost Benefit Interest $ Amount Carrying Value Start 100,000 End Yr 1 27,000 (9.000) 82.000 End Yr 2 27,000 End Yr 3 27,000 End Yr 4 27,000 End Yr 5 10,000 27,000 TOTALS Sum of cost and Sum of interest dispose cost (yrito yrs) Example 2: Consider a second project that has an initial cost of $140,000, and yields $35,000 for 6 years. At the end of year 5 there is a cost of $25,000 to update the system. At a discount rate of 10 (cost of funds), should the project be undertaken? Show your calculations. Assume annual compounding of interest, payments out are (1) at beginning of entire project and (2) on last day of year 5. foge Year Cost Benefit Interests Amount Carrying Value 0 140,000 End Yr 1 End Yr 2 End Yr 3 End Yr 4 End Yr 5 End Yr 6 TOTALS 35,000 35,000 35,000 35,000 35,000 35,000 25,000 Sum of cost and dispose cost Sum of interest (yr1 to yr6) Example 1: Consider an IS project has initial costs equal to $100,000, and yields $27,000 in gross sales for five years. At the end of year 5 there is a cost of $10,000 to dispose of the system. At a discount rate of 9% (cost of funds/investment), should the project be undertaken? Show your calculations. Assume annual compounding of interest, payments out are (1) at beginning of entire project and (2) on last day. Calculate the amount of interest for each year and enter into Interest column. The carrying value is the expense you have incurred less any retum(revenue) you have received. I entered the first row of numbers. Year Cost Benefit Interest $ Amount Carrying Value Start 100,000 End Yr 1 27,000 (9.000) 82.000 End Yr 2 27,000 End Yr 3 27,000 End Yr 4 27,000 End Yr 5 10,000 27,000 TOTALS Sum of cost and Sum of interest dispose cost (yrito yrs) Example 2: Consider a second project that has an initial cost of $140,000, and yields $35,000 for 6 years. At the end of year 5 there is a cost of $25,000 to update the system. At a discount rate of 10 (cost of funds), should the project be undertaken? Show your calculations. Assume annual compounding of interest, payments out are (1) at beginning of entire project and (2) on last day of year 5. foge Year Cost Benefit Interests Amount Carrying Value 0 140,000 End Yr 1 End Yr 2 End Yr 3 End Yr 4 End Yr 5 End Yr 6 TOTALS 35,000 35,000 35,000 35,000 35,000 35,000 25,000 Sum of cost and dispose cost Sum of interest (yr1 to yr6)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts