Question: Example 1. Develop objectives for your portfolio. These might be simply to earn a moderately high, but safe rate of return; or they might be

Example

1. Develop objectives for your portfolio. These might be simply to earn a moderately high, but

1. Develop objectives for your portfolio. These might be simply to earn a moderately high, but

safe rate of return; or they might be to earn a satisfactory rate of return while investing only in

socially responsible companies; or to earn the highest rate of return possible; or to invest in

well-managed agribusiness companies; or to invest in companies that you want to investigate as

future employers; or some other objectives.

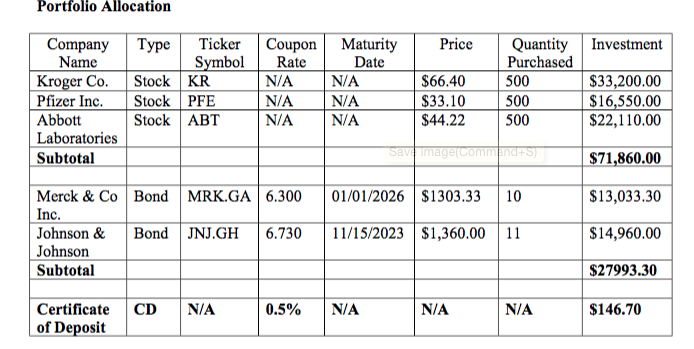

2. Invest $100,000 in a portfolio of stocks and corporate bonds that is consistent with your

portfolio objective(s). You must invest in the stock and bonds of the agribusiness firm you have

been assigned (Smuckers) and at least two other companies of your choice. You must keep your

investments in the agribusiness throughout the semester but may sell part of all of your original

investment in the other companies at any time and use the proceeds to re-invest in different

companies stocks and bonds.

Portfolio Objectives Our objectives are to invest in strong, highly-rated pharmaceutical companies, in addition to Kroger Co., our assigned agribusiness firm. The pharmaceutical companies are all rated at least A by S&P. These investments, we hope, will allow us to get a moderate rate of return with low risk Portfolio Objectives Our objectives are to invest in strong, highly-rated pharmaceutical companies, in addition to Kroger Co., our assigned agribusiness firm. The pharmaceutical companies are all rated at least A by S&P. These investments, we hope, will allow us to get a moderate rate of return with low risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts