Question: Example 1: High Value Computer Co. (HVC) manufactures and sells computers for $850. The company has two production divisions: Manufacturing and Assembly. Manufacturing Division produces

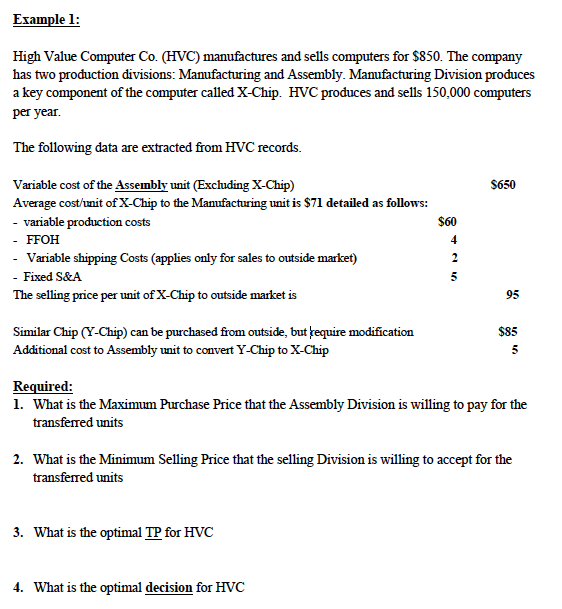

Example 1: High Value Computer Co. (HVC) manufactures and sells computers for $850. The company has two production divisions: Manufacturing and Assembly. Manufacturing Division produces a key component of the computer called X-Chip. HVC produces and sells 150,000 computers per year. The following data are extracted from HVC records. $650 Variable cost of the Assembly unit (Excluding X-Chip) Average cost/unit of X-Chip to the Manufacturing unit is $71 detailed as follows: - variable production costs - FFOH - Variable shipping Costs (applies only for sales to outside market) - Fixed S&A The selling price per unit of X-Chip to outside market is Similar Chip (Y-Chip) can be purchased from outside, but require modification Additional cost to Assembly unit to convert Y-Chip to X-Chip Required: 1. What is the Maximum Purchase Price that the Assembly Division is willing to pay for the transferred units 2. What is the Minimum Selling Price that the selling Division is willing to accept for the transferred units 3. What is the optimal TP for HVC 4. What is the optimal decision for HVC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts