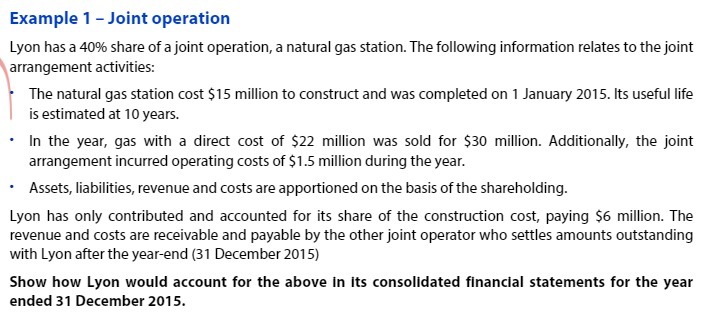

Question: Example 1 - Joint operation Lyon has a 40% share of a joint operation, a natural gas station. The following information relates to the joint

Example 1 - Joint operation Lyon has a 40% share of a joint operation, a natural gas station. The following information relates to the joint arrangement activities: The natural gas station cost $15 million to construct and was completed on 1 January 2015. Its useful life is estimated at 10 years. In the year, gas with a direct cost of $22 million was sold for $30 million. Additionally, the joint arrangement incurred operating costs of $1.5 million during the year. Assets, liabilities, revenue and costs are apportioned on the basis of the shareholding. Lyon has only contributed and accounted for its share of the construction cost, paying $6 million. The revenue and costs are receivable and payable by the other joint operator who settles amounts outstanding with Lyon after the year-end (31 December 2015) Show how Lyon would account for the above in its consolidated financial statements for the year ended 31 December 2015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts