Question: Example 1 : Portfolio Selection MBX Group has just obtained $ 1 0 0 , 0 0 0 by converting corporate bonds into cash. It

Example : Portfolio Selection

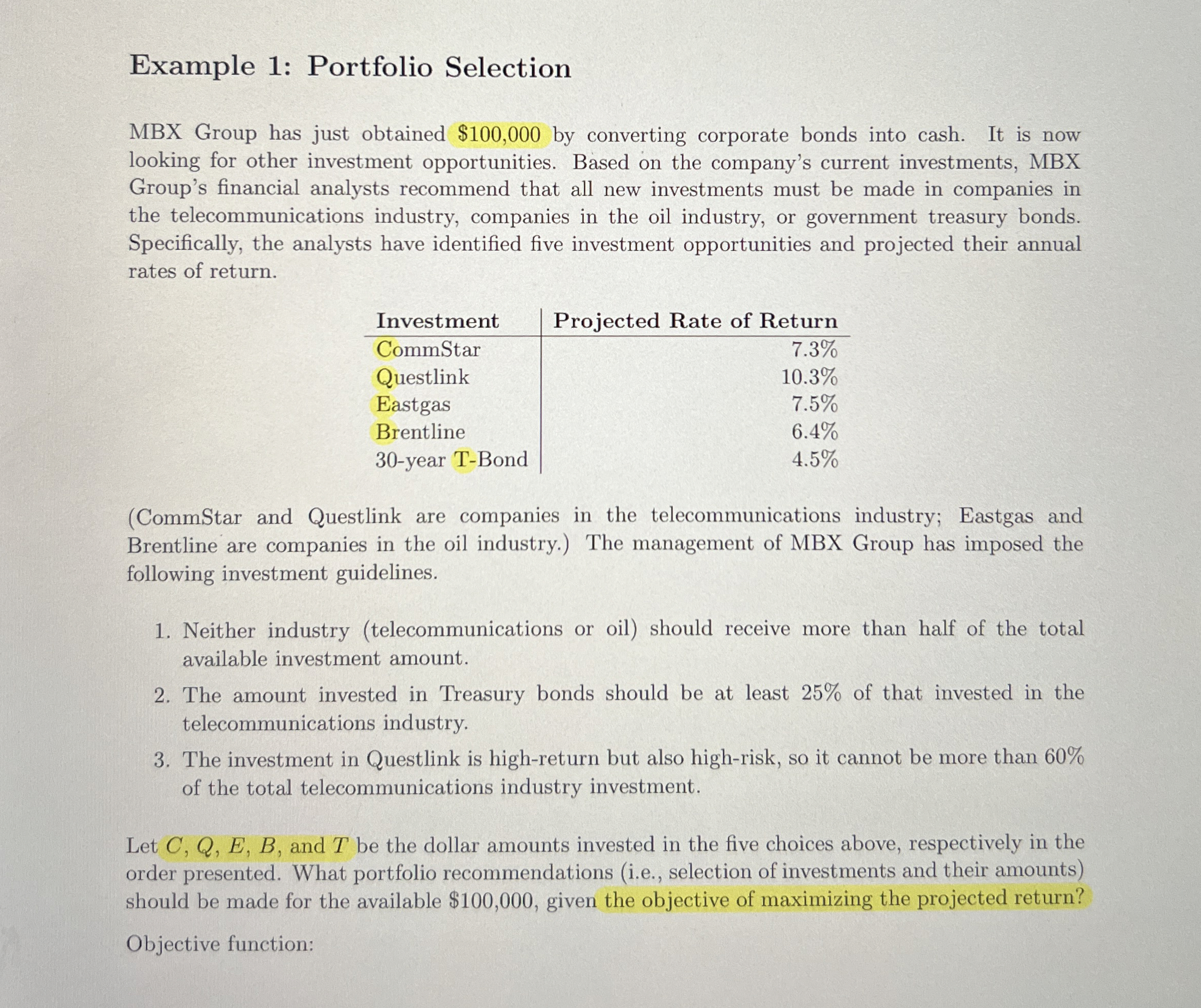

MBX Group has just obtained $ by converting corporate bonds into cash. It is now

looking for other investment opportunities. Based on the company's current investments, MBX

Group's financial analysts recommend that all new investments must be made in companies in

the telecommunications industry, companies in the oil industry, or government treasury bonds.

Specifically, the analysts have identified five investment opportunities and projected their annual

rates of return.

CommStar and Questlink are companies in the telecommunications industry; Eastgas and

Brentline are companies in the oil industry. The management of MBX Group has imposed the

following investment guidelines.

Neither industry telecommunications or oil should receive more than half of the total

available investment amount.

The amount invested in Treasury bonds should be at least of that invested in the

telecommunications industry.

The investment in Questlink is highreturn but also highrisk, so it cannot be more than

of the total telecommunications industry investment.

Let and be the dollar amounts invested in the five choices above, respectively in the

order presented. What portfolio recommendations ie selection of investments and their amounts

should be made for the available $ given the objective of maximizing the projected return?

Objective function:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock