Question: Example 2 1 Dark Co . purchases land and constructs a service station and car wash for a total of ( $ 6

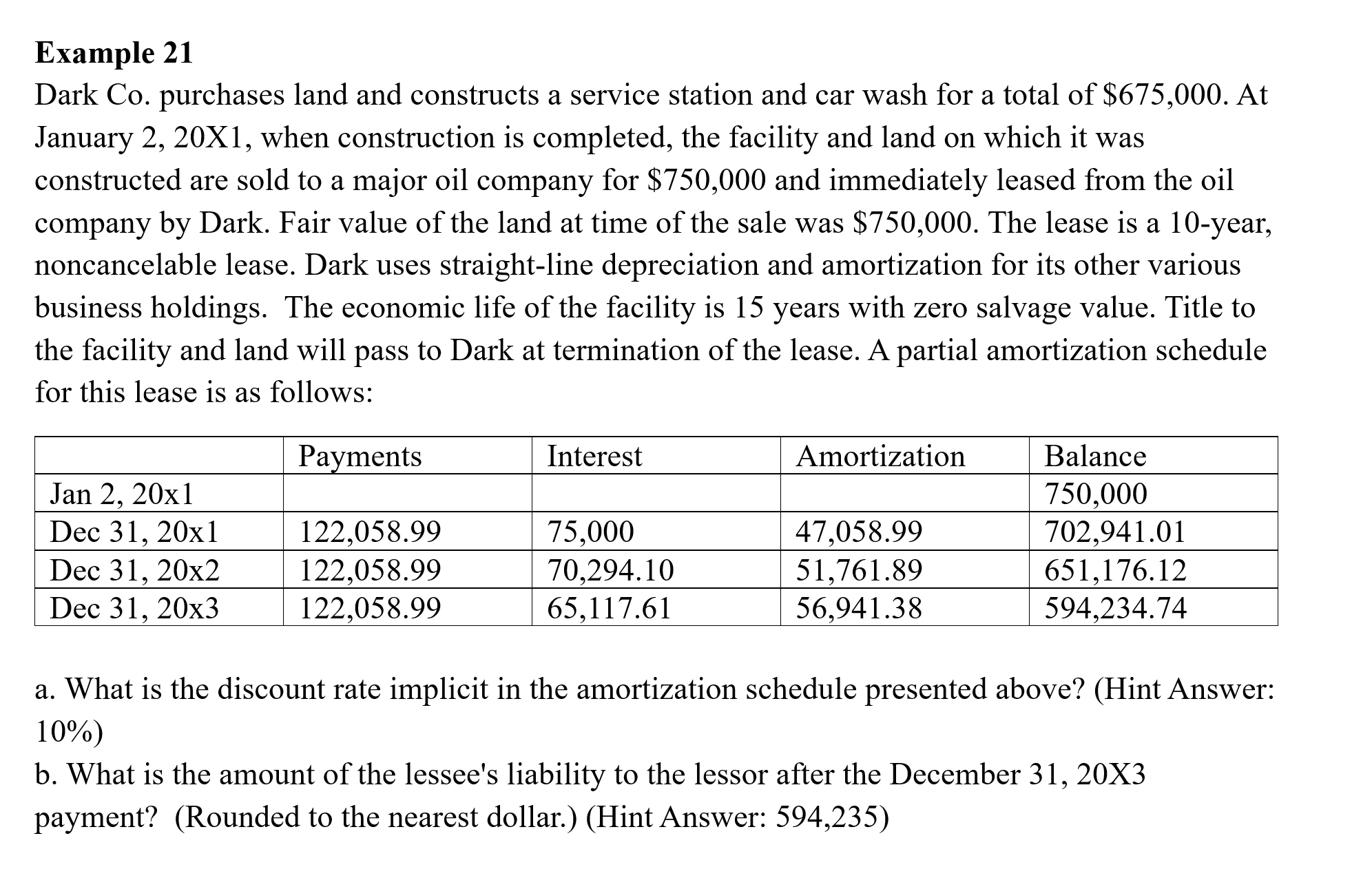

Example Dark Co purchases land and constructs a service station and car wash for a total of $ At January X when construction is completed, the facility and land on which it was constructed are sold to a major oil company for $ and immediately leased from the oil company by Dark. Fair value of the land at time of the sale was $ The lease is a year, noncancelable lease. Dark uses straightline depreciation and amortization for its other various business holdings. The economic life of the facility is years with zero salvage value. Title to the facility and land will pass to Dark at termination of the lease. A partial amortization schedule for this lease is as follows: a What is the discount rate implicit in the amortization schedule presented above? Hint Answer: b What is the amount of the lessee's liability to the lessor after the December X payment? Rounded to the nearest dollar.Hint Answer:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock