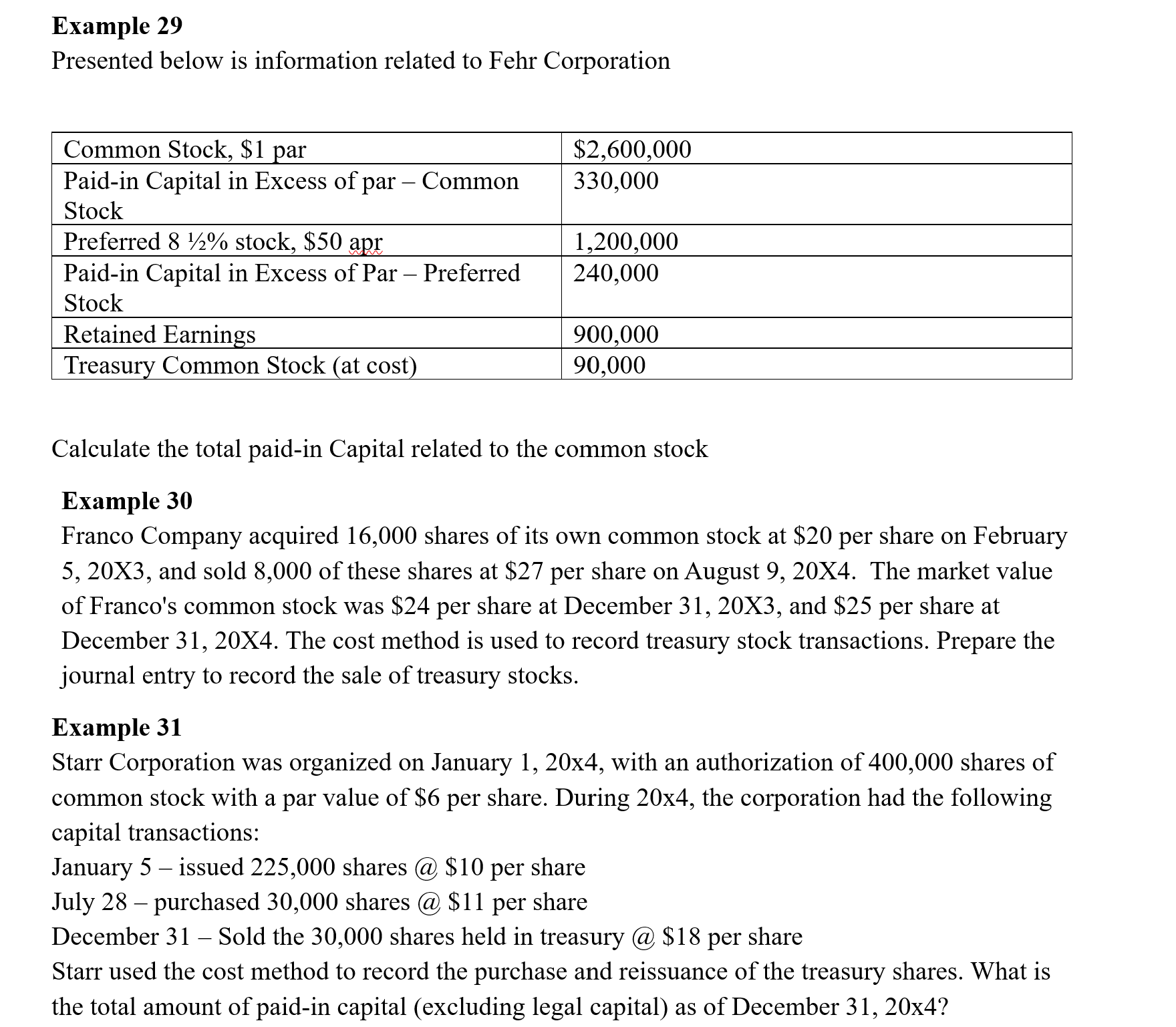

Question: Example 2 9 Presented below is information related to Fehr CorporationPaid - in Capital in Excess of par - Common StockPaid - in Capital in

Example Presented below is information related to Fehr CorporationPaidin Capital in Excess of par Common StockPaidin Capital in Excess of Par Preferred Stock Calculate the total paidin Capital related to the common stock Example Franco Company acquired shares of its own common stock at $ per share on February X and sold of these shares at $ per share on August X The market value of Franco's common stock was $ per share at December X and $ per share at December X The cost method is used to record treasury stock transactions. Prepare the journal entry to record the sale of treasury stocks. Example Starr Corporation was organized on January x with an authorization of shares of common stock with a par value of $ per share. During x the corporation had the following capital transactions: January issued shares @ $ per share July purchased shares @ $ per share December Sold the shares held in treasury @ $ per share Starr used the cost method to record the purchase and reissuance of the treasury shares. What is the total amount of paidin capital excluding legal capital as of December x

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock