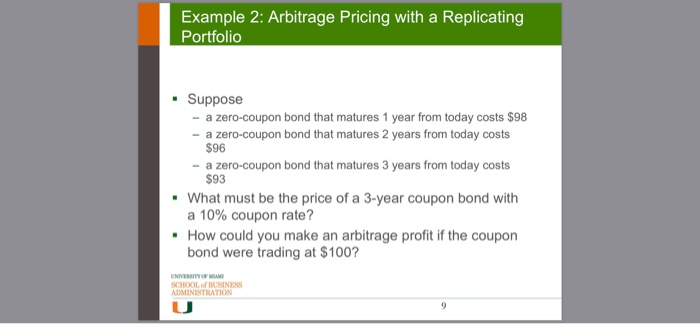

Question: Example 2: Arbitrage Pricing with a Replicating Portfolio Suppose - a zero-coupon bond that matures 1 year from today costs $98 -a zero-coupon bond that

Example 2: Arbitrage Pricing with a Replicating Portfolio Suppose - a zero-coupon bond that matures 1 year from today costs $98 -a zero-coupon bond that matures 2 years from today costs $96 - a zero-coupon bond that matures 3 years from today costs $93 What must be the price of a 3-year coupon bond with a 10% coupon rate? How could you make an arbitrage profit if the coupon bond were trading at $100? SCHOOL of BUSINE88 DMINISTRATION LU

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock