Question: Example 2: Given that you wish to construct an index from the following price series for three securities: Base Year Period T=0 Period T =

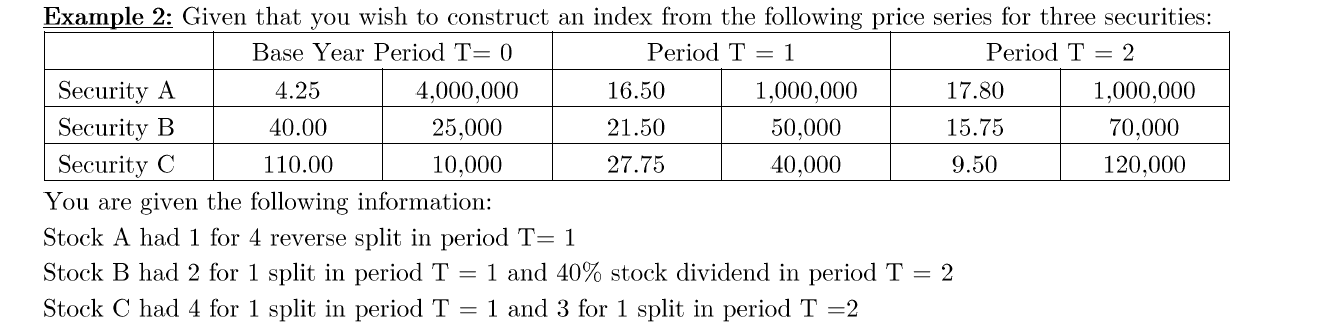

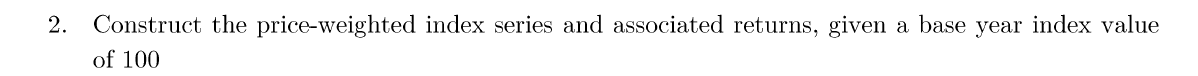

Example 2: Given that you wish to construct an index from the following price series for three securities: Base Year Period T=0 Period T = 1 Period T = 2 Security A 4.25 4,000,000 16.50 1,000,000 17.80 1,000,000 Security B 40.00 25,000 21.50 50,000 15.75 70,000 Security C 110.00 10,000 27.75 40,000 9.50 120,000 You are given the following information: Stock A had 1 for 4 reverse split in period T=1 Stock B had 2 for 1 split in period T = 1 and 40% stock dividend in period T = 2 Stock C had 4 for 1 split in period T = 1 and 3 for 1 split in period T =2 2. Construct the price-weighted index series and associated returns, given a base year index value of 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts