Question: Example: 3 . 4 : Microtec is a small manufacturer of microcomputers. Its board of directors is faced with the problem of evaluating four proposals

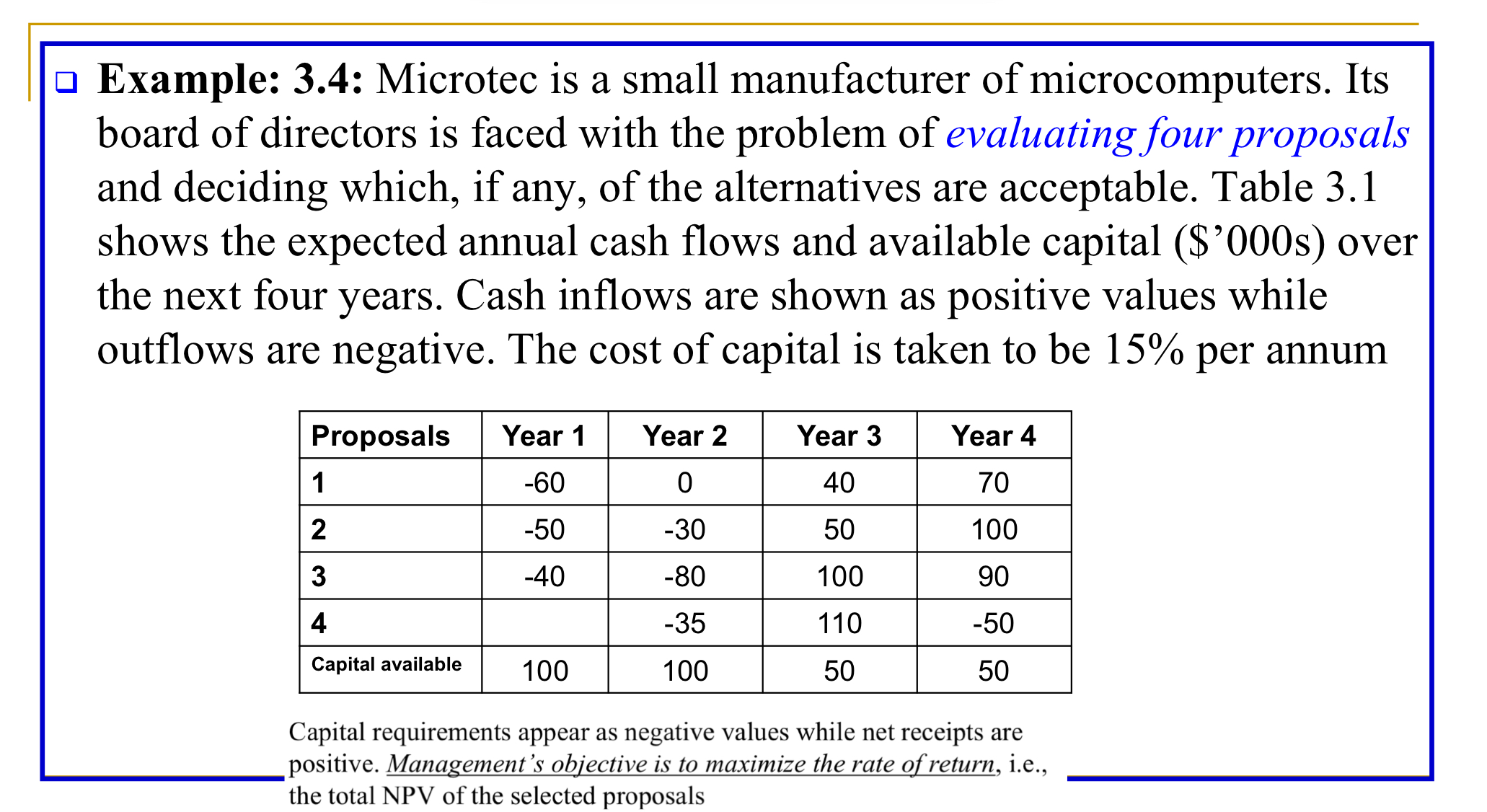

Example: : Microtec is a small manufacturer of microcomputers. Its board of directors is faced with the problem of evaluating four proposals and deciding which, if any, of the alternatives are acceptable. Table shows the expected annual cash flows and available capital $s over the next four years. Cash inflows are shown as positive values while outflows are negative. The cost of capital is taken to be per annum

tableProposalsYear Year Year Year Capital available,

Capital requirements appear as negative values while net receipts are positive. Management's objective is to maximize the rate of return, ie the total NPV of the selected proposals

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock