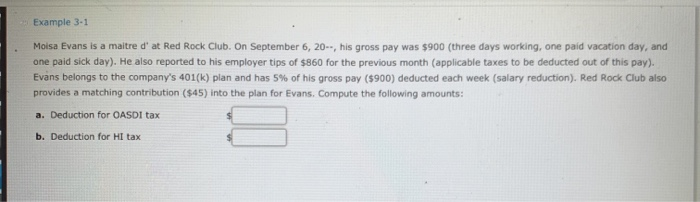

Question: Example 3-1 Molsa Evans is a maitre d' at Red Rock Club. On September 6, 20-, his gross pay was $900 (three days working, one

Example 3-1 Molsa Evans is a maitre d' at Red Rock Club. On September 6, 20-, his gross pay was $900 (three days working, one paid vacation day, and one paid sick day). He also reported to his employer tips of $860 for the previous month (applicable taxes to be deducted out of this pay). Evans belongs to the company's 401(k) plan and has 5% of his gross pay ($900) deducted each week (salary reduction). Red Rock Club also provides a matching contribution ($45) into the plan for Evans. Compute the following amounts: a. Deduction for OASDi tax b. Deduction for HI tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts