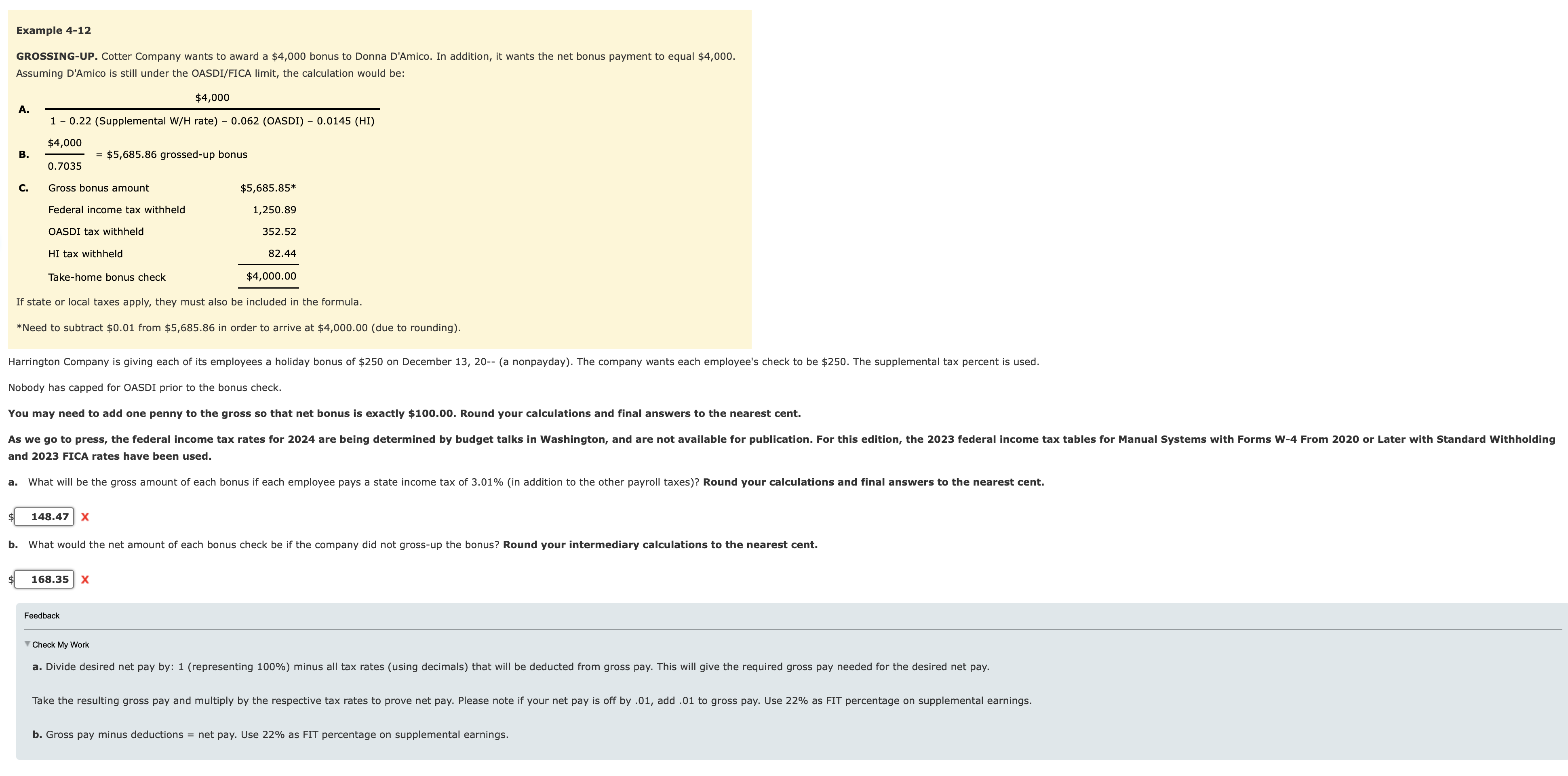

Question: Example 4 - 1 2 GROSSING - UP . Cotter Company wants to award a $ 4 , 0 0 0 bonus to Donna D'Amico.

Example

GROSSINGUP Cotter Company wants to award a $ bonus to Donna D'Amico. In addition, it wants the net bonus payment to equal $

Assuming D'Amico is still under the OASDIFICA limit the calculation would be:

A

B$ grossedup bonus

C Gross bonus amount

If state or local taxes apply, they must also be included in the formula.

Need to subtract $ from $ in order to arrive at $due to rounding

Nobody has capped for OASDI prior to the bonus check.

You may need to add one penny to the gross so that net bonus is exactly $ Round your calculations and final answers to the nearest cent.

and FICA rates have been used.

b What would the net amount of each bonus check be if the company did not grossup the bonus? Round your intermediary calculations to the nearest cent.

Feedback

Theck My Work

b Gross pay minus deductions net pay. Use as FIT percentage on supplemental earnings.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock