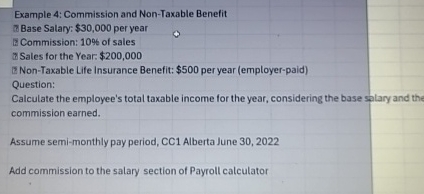

Question: Example 4 : Commission and Non - Taxable Benefit 3 Base Salary: $ 3 0 , 0 0 0 per year ECommission: 1 0 %

Example : Commission and NonTaxable Benefit

Base Salary: $ per year

ECommission: of sales

Sales for the Year: $

E NonTaxable Life Insurance Benefit: $ per year employerpaid

Question:

Calculate the employee's total taxable income for the year, considering the base salary and the

commission earned.

Assume semimonthly pay period, CC Alberta June

Add commission to the salary section of Payroll calculator

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock