Question: Example 4-3 To compute the tax using the percentage method for Manual Payroll Systems with Forms W-4 from 2020 or Later using Standard Withholding Rate

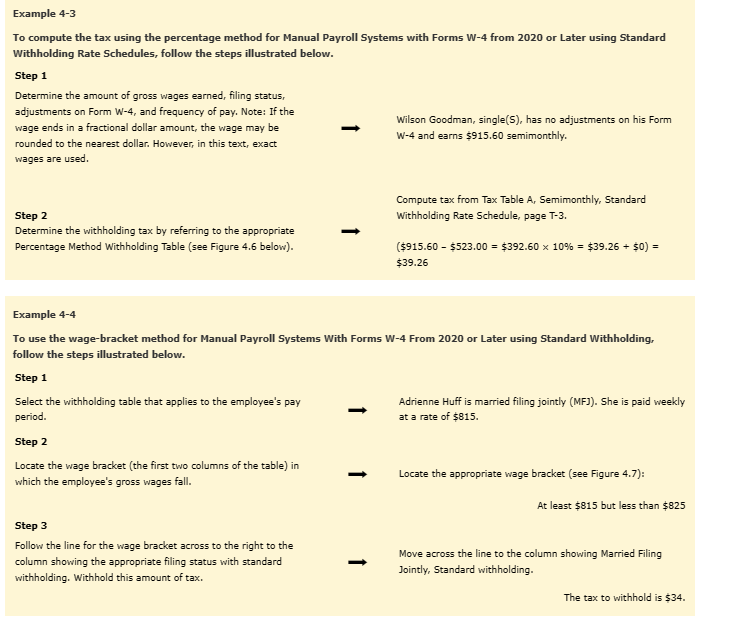

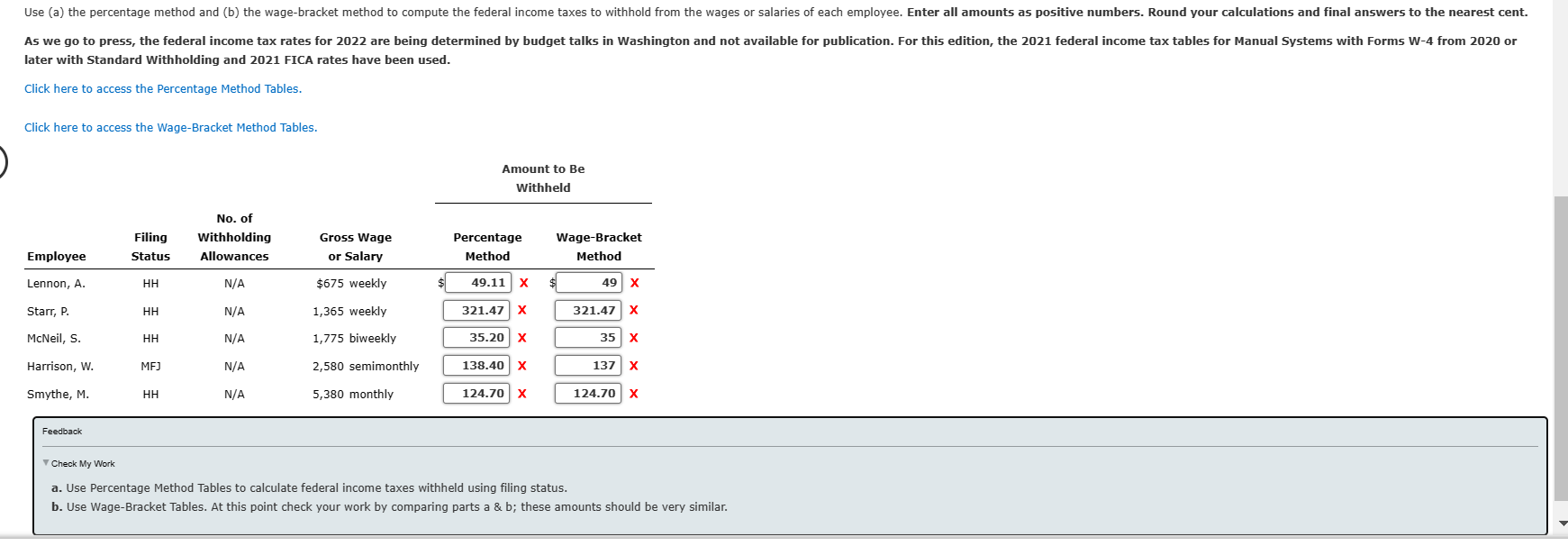

Example 4-3 To compute the tax using the percentage method for Manual Payroll Systems with Forms W-4 from 2020 or Later using Standard Withholding Rate Schedules, follow the steps illustrated below. Step 1 Determine the amount of gross wages earned, filing status, adjustments on Form W4, and frequency of pay. Note: If the wage ends in a fractional dollar amount, the wage may be Wilson Goodman, single(S), has no adjustments on his Form W-4 and earns $915.60 semimonthly. rounded to the nearest dollar. However, in this text, exact wages are used. Compute tax from Tax Table A, Semimonthly, Standard Step 2 Withholding Rate Schedule, page T-3. Percentage Method Withholding Table (see Figure 4.6 below). ($915.60$523.00=$392.6010%=$39.26+$0)=$39.26 Example 4-4 To use the wage-bracket method for Manual Payroll Systems With Forms W-4 From 2020 or Later using Standard Withholding, follow the steps illustrated below. Step 1 Select the withholding table that applies to the employee's pay Adrienne Huff is married filing jointly (MFJ). She is paid weekly period. at a rate of $815. Step 2 Locate the wage bracket (the first two columns of the table) in which the employee's gross wages fall. Locate the appropriate wage bracket (see Figure 4.7): At least $815 but less than $825 Step 3 Follow the line for the wage bracket across to the right to the column showing the appropriate filing status with standard Move across the line to the column showing Married Filing Jointly, Standard withholding. withholding. Withhold this amount of tax. The tax to withhold is $34. later with Standard Withholding and 2021 FICA rates have been used. Click here to access the Percentage Method Tables. Click here to access the Wage-Bracket Method Tables. \begin{tabular}{l} AmounttoBeWithheld \\ \hline \end{tabular} Feedback V Check My Work a. Use Percentage Method Tables to calculate federal income taxes withheld using filing status. b. Use Wage-Bracket Tables. At this point check your work by comparing parts a \& b; these amounts should be very similar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts