Question: Example 5 Widury Bhd ( WB ) purchased Ikhwan Sdn Bhd ( ISB ) on 1 January 2 0 1 9 . On the date

Example

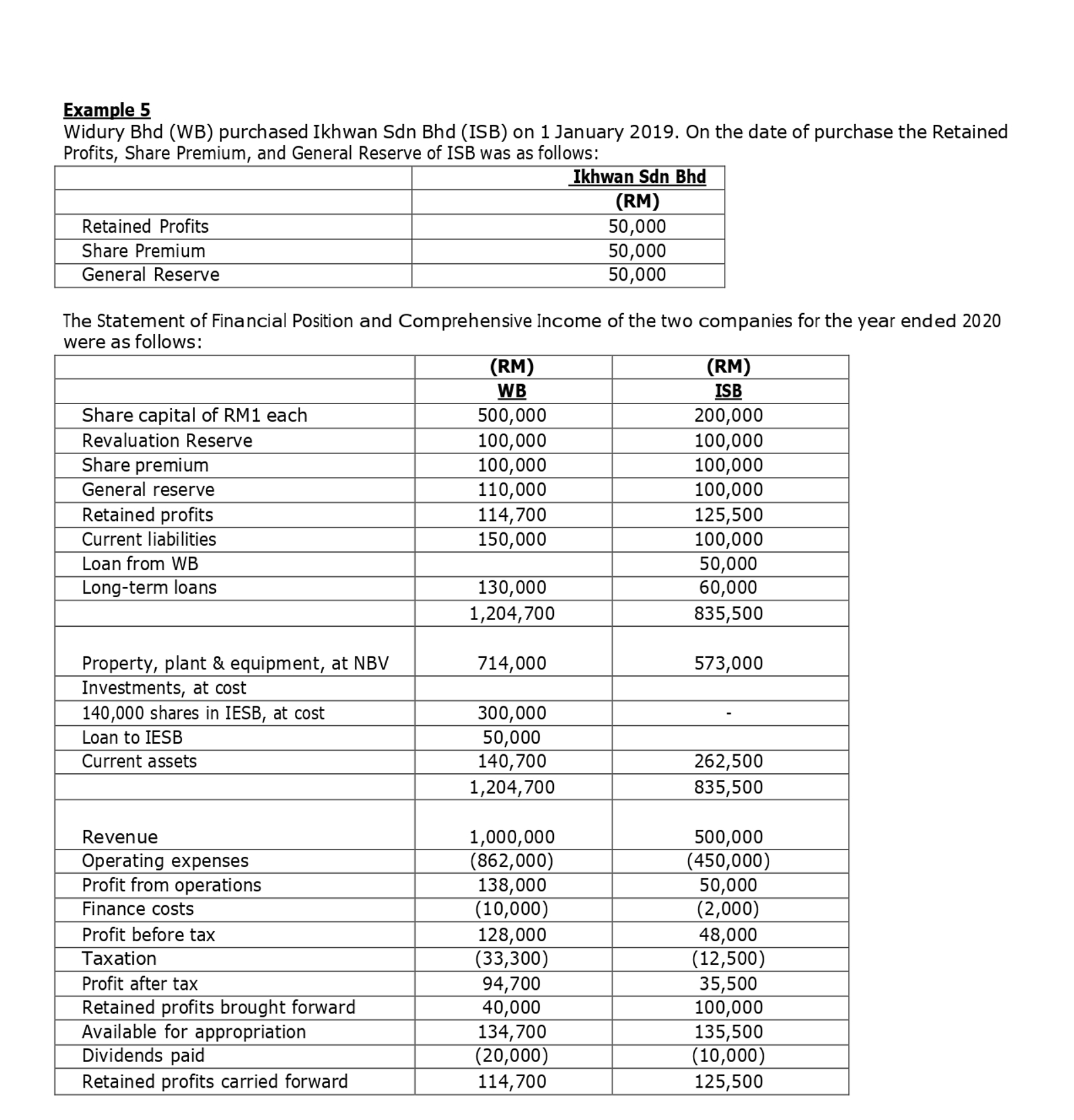

Widury Bhd WB purchased Ikhwan Sdn Bhd ISB on January On the date of purchase the Retained Profits, Share Premium, and General Reserve of ISB was as follows:

tableIkhwan Sdn BhdRMRetained Profits,Share Premium,General Reserve,

The Statement of Financial Position and Comprehensive Income of the two companies for the year ended were as follows:

tableRMRMWBISBShare capital of RM each,Revaluation Reserve,Share premium,General reserve,Retained profits,Current liabilities,Loan from WBLongterm loans,Property plant & equipment, at NBVInvestments at cost shares in IESB, at costLoan to IESB,Current assets,RevenueOperating expenses,Profit from operations,Finance costs,Profit before tax,TaxationProfit after tax,Retained profits brought forward,Available for appropriation,Dividends paid,Retained profits carried forward,

Additional information:

a Included in the property, plant & equipment of IESB was freehold land at a cost of RM At the date of the acquisition of these two companies, the fair value of IESBs land was RM At the date of acquisition,

no adjustments have been made in the accounts of these two companies for fair values. However, as of the current year reporting date, the adjustments have been included in the subsidiary accounts.

b On January IESB sold Plant & Equipment PE to WEB for RM The PEs cost to IESB was RM WEB classified the asset purchased as another PE Depreciation charges for the group are at per annum.

c On December WEB held stocks purchased from IESB amounting to RMinvoiced price The intercompany sales in the current year amounted to RM in total. These sales had a profit margin of from the invoice price.

d On December WEB sold Plant & Equipment PE to IESB at RM The PEs cost to WEB was RM IESB classified the assets purchased as another PE Depreciation charges for the group are at per annum.

e WEB provided consultancy services to IESB. For the year the management fees were RM IESB classified the fees as finance costs while WEB treated the fees as normal revenue. At the end of the year, the management fees have not been paid by IESB to WEB. The unpaid amounts were classified as shortterm in nature.

f Full goodwill method shall be used. No impairment of goodwill shall be recorded.

g Assume an income tax rate of Ignore tax effect on intercompany transactions.

Required:

Calculate goodwill that the group will recognize in the CFS

Calculate NCI shares in pre and post acquisition reserves.

Raise general journals to record all the elimination journals for the above group. No goodwill value shall be allocated to NCI.

Prepare a worksheet for the group for the year ended December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock