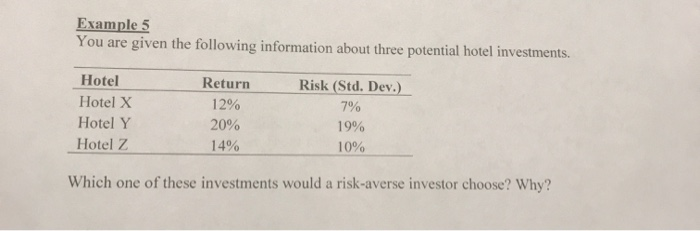

Question: Example 5 You are given the following information about three potential hotel investments. Hotel Return Risk (Std. Dev.) Hotel X 12% 7% Hotel Y 20%

Example 5 You are given the following information about three potential hotel investments. Hotel Return Risk (Std. Dev.) Hotel X 12% 7% Hotel Y 20% 19% Hotel Z 14% 10% Which one of these investments would a risk-averse investor choose? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts