Question: Example (5-2) A, B and C are partners in ABC Company. The Company's Deed provides for the distribution of profits and losses between partners as

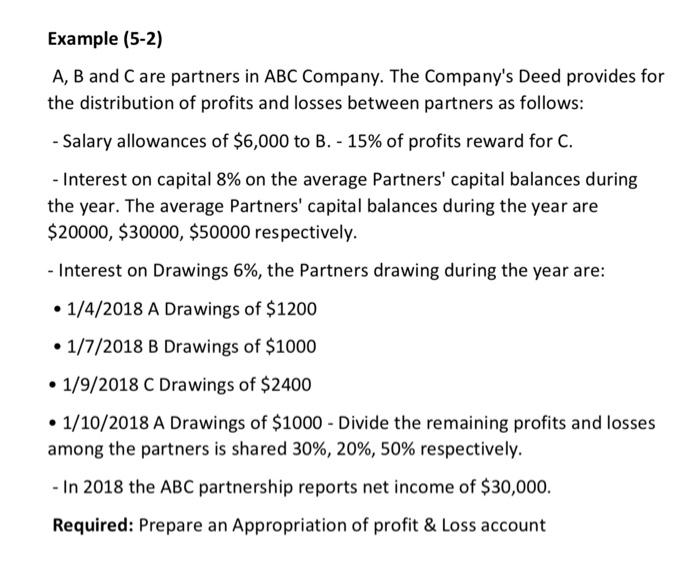

Example (5-2) A, B and C are partners in ABC Company. The Company's Deed provides for the distribution of profits and losses between partners as follows: - Salary allowances of $6,000 to B. - 15% of profits reward for C. - Interest on capital 8% on the average Partners' capital balances during the year. The average Partners' capital balances during the year are $20000,$30000,$50000 respectively. - Interest on Drawings 6%, the Partners drawing during the year are: - 1/4/2018 A Drawings of $1200 - 1/7/2018 B Drawings of $1000 - 1/9/2018 C Drawings of $2400 - 1/10/2018 A Drawings of $1000 - Divide the remaining profits and losses among the partners is shared 30%,20%,50% respectively. - In 2018 the ABC partnership reports net income of $30,000. Required: Prepare an Appropriation of profit \& Loss account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts