Question: Example 6-2 John Jenkins earns $1,290 per week. The deductions from his pay were: FIT FICA-OASDI FICA-HT State income tax State disability insurance Credit union

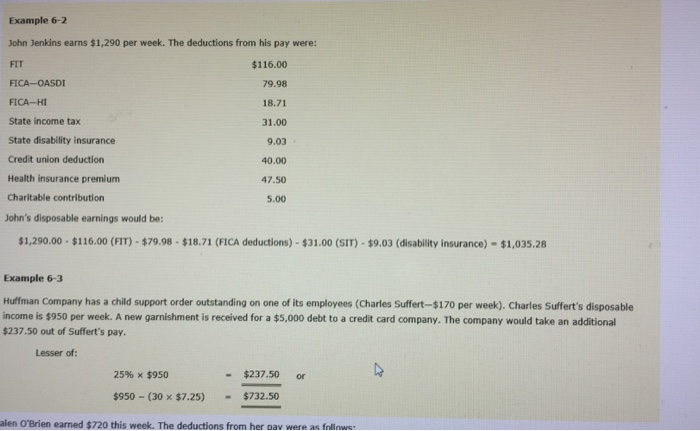

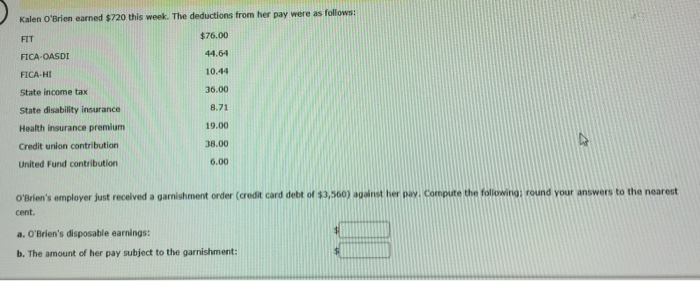

Example 6-2 John Jenkins earns $1,290 per week. The deductions from his pay were: FIT FICA-OASDI FICA-HT State income tax State disability insurance Credit union deduction Health insurance premium Charitable contribution John's disposable earnings would be: $116.00 79.98 18.71 31.00 9.03 40.00 47.50 5.00 1,290.00 $116.00 (FIT)-$79.98-$18.71 (FICA deductions)-$31.00 (SIT)-$9.03 (disability insurance)- $1,035.28 Example 6-3 Huffman Company has a child support order outstanding on one of its employees (Charles Suffert-$170 per week). Charles Suffert's disposable income is $950 per week. A new garnishment is received for a $5,000 debt to a credit card company. The company would take an additional $237.50 out of Suffert's pay. Lesser of: 2596 $950 $237.50 or $950-(30 $7.25) $732.50 - alen O'Brien earned $720 this week. The deductions from her oav were as frollows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts