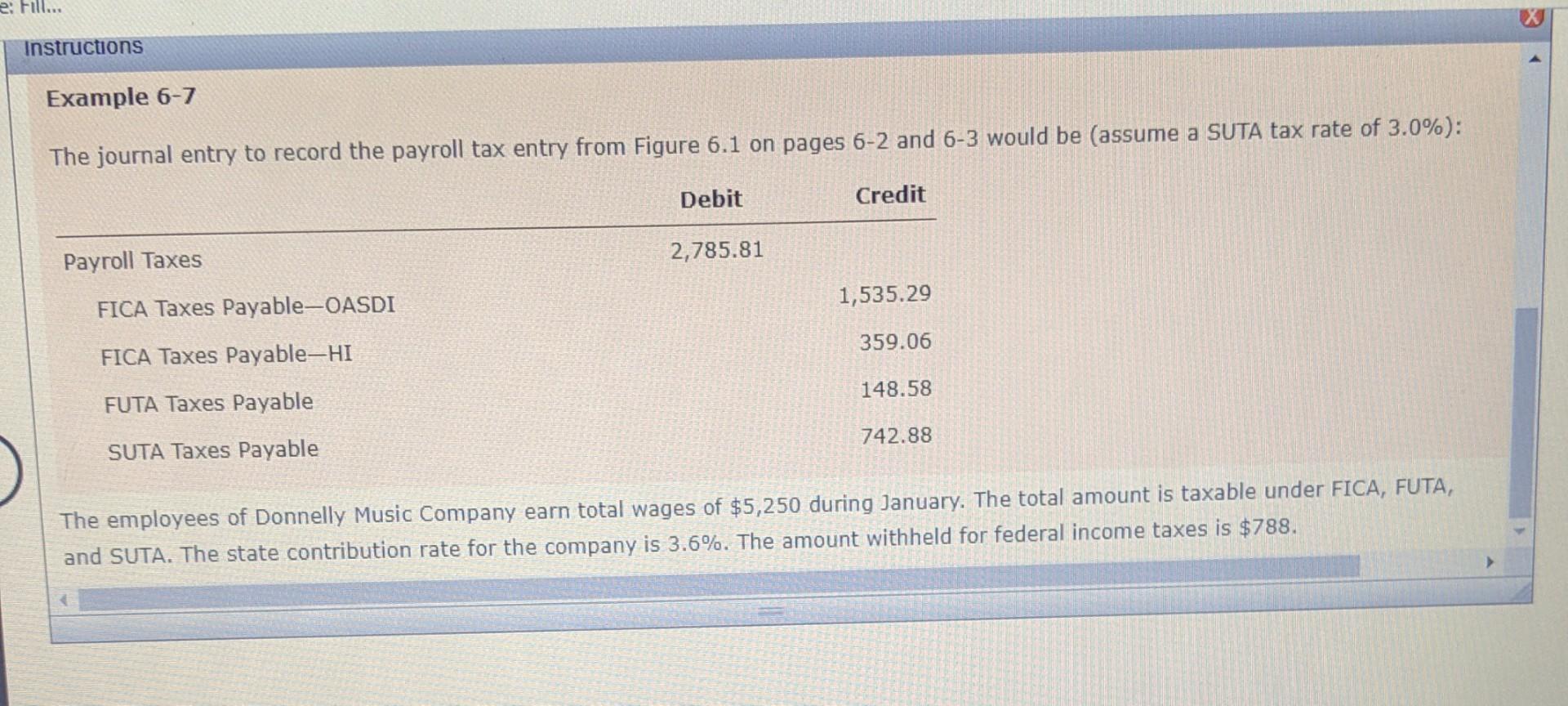

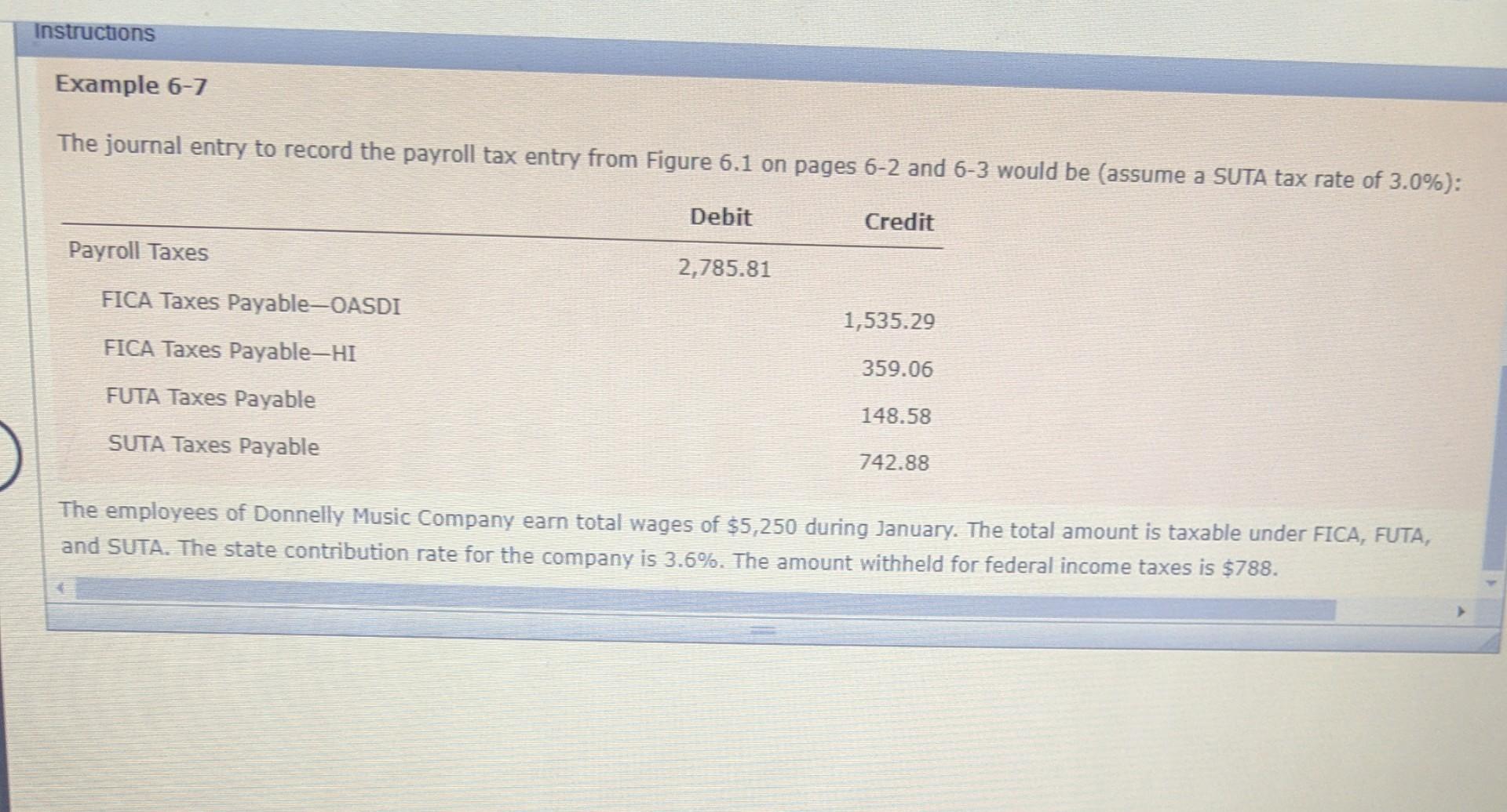

Question: Example 6-7 The journal entry to record the payroll tax entry from Figure 6.1 on pages 6-2 and 63 would be (assume a SUTA tax

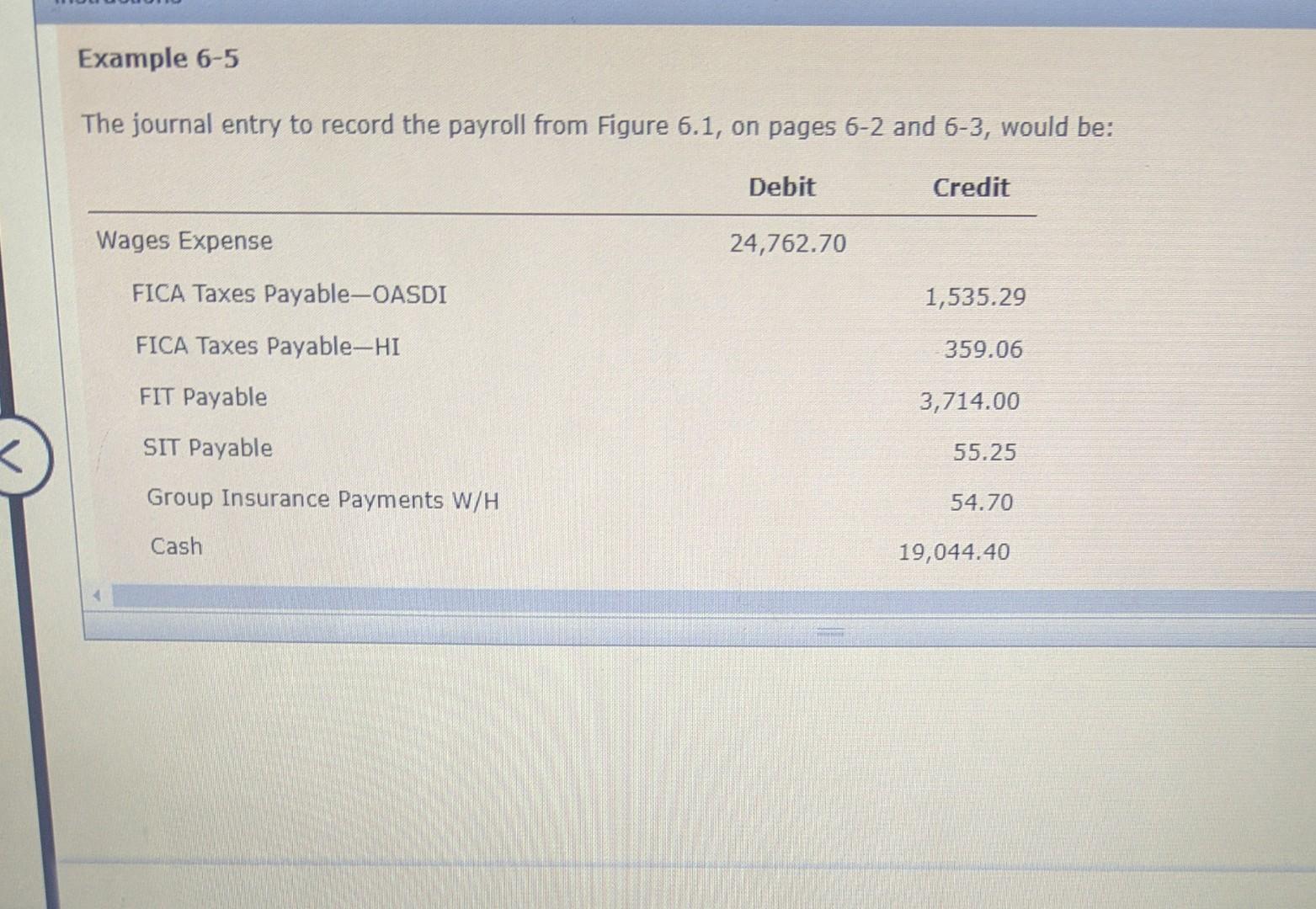

Example 6-7 The journal entry to record the payroll tax entry from Figure 6.1 on pages 6-2 and 63 would be (assume a SUTA tax rate of 3.0% ): The employees of Donnelly Music Company earn total wages of $5,250 during January. The total amount is taxable under FICA, FUTA, and SUTA. The state contribution rate for the company is 3.6%. The amount withheld for federal income taxes is $788. The journal entry to record the payroll from Figure 6.1, on pages 62 and 63, would be: The journal entry to record the payroll tax entry from Figure 6.1 on pages 62 and 63 would be (assume a SUTA tax rate of 3.0% ): The employees of Donnelly Music Company earn total wages of $5,250 during January. The total amount is taxable under FICA, FUTA, and SUTA. The state contribution rate for the company is 3.6%. The amount withheld for federal income taxes is $788

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts