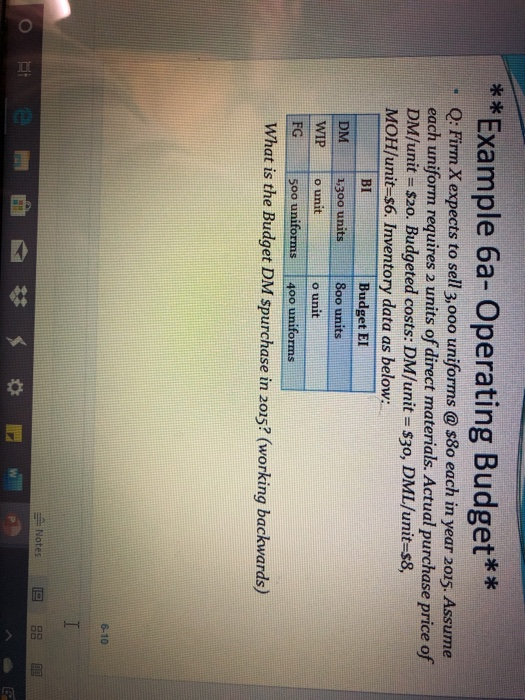

Question: **Example 6a- Operating Budget** Q: Firm X expects to sell 3,000 uniforms @ $80 each in year 2015. Assume each uniform requires 2 units of

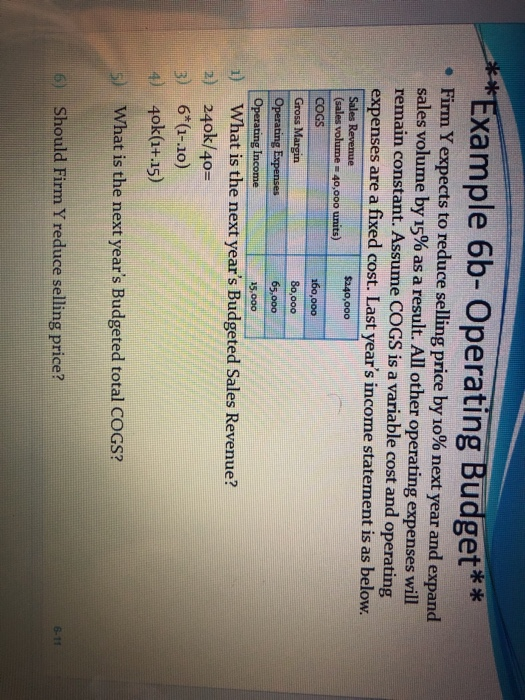

**Example 6a- Operating Budget** Q: Firm X expects to sell 3,000 uniforms @ $80 each in year 2015. Assume each uniform requires 2 units of direct materials. Actual purchase price of DM/unit = $20. Budgeted costs: DM/unit = $30, DML/unit=$8, MOH/unit=$6. Inventory data as below: Budget EI 1,300 units 8oo units o unit 500 uniforms 400 uniforms What is the Budget DM spurchase in 2015? (working backwards) WIP o unit FG 6-10 ^ E **Example 6b- Operating Budget** Firm Y expects to reduce selling price by 10% next year and expand sales volume by 15% as a result. All other operating expenses will remain constant. Assume COGS is a variable cost and operating expenses are a fixed cost. Last year's income statement is as below. Sales Revenue $240,000 (sales volume = 40,000 units) COGS 160,000 Gross Margin Operating Expenses 65,000 Operating Income 15,000 1) What is the next year's Budgeted Sales Revenue? 2) 240k/40= 3) 6*(1-.10) 4) 4ok(1+.15) 5) What is the next year's Budgeted total COGS? 80,000 6) Should Firm Y reduce selling price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts