Question: Example 9 : Review the completed example below. A company has a ( $ 5 0 0 , 0 0 0 )

Example : Review the completed example below.

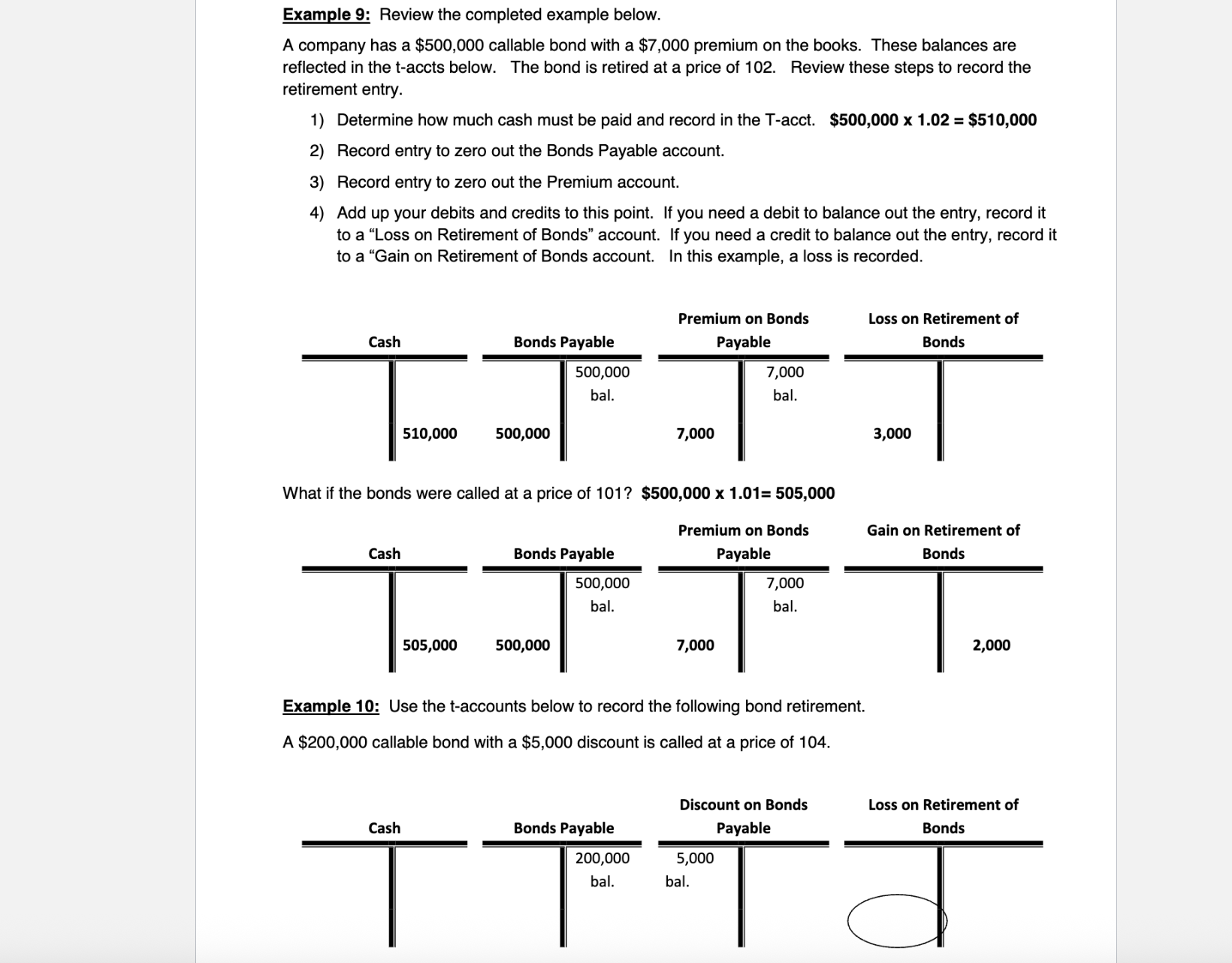

A company has a $ callable bond with a $ premium on the books. These balances are reflected in the t accts below. The bond is retired at a price of Review these steps to record the retirement entry.

Determine how much cash must be paid and record in the Tacct. mathbf$ mathbftimes mathbf$

Record entry to zero out the Bonds Payable account.

Record entry to zero out the Premium account.

Add up your debits and credits to this point. If you need a debit to balance out the entry, record it to a "Loss on Retirement of Bonds" account. If you need a credit to balance out the entry, record it to a "Gain on Retirement of Bonds account. In this example, a loss is recorded.

What if the bonds were called at a price of mathbf$ mathbftimes mathbf

Example : Use the t accounts below to record the following bond retirement.

A $ callable bond with a $ discount is called at a price of Exercise : Complete the following problem.

A $ year,Stated rate bond is sold when the Effective Market rate is The bond pays interest semiannually. Assuming a price of at issuance record the following.

Entry required upon issuance of the bond.

Cash proceeds: $ quad x quad$

Entry on the first interest payment date. Use STRAIGHTLINE method for amortization.

a Actual Interest payment

$ boldsymbolxmathbfboldsymbolxmathbfmathbf$

b Amortization of the Premium using the STRAIGHTLINE method. periods$

Entry on the second interest payment date. Use STRAIGHTLINE method for amortization.

a Actual Interest payment

b Amortization of the Premium using the STRAIGHTLINE method.

Next, use the t accounts below the table to repeat the same three steps from above but this time use the EFFECTIVE INTEREST RATE METHOD. Round any calculations to the nearest dollar x $K x Col.E Interest ExpensePremium AmortizationPremium BalanceCarrying Amount points for correct answer. No partial credit

Text Entry

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock