Question: Example 9.11 (The Black-Scholes Equation). This example transforms a known law into dimensionless form. The celebrated Black-Scholes equation is the partial differential equation av (9.22)

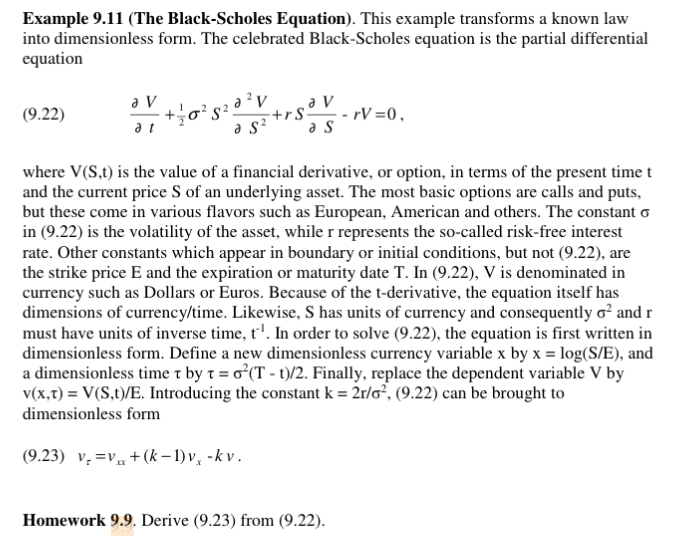

Example 9.11 (The Black-Scholes Equation). This example transforms a known law into dimensionless form. The celebrated Black-Scholes equation is the partial differential equation av (9.22) + o?520?v a V +rs-rV=0, as as? where V(S,t) is the value of a financial derivative, or option, in terms of the present time t and the current price of an underlying asset. The most basic options are calls and puts, but these come in various flavors such as European, American and others. The constant o in (9.22) is the volatility of the asset, while r represents the so-called risk-free interest rate. Other constants which appear in boundary or initial conditions, but not (9.22), are the strike price E and the expiration or maturity date T. In (9.22), V is denominated in currency such as Dollars or Euros. Because of the t-derivative, the equation itself has dimensions of currency/time. Likewise, S has units of currency and consequently o and r must have units of inverse time, t'. In order to solve (9.22), the equation is first written in dimensionless form. Define a new dimensionless currency variable x by x = log(S/E), and a dimensionless time t by t = o(T - t)/2. Finally, replace the dependent variable V by v(x,t) = V(S,t)/E. Introducing the constant k = 2r/o, (9.22) can be brought to dimensionless form (9.23) v.=vxx +(k-1)v, -kv. Homework 9.9. Derive (9.23) from (9.22). Example 9.11 (The Black-Scholes Equation). This example transforms a known law into dimensionless form. The celebrated Black-Scholes equation is the partial differential equation av (9.22) + o?520?v a V +rs-rV=0, as as? where V(S,t) is the value of a financial derivative, or option, in terms of the present time t and the current price of an underlying asset. The most basic options are calls and puts, but these come in various flavors such as European, American and others. The constant o in (9.22) is the volatility of the asset, while r represents the so-called risk-free interest rate. Other constants which appear in boundary or initial conditions, but not (9.22), are the strike price E and the expiration or maturity date T. In (9.22), V is denominated in currency such as Dollars or Euros. Because of the t-derivative, the equation itself has dimensions of currency/time. Likewise, S has units of currency and consequently o and r must have units of inverse time, t'. In order to solve (9.22), the equation is first written in dimensionless form. Define a new dimensionless currency variable x by x = log(S/E), and a dimensionless time t by t = o(T - t)/2. Finally, replace the dependent variable V by v(x,t) = V(S,t)/E. Introducing the constant k = 2r/o, (9.22) can be brought to dimensionless form (9.23) v.=vxx +(k-1)v, -kv. Homework 9.9. Derive (9.23) from (9.22)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts