Question: Example: A 30-year maturity bond making annual coupon payments with a coupon rate of 15.5% has duration of 10.58 years and convexity of 162.6. The

Example:

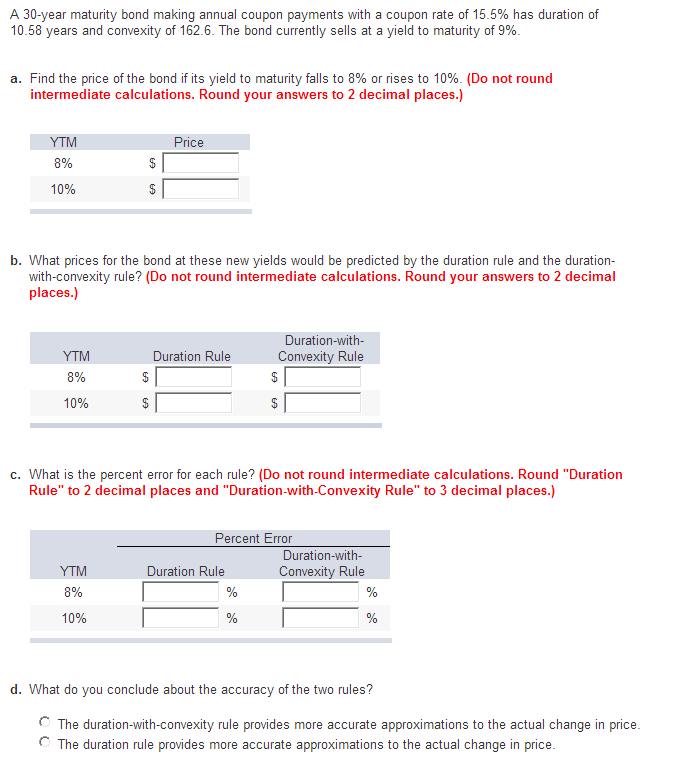

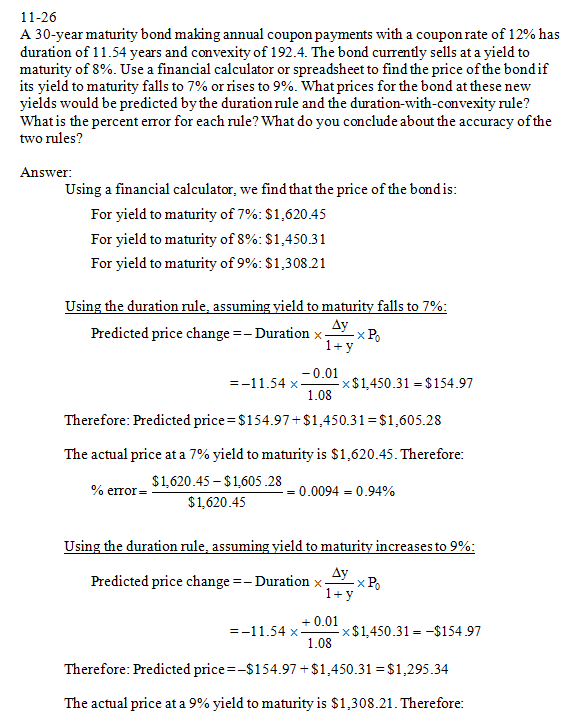

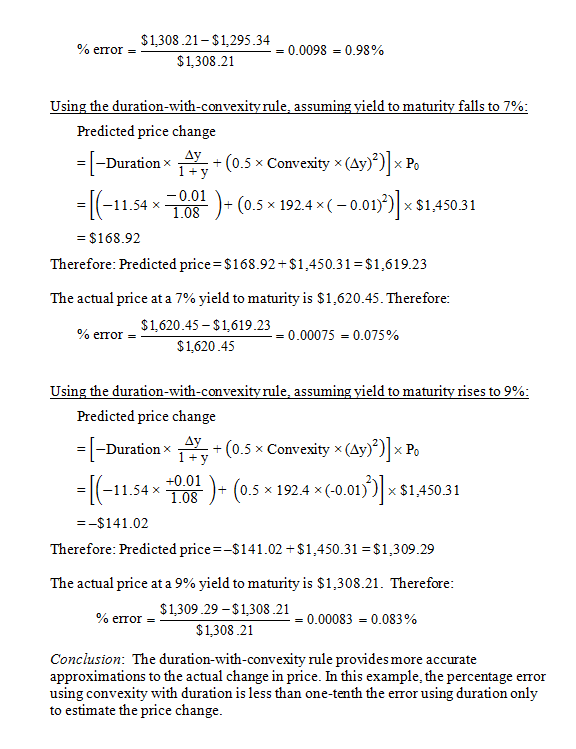

A 30-year maturity bond making annual coupon payments with a coupon rate of 15.5% has duration of 10.58 years and convexity of 162.6. The bond currently sells at a yield to maturity of 9% a. Find the price of the bond if its yield to maturity falls to 8% or rises to 10%. (Do not round intermediate calculations. Round your answers to 2 decimal places.) YTM 8% 10% Price b. What prices for the bond at these new yields would be predicted by the duration rule and the duration- with-convexity rule? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Duration-with- Convexity Rule Duration Rule 8% 10% c. What is the percent error for each rule? (Do not round intermediate calculations. Round "Duration Rule" to 2 decimal places and "Duration-with-Convexity Rule" to 3 decimal places.) Percent Error Duration-with- Convexity Rule Duration Rule 8% 10% d. What do you conclude about the accuracy of the two rules? The duration-with-convexity rule provides more accurate approximations to the actual change in price C The duration rule provides more accurate approximations to the actual change in price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts