Question: . Example: A bond was issued several years ago at par when the interest rate was 7 %, which was also its coupon rate (annual

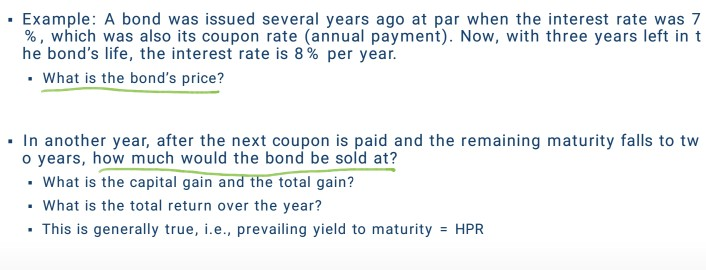

. Example: A bond was issued several years ago at par when the interest rate was 7 %, which was also its coupon rate (annual payment). Now, with three years left in t he bond's life, the interest rate is 8% per year. . What is the bond's price? . In another year, after the next coupon is paid and the remaining maturity falls to tw o years, how much would the bond be sold at? . What is the capital gain and the total gain? . What is the total return over the year? . This is generally true, i.e., prevailing yield to maturity = HPR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts