Question: Example: Applying the Gordon Growth Model An analyst obtained the following information regarding Global Shipping Inc.: Current share price = $ 2 8 Recent dividend

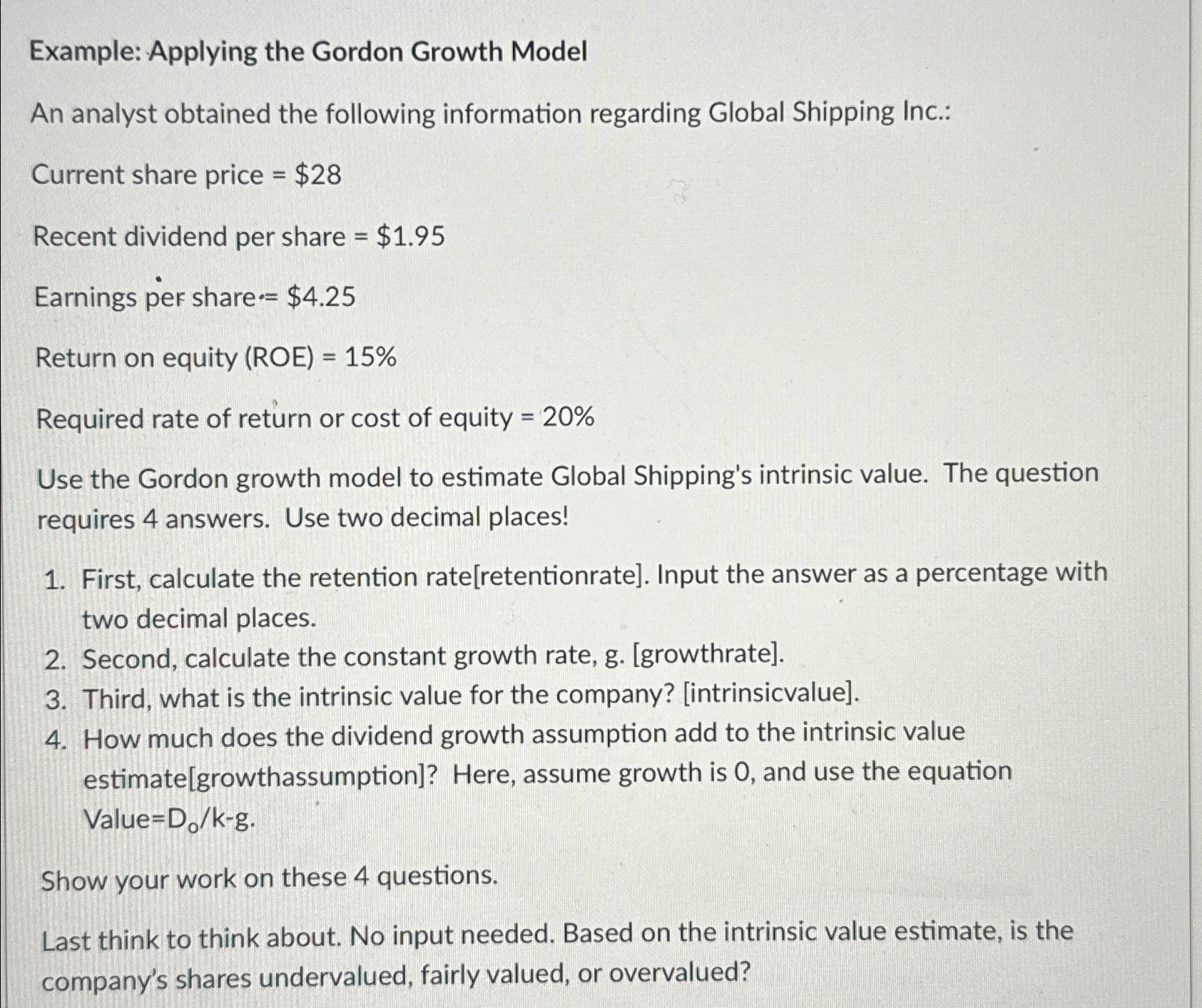

Example: Applying the Gordon Growth Model

An analyst obtained the following information regarding Global Shipping Inc.:

Current share price $

Recent dividend per share $

Earnings per share $

Return on equity

Required rate of return or cost of equity

Use the Gordon growth model to estimate Global Shipping's intrinsic value. The question requires answers. Use two decimal places!

First, calculate the retention rateretentionrate Input the answer as a percentage with two decimal places.

Second, calculate the constant growth rate, ggrowthrate

Third, what is the intrinsic value for the company? intrinsicvalue

How much does the dividend growth assumption add to the intrinsic value estimategrowthassumption Here, assume growth is and use the equation Value

Show your work on these questions.

Last think to think about. No input needed. Based on the intrinsic value estimate, is the company's shares undervalued, fairly valued, or overvalued?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock