Question: Example: CCA Tax Shield You purchase equipment for $ 1 0 0 , 0 0 0 and it costs $ 1 0 , 0 0

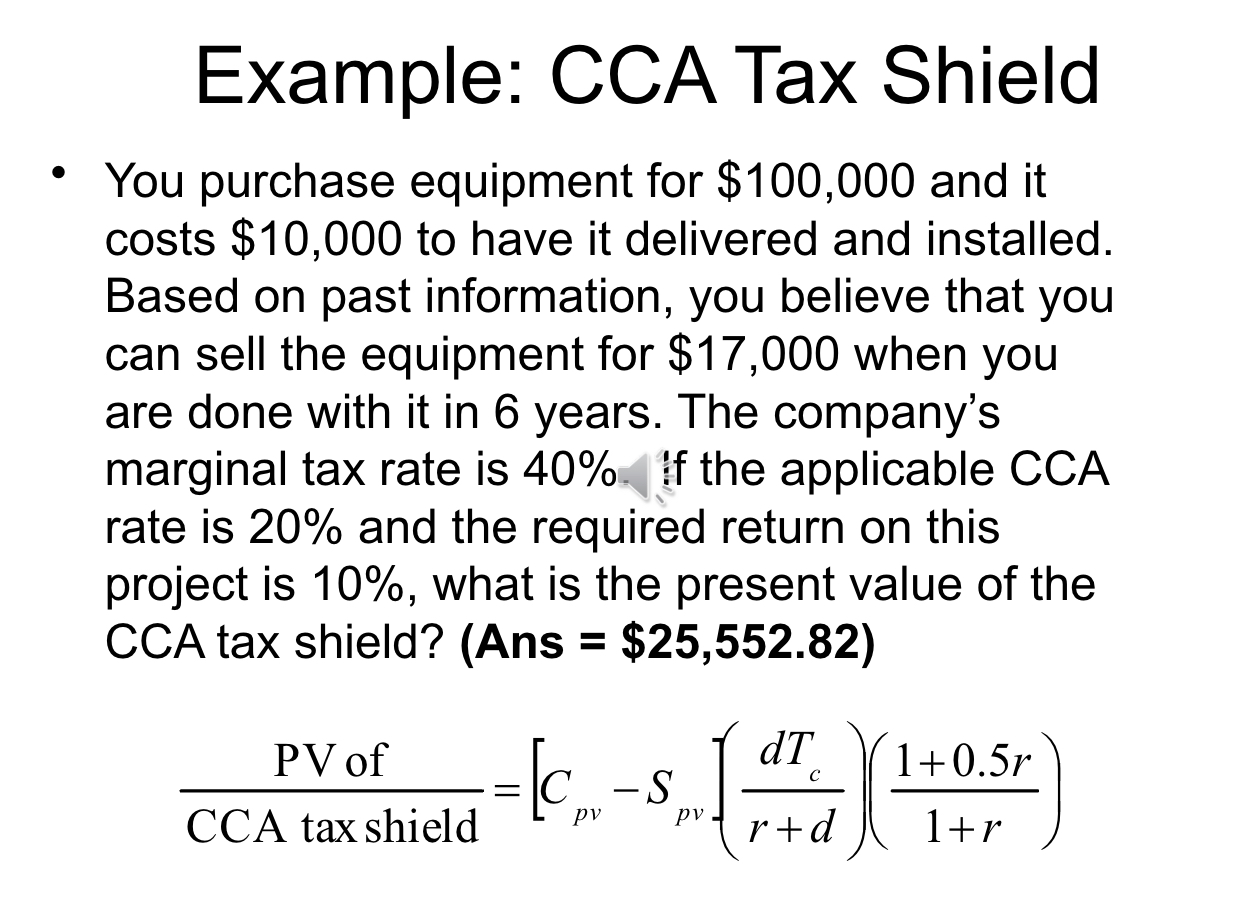

Example: CCA Tax Shield

You purchase equipment for $ and it costs $ to have it delivered and installed. Based on past information, you believe that you can sell the equipment for $ when you are done with it in years. The company's marginal tax rate is If the applicable CCA rate is and the required return on this project is what is the present value of the CCA tax shield? Show me how to calcualte it in excel formula. Thank you

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock