Question: Example: Computing convexity Suppose there is a 15-year option-free noncallable bond with an annual coupon of 7% trading at par. If interest rates rise by

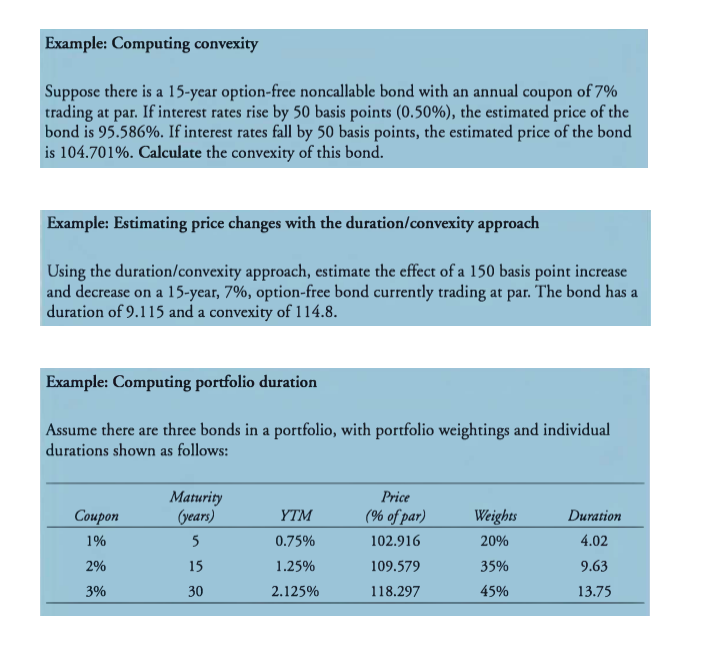

Example: Computing convexity Suppose there is a 15-year option-free noncallable bond with an annual coupon of 7% trading at par. If interest rates rise by 50 basis points (0.50%), the estimated price of the bond is 95.586%. If interest rates fall by 50 basis points, the estimated price of the bond is 104.701%. Calculate the convexity of this bond. Example: Estimating price changes with the duration/convexity approach Using the duration/convexity approach, estimate the effect of a 150 basis point increase and decrease on a 15-year, 7%, option-free bond currently trading at par. The bond has a duration of 9.115 and a convexity of 114.8 Example: Computing portfolio duration Assume there are three bonds in a portfolio, with portfolio weightings and individual durations shown as follows: Maturity years) 6 of par) Weights Duration 20% 3596 4596 YTM 0.75% 1.25% 2.125% Coupon 1% 2% 3% 4.02 9.63 13.75 102.916 109.579 118.297 30 Example: Computing convexity Suppose there is a 15-year option-free noncallable bond with an annual coupon of 7% trading at par. If interest rates rise by 50 basis points (0.50%), the estimated price of the bond is 95.586%. If interest rates fall by 50 basis points, the estimated price of the bond is 104.701%. Calculate the convexity of this bond. Example: Estimating price changes with the duration/convexity approach Using the duration/convexity approach, estimate the effect of a 150 basis point increase and decrease on a 15-year, 7%, option-free bond currently trading at par. The bond has a duration of 9.115 and a convexity of 114.8 Example: Computing portfolio duration Assume there are three bonds in a portfolio, with portfolio weightings and individual durations shown as follows: Maturity years) 6 of par) Weights Duration 20% 3596 4596 YTM 0.75% 1.25% 2.125% Coupon 1% 2% 3% 4.02 9.63 13.75 102.916 109.579 118.297 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts