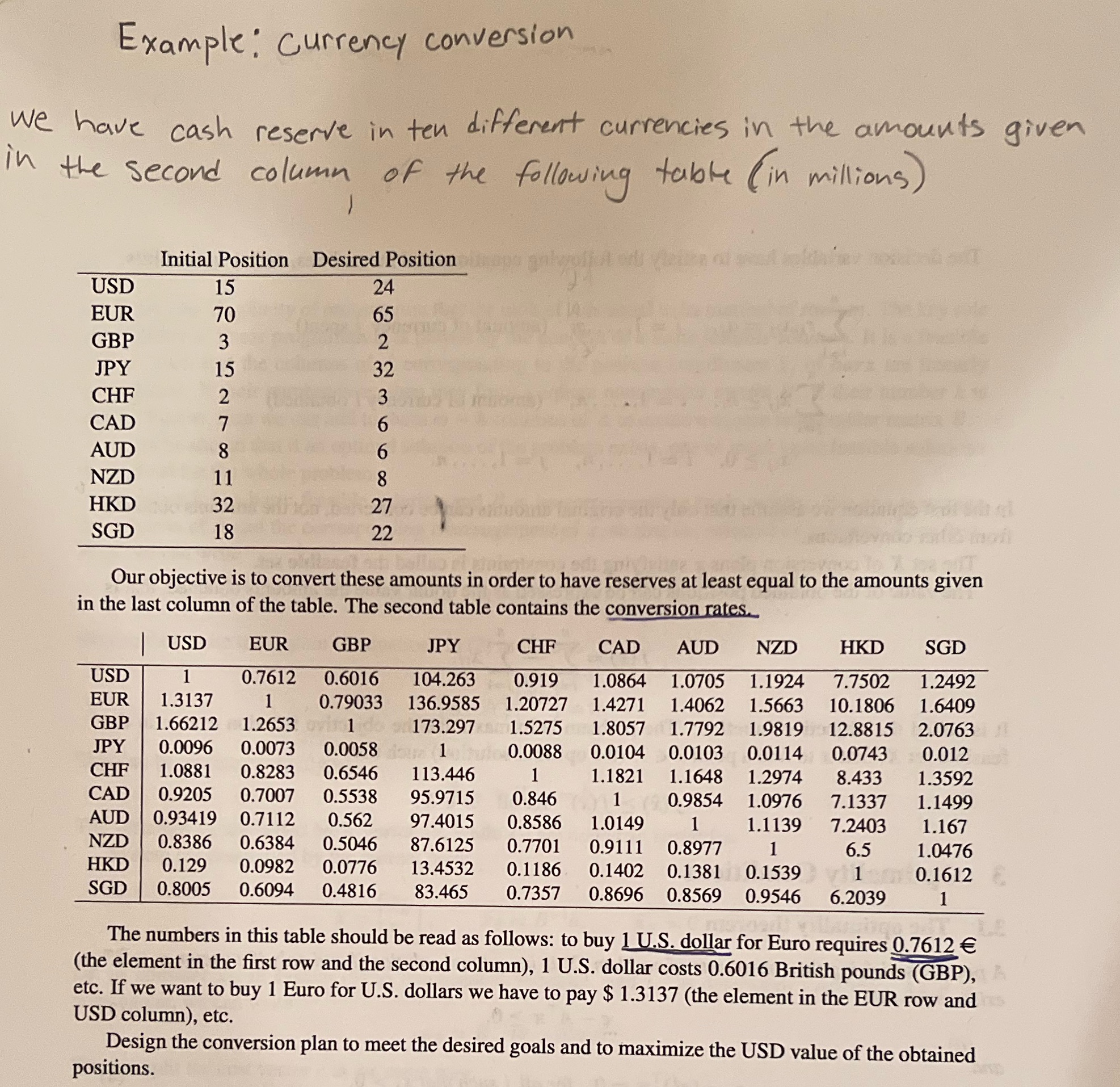

Question: Example : currency conversion We have cash reserve in ten different currencies in the amounts given in the second column of the following table (

Example : currency conversion We have cash reserve in ten different currencies in the amounts given in the second column of the following table ( in millions) Initial Position Desired Position USD 15 24 EUR 70 65 GBP 3 2 JPY 15 32 CHF IN 3 CAD 6 AUD 8 6 NZD 11 HKD 32 27 SGD 18 22 Our objective is to convert these amounts in order to have reserves at least equal to the amounts given in the last column of the table. The second table contains the conversion rates. USD EUR GBP JPY CHF CAD AUD NZD HKD SGD USD 0.7612 0.6016 104.263 0.919 1.0864 1.0705 1.1924 7.7502 1.2492 EUR 1.3137 0.79033 136.9585 1.20727 1.4271 1.4062 1.5663 10.1806 1.6409 GBP 1.66212 1.2653 173.297 1.5275 1.8057 1.7792 1.9819 12.8815 2.0763 JPY 0.0096 0.0073 0.0058 1 0.0088 0.0104 0.0103 0.0114 0.0743 0.012 CHF 1.0881 0.8283 0.6546 113.446 1.1821 1.1648 1.2974 8.433 1.3592 CAD 0.9205 0.7007 0.5538 95.9715 0.846 0.9854 1.0976 7.1337 1.1499 AUD 0.93419 0.7112 0.562 97.4015 0.8586 1.0149 1.1139 7.2403 1.167 NZD 0.8386 0.6384 0.5046 87.6125 0.7701 0.9111 0.8977 6.5 1.0476 HKD 0.129 0.0982 0.0776 13.4532 0.1186 0.1402 0.1381 0.1539 1 0.1612 SGD 0.8005 0.6094 0.4816 83.465 0.7357 0.8696 0.8569 0.9546 6.2039 The numbers in this table should be read as follows: to buy 1 U.S. dollar for Euro requires 0.7612 E (the element in the first row and the second column), 1 U.S. dollar costs 0.6016 British pounds (GBP), etc. If we want to buy 1 Euro for U.S. dollars we have to pay $ 1.3137 (the element in the EUR row and USD column), etc. Design the conversion plan to meet the desired goals and to maximize the USD value of the obtained positions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts