Question: Example Exercise 20-5 Cost per Equivalent Unit Obj. 2 The cost of direct materials transferred into the Bottling Department of Rocky Springs Beverage Company is

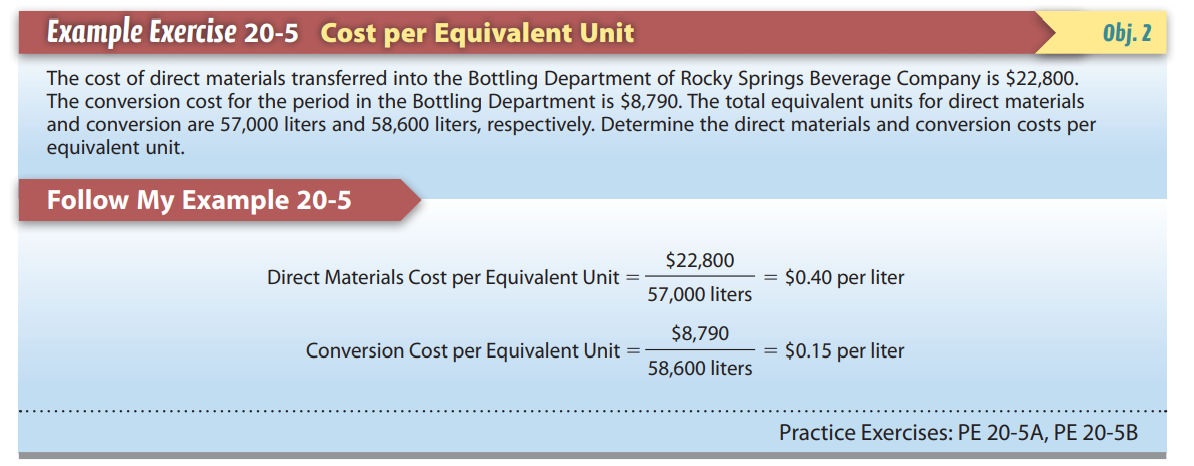

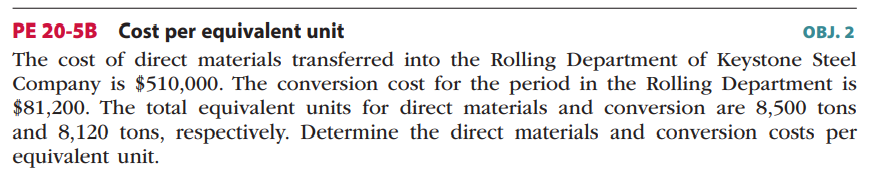

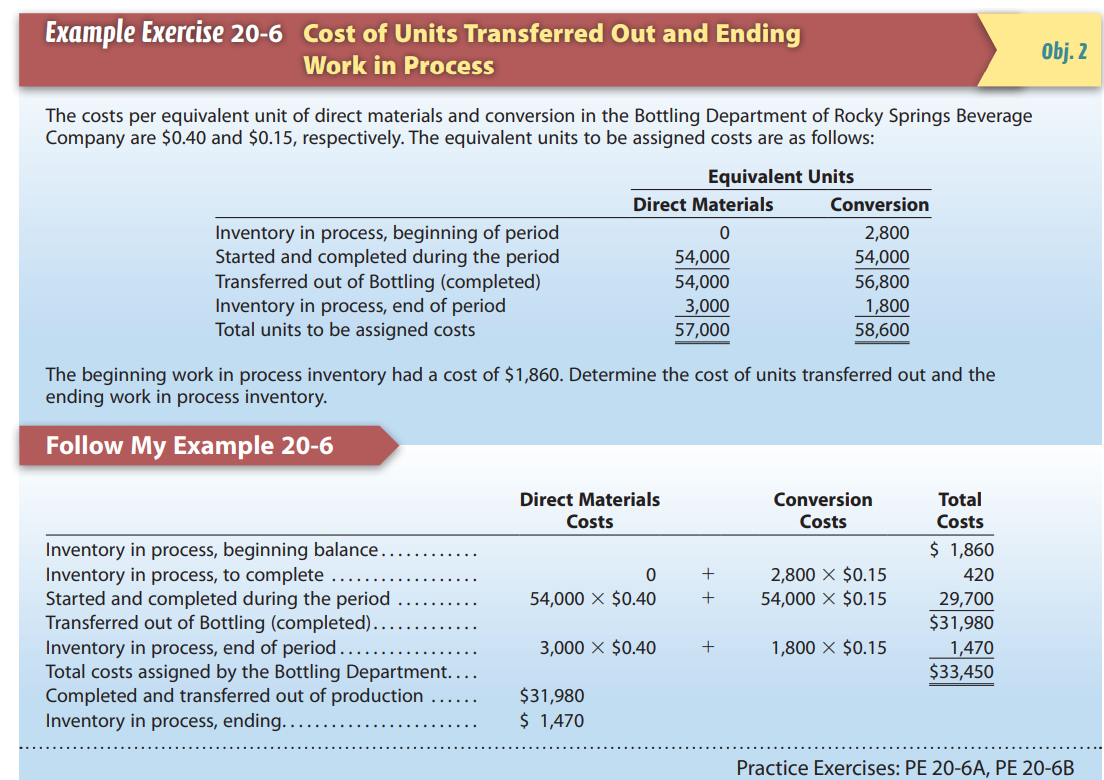

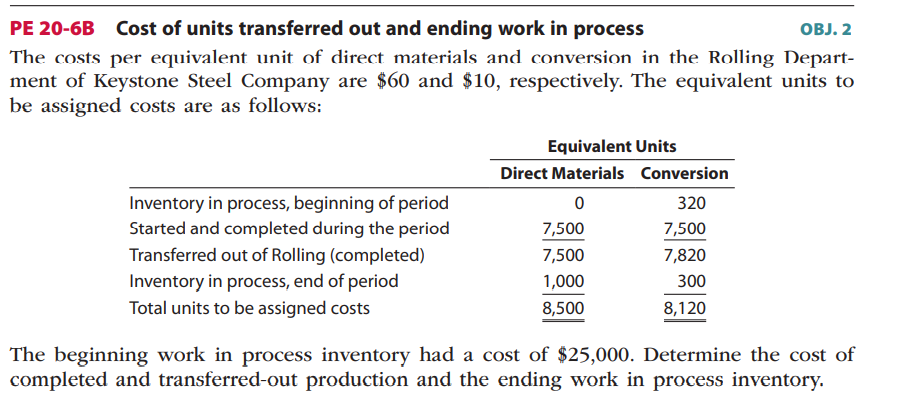

Example Exercise 20-5 Cost per Equivalent Unit Obj. 2 The cost of direct materials transferred into the Bottling Department of Rocky Springs Beverage Company is $22,800. The conversion cost for the period in the Bottling Department is $8,790. The total equivalent units for direct materials and conversion are 57,000 liters and 58,600 liters, respectively. Determine the direct materials and conversion costs per equivalent unit. Follow My Example 20-5 $22,800 Direct Materials Cost per Equivalent Unit = 57,000 liters $0.40 per liter $8,790 Conversion Cost per Equivalent Unit = 58,600 liters $0.15 per liter Practice Exercises: PE 20-5A, PE 20-5B PE 20-5B Cost per equivalent unit OBJ. 2 The cost of direct materials transferred into the Rolling Department of Keystone Steel Company is $510,000. The conversion cost for the period in the Rolling Department is $81,200. The total equivalent units for direct materials and conversion are 8,500 tons and 8,120 tons, respectively. Determine the direct materials and conversion costs per equivalent unit. Example Exercise 20-6 Cost of Units Transferred Out and Ending Work in Process Obj. 2 The costs per equivalent unit of direct materials and conversion in the Bottling Department of Rocky Springs Beverage Company are $0.40 and $0.15, respectively. The equivalent units to be assigned costs are as follows: Equivalent Units Direct Materials Conversion Inventory in process, beginning of period 0 2,800 Started and completed during the period 54,000 54,000 Transferred out of Bottling (completed) 54,000 56,800 Inventory in process, end of period 3,000 1,800 Total units to be assigned costs 57,000 58,600 The beginning work in process inventory had a cost of $1,860. Determine the cost of units transferred out and the ending work in process inventory. Follow My Example 20-6 Direct Materials Costs Conversion Costs 0 54,000 X $0.40 + + 2,800 X $0.15 54,000 X $0.15 Inventory in process, beginning balance... Inventory in process, to complete Started and completed during the period Transferred out of Bottling (completed).. Inventory in process, end of period. Total costs assigned by the Bottling Department.... Completed and transferred out of production Inventory in process, ending... Total Costs $ 1,860 420 29,700 $31,980 1,470 $33,450 3,000 X $0.40 + 1,800 X $0.15 $31,980 $ 1,470 Practice Exercises: PE 20-6A, PE 20-6B Cost of units transferred out and ending work in process OBJ. 2 The costs per equivalent unit of direct materials and conversion in the Rolling Depart- ment of Keystone Steel Company are $60 and $10, respectively. The equivalent units to be assigned costs are as follows: Inventory in process, beginning of period Started and completed during the period Transferred out of Rolling (completed) Inventory in process, end of period Total units to be assigned costs Equivalent Units Direct Materials Conversion 0 320 7,500 7,500 7,500 7,820 1,000 300 8,500 8,120 The beginning work in process inventory had a cost of $25,000. Determine the cost of completed and transferred-out production and the ending work in process inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts