Question: Example for Question 2: Calculating IRR: A firm evaluates all of its projects by applying the IRR rule. If the required return is 14 percent,

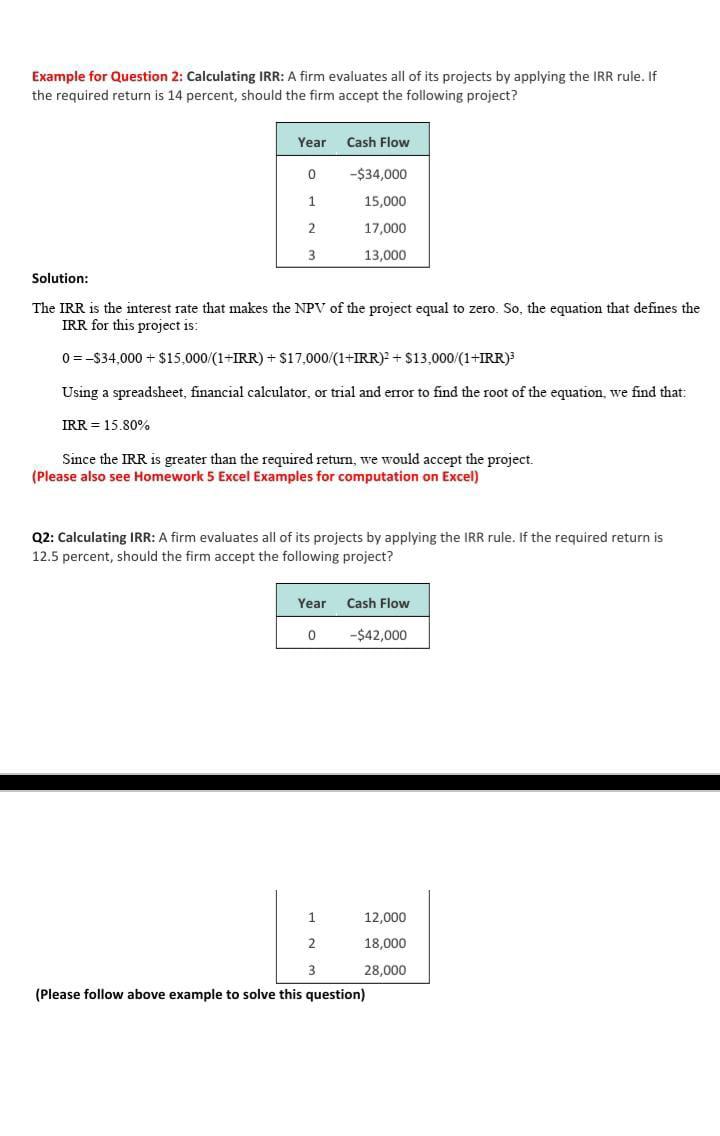

Example for Question 2: Calculating IRR: A firm evaluates all of its projects by applying the IRR rule. If the required return is 14 percent, should the firm accept the following project? Year Cash Flow 0 -$34,000 1 15,000 2 17,000 3 13,000 Solution: The IRR is the interest rate that makes the NPV of the project equal to zero. So, the equation that defines the IRR for this project is: 0=-S34,000+ $15,000/(1+IRR) +$17,000/(1+IRR) +$13,000/(1+IRR) Using a spreadsheet, financial calculator, or trial and error to find the root of the equation, we find that: IRR = 15.80% Since the IRR is greater than the required return, we would accept the project. (Please also see Homework 5 Excel Examples for computation on Excel) Q2: Calculating IRR: A firm evaluates all of its projects by applying the IRR rule. If the required return is 12.5 percent, should the firm accept the following project? Year Cash Flow 0 -$42,000 1 12,000 2 18,000 28,000 (Please follow above example to solve this question)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts