Question: Example for Question 8: Using CAPM: A stock has an expected return of 10.2 percent, the risk-free rate is 3.9 percent, and the market

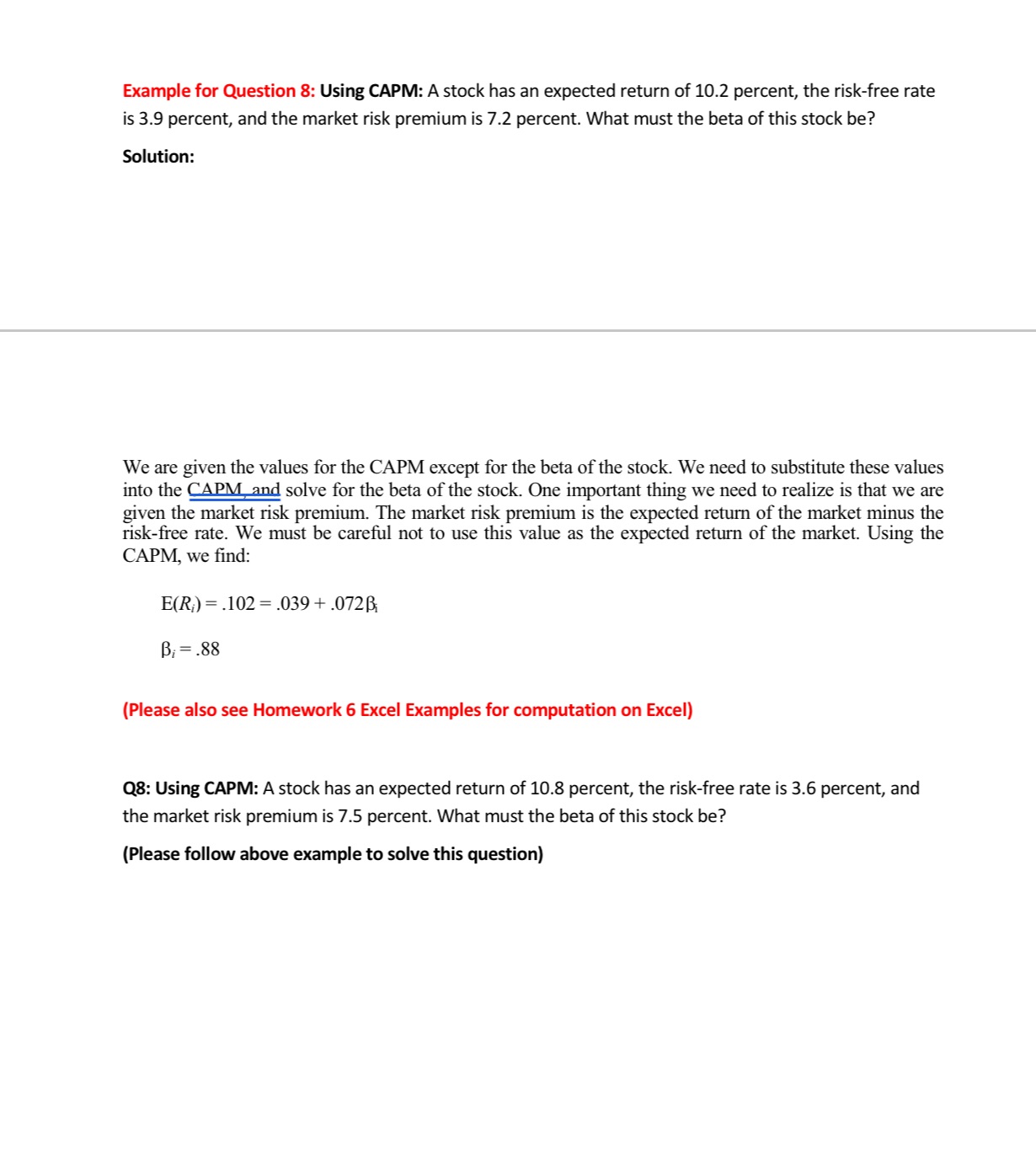

Example for Question 8: Using CAPM: A stock has an expected return of 10.2 percent, the risk-free rate is 3.9 percent, and the market risk premium is 7.2 percent. What must the beta of this stock be? Solution: We are given the values for the CAPM except for the beta of the stock. We need to substitute these values into the CAPM and solve for the beta of the stock. One important thing we need to realize is that we are given the market risk premium. The market risk premium is the expected return of the market minus the risk-free rate. We must be careful not to use this value as the expected return of the market. Using the CAPM, we find: E(R)=.102.039 + .072 B B = .88 (Please also see Homework 6 Excel Examples for computation on Excel) Q8: Using CAPM: A stock has an expected return of 10.8 percent, the risk-free rate is 3.6 percent, and the market risk premium is 7.5 percent. What must the beta of this stock be? (Please follow above example to solve this question)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts