Question: Example: Interest rate risk Both Bond Bill and Bond Ted have 8% coupons, make half- yearly payments, have a $1,000 face value, and are

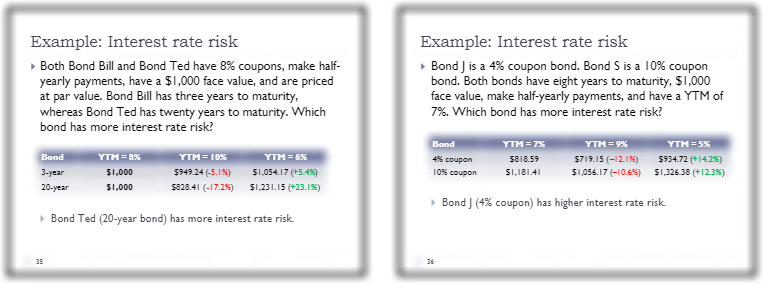

Example: Interest rate risk Both Bond Bill and Bond Ted have 8% coupons, make half- yearly payments, have a $1,000 face value, and are priced at par value. Bond Bill has three years to maturity, whereas Bond Ted has twenty years to maturity. Which bond has more interest rate risk? Example: Interest rate risk Bond J is a 4% coupon bond. Bond S is a 10% coupon bond. Both bonds have eight years to maturity, $1,000 face value, make half-yearly payments, and have a YTM of 7%. Which bond has more interest rate risk? Bond 3-year YTM=8% $1,000 20-year $1,000 YTM=10% $949.24 (-5.1%) $828.41 (-17.2%) YTM = 6% $1,054.17 (+5.4%) $1,231.15 (+23.1%) Bond Ted (20-year bond) has more interest rate risk. 35 36 Bond 4% coupon 10% coupon YTM=7% $818.59 $1,181.41 YTM=9% $719.15(-12.1%) $1,056.17 (-10.6%) YTM=5% $934.72 (+14.2%) $1,326.38 (+12.3%) Bond J (4% coupon) has higher interest rate risk.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts