Question: Example (IRR calculation) Determine the IRR on the following projects: a. An initial outlay of $11,000 resulting in a single free cash flow of $17,429

Example

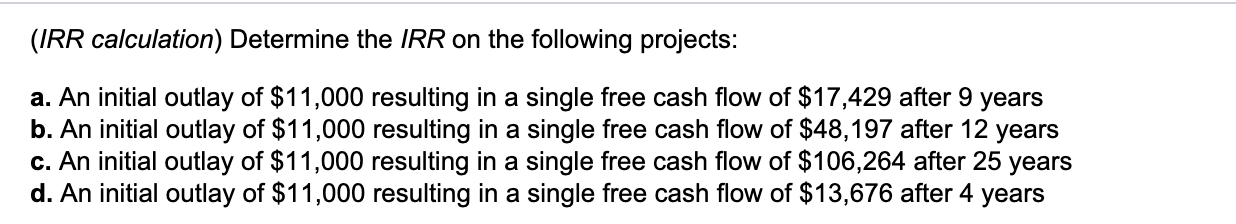

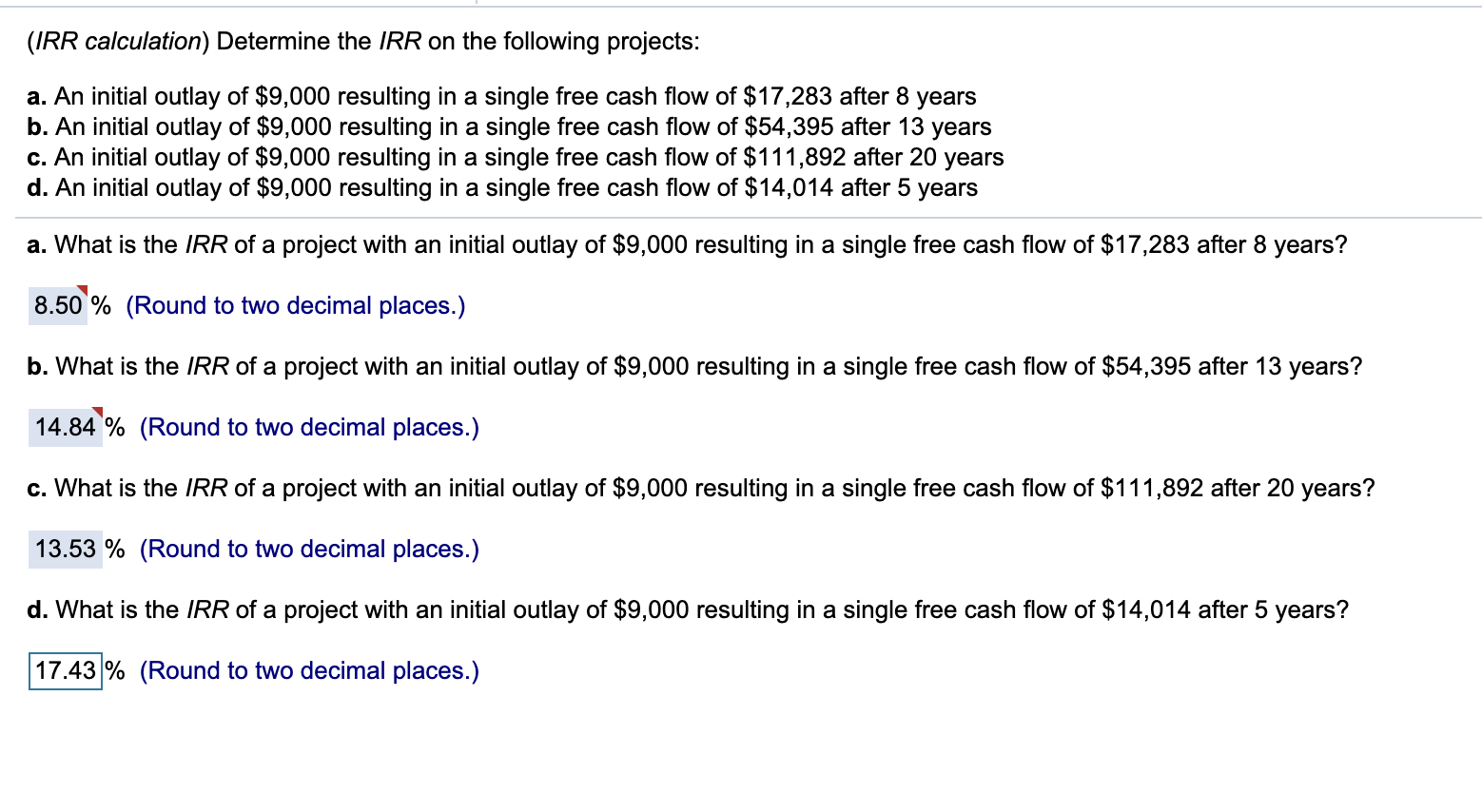

(IRR calculation) Determine the IRR on the following projects: a. An initial outlay of $11,000 resulting in a single free cash flow of $17,429 after 9 years b. An initial outlay of $11,000 resulting in a single free cash flow of $48,197 after 12 years c. An initial outlay of $11,000 resulting in a single free cash flow of $106,264 after 25 years d. An initial outlay of $11,000 resulting in a single free cash flow of $13,676 after 4 years (IRR calculation) Determine the IRR on the following projects: a. An initial outlay of $9,000 resulting in a single free cash flow of $17,283 after 8 years b. An initial outlay of $9,000 resulting in a single free cash flow of $54,395 after 13 years c. An initial outlay of $9,000 resulting in a single free cash flow of $111,892 after 20 years d. An initial outlay of $9,000 resulting in a single free cash flow of $14,014 after 5 years a. What is the IRR of a project with an initial outlay of $9,000 resulting in a single free cash flow of $17,283 after 8 years? 8.50 % (Round to two decimal places.) b. What is the IRR of a project with an initial outlay of $9,000 resulting in a single free cash flow of $54,395 after 13 years? 14.84 % (Round to two decimal places.) c. What is the IRR of a project with an initial outlay of $9,000 resulting in a single free cash flow of $111,892 after 20 years? 13.53 % (Round to two decimal places.) d. What is the IRR of a project with an initial outlay of $9,000 resulting in a single free cash flow of $14,014 after 5 years? 17.43% (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts