Question: Example No . 1 5 ABC Corporation is considering the purchase of equipment employing advanced technology to lower the production costs in a product line.

Example No

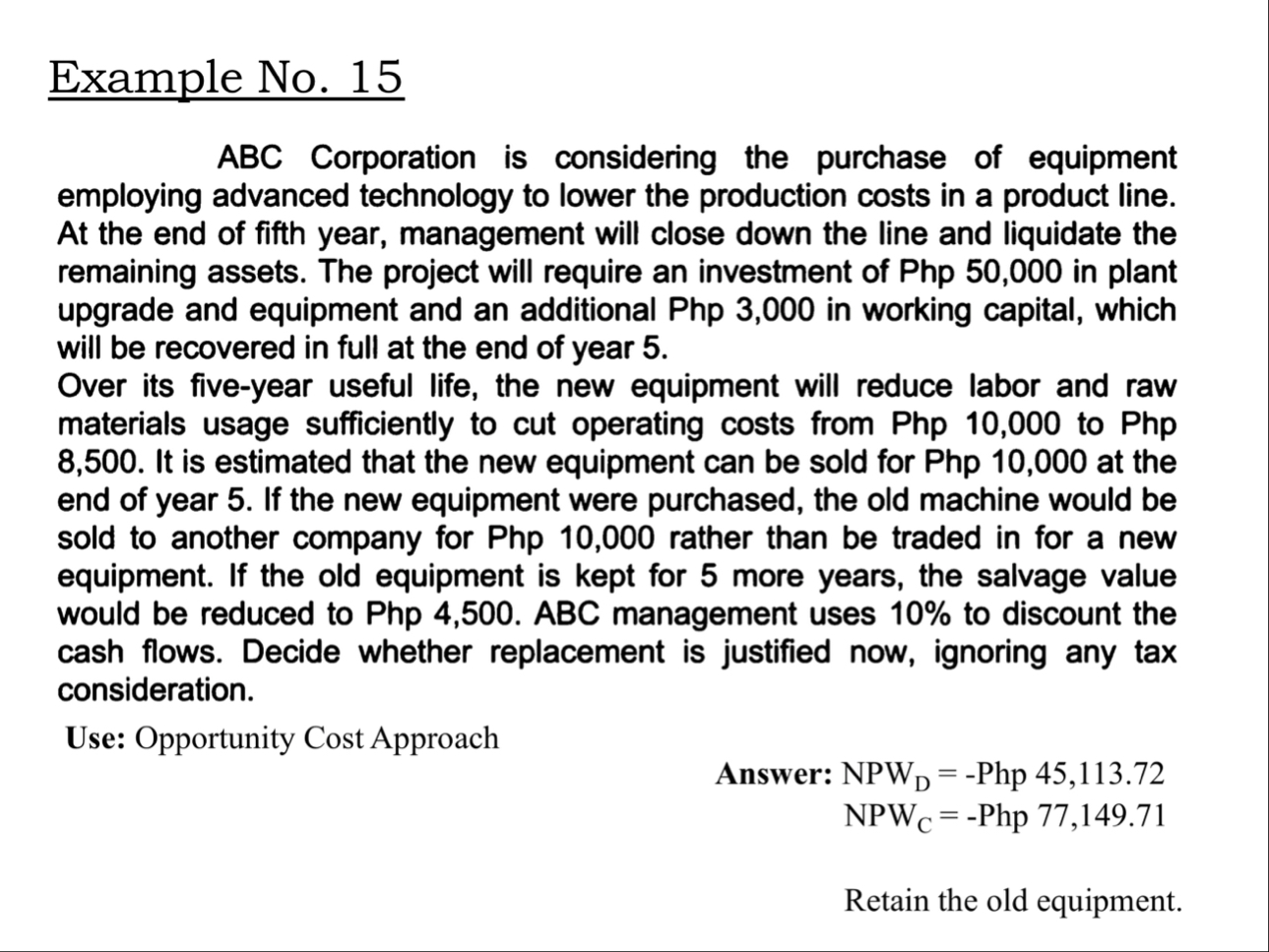

ABC Corporation is considering the purchase of equipment employing advanced technology to lower the production costs in a product line. At the end of fifth year, management will close down the line and liquidate the remaining assets. The project will require an investment of Php in plant upgrade and equipment and an additional Php in working capital, which will be recovered in full at the end of year

Over its fiveyear useful life, the new equipment will reduce labor and raw materials usage sufficiently to cut operating costs from Php to Php It is estimated that the new equipment can be sold for Php at the end of year If the new equipment were purchased, the old machine would be sold to another company for Php rather than be traded in for a new equipment. If the old equipment is kept for more years, the salvage value would be reduced to Php ABC management uses to discount the cash flows. Decide whether replacement is justified now, ignoring any tax consideration.

Use: Opportunity Cost Approach

Example No

The original cost of a certain machine is P has a life of years with a salvage value of How much is the depreciation on the th year, if the constantpercentage of declining value is used:

Answer:

Example No

XYZ Manufacturing is considering replacing a broken metal cutting machine. Several options have been proposed.

Option : The broken machine can be sold today for $

Option : It can be overhauled completely for $ after which it will produce $ in annual cash flows over the next five years. The resale value of the asset at the end of five years is zero.

Option : It can be replaced for $ The life of the replacement machine is five years, and it has an estimated salvage value of $ at the end of five years. The anticipated operating cash inflows for each year will be $

If the firm's required rate of return of what should do

Use: Cash Flow Approach

Answer: $

$

Choose Option PROVIDE DRAWING OF A CASH FLOW DIAGRAM

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock