Question: Example - Pro Forms Financial Statements and Project Cash Flows: Suppose we think we can sell 50,000 containters of Bully's Premimm Ice Cream per year

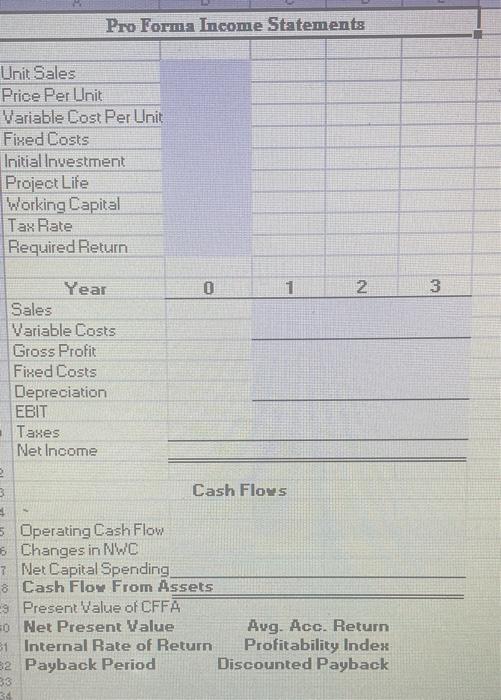

Example - Pro Forms Financial Statements and Project Cash Flows: Suppose we think we can sell 50,000 containters of Bully's Premimm Ice Cream per year at a price of $4 per conthiner. It costs us about $2.50 per container to make the ice cream, and a new product such as this one typically has only a three-year Ife (perhaps becanse the customer base dwindiles rapidly), We require a 20% return on new products. Fixed costs for the project, including such things as rent on the production facilty, will run $17,430 per year. Further, we will need to irvest a total of $90,000 in mumafacturing equipment. For simplicity, we will assume that this $90,000 will be 100% depreciated over the three-year lfe of the project Furthermore, the cost of removing the equipment will roughly equal its actual value in three years, so it will be essentially worthless on a market value basis as well. Finally, the project will require an initial 520,000 irvestment in net working capital, and the tax rate is 21%. You will organize these initial projections by first preparing the pro forma income statement. Once again, notice that you will not deduct any interest expense. since interest paid is a financing expense. Unit Sales Price Per Unit Wariable Cost Per Unit Fired Costs Initial Investment Project Life Working Capital TanPate Required Return Sales Year B 1 2 3 Wariable Casts Gross Profit Fised Costs Depreciation EBIT Taxes Net lnoome Cash Flows Dperating Cash Flow Changes in WWC Met Capital Spending Cash Flow From Assets Present Value of CFF Het Present Value Avg. Acc. Return Internal Rate of Return Profitability Index Payback Period Discounted Payback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts