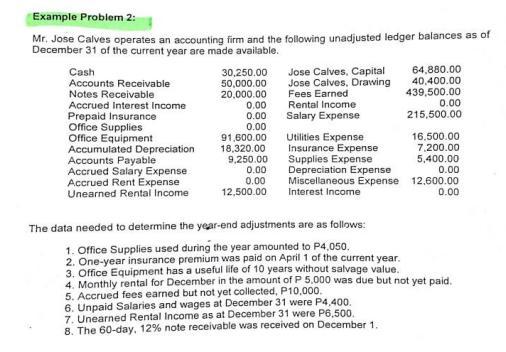

Question: Example Problem 2: Mr. Jose Calves operates an accounting firm and the following unadjusted ledger balances as of December 31 of the current year

Example Problem 2: Mr. Jose Calves operates an accounting firm and the following unadjusted ledger balances as of December 31 of the current year are made available. Jose Calves, Capital Jose Calves, Drawing 64,880.00 Cash 30,250.00 Accounts Receivable 50,000.00 Notes Receivable 20,000.00 Fees Earned Accrued Interest Income 0.00 Rental Income Prepaid Insurance 0.00 Salary Expense 40,400.00 439,500.00 0.00 215,500.00 Office Supplies 0.00 Office Equipment Accounts Payable 91,600.00 Utilities Expense 16.500.00 Accumulated Depreciation 18,320.00 Insurance Expense 7,200.00 9,250.00 Supplies Expense 5,400.00 Accrued Salary Expense 0.00 Depreciation Expense 0.00 Accrued Rent Expense 0.00 Miscellaneous Expense 12.600.00 Unearned Rental Income 12,500.00 Interest Income 0.00 The data needed to determine the year-end adjustments are as follows: 1. Office Supplies used during the year amounted to P4,050. 2. One-year insurance premium was paid on April 1 of the current year. 3. Office Equipment has a useful life of 10 years without salvage value. 4. Monthly rental for December in the amount of P 5,000 was due but not yet paid. 5. Accrued fees earned but not yet collected, P10,000. 6. Unpaid Salaries and wages at December 31 were P4,400. 7. Unearned Rental Income as at December 31 were P6,500. 8. The 60-day, 12% note receivable was received on December 1.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts