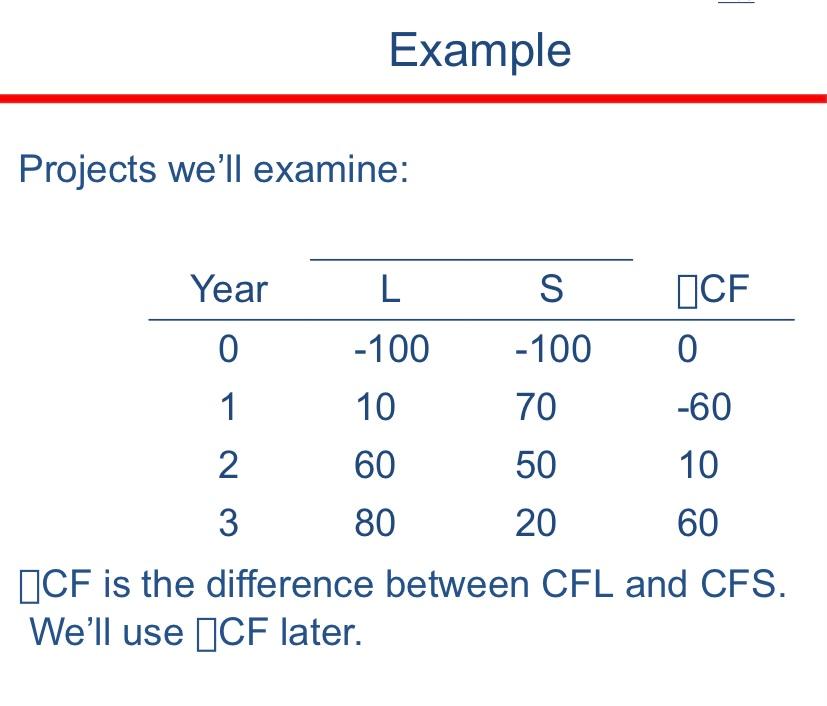

Question: Example Projects we'll examine: Year L S ICF 0 -100 -100 0 1 10 70 -60 2 60 50 10 3 80 20 60 ICF

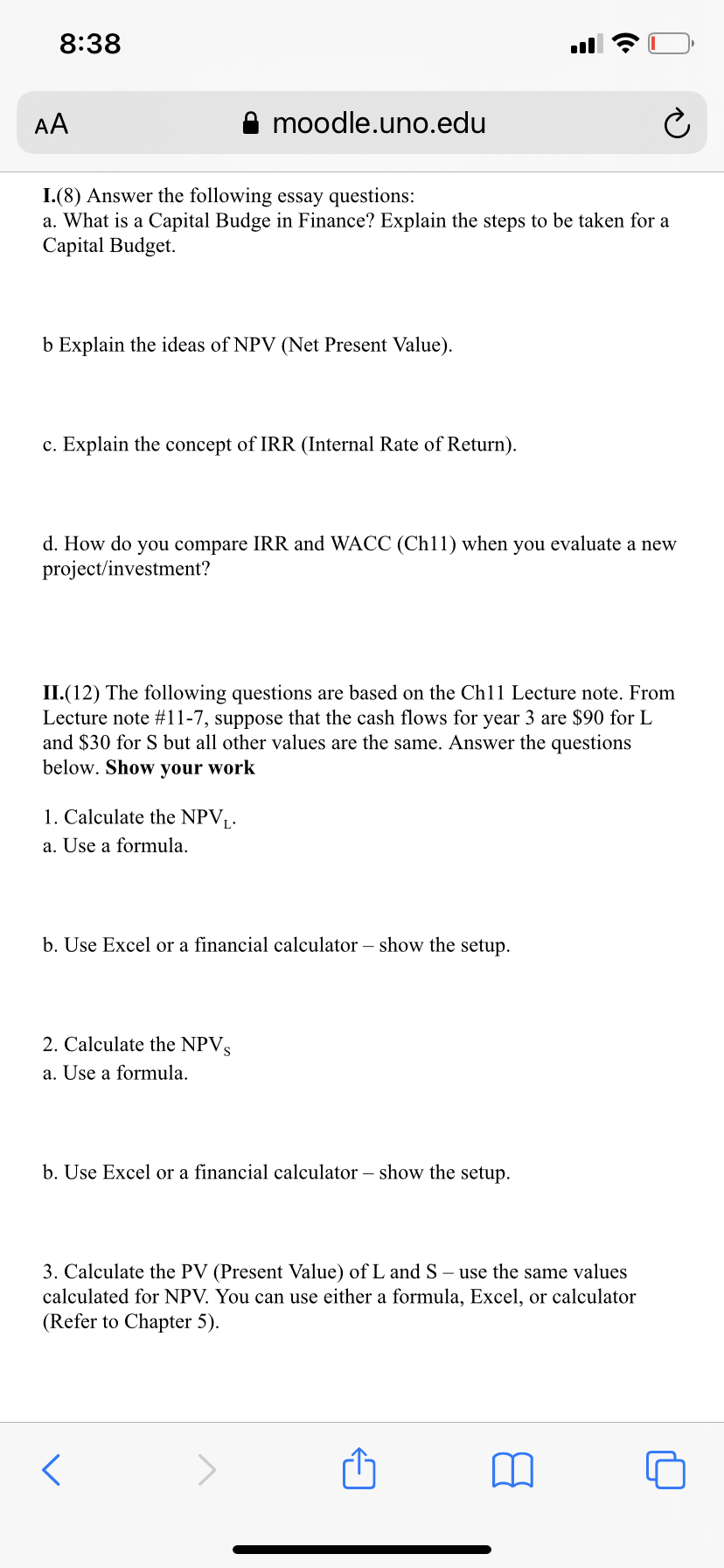

Example Projects we'll examine: Year L S ICF 0 -100 -100 0 1 10 70 -60 2 60 50 10 3 80 20 60 ICF is the difference between CFL and CFS. We'll use CF later. 8:38 & AA moodle.uno.edu I.(8) Answer the following essay questions: a. What is a Capital Budge in Finance? Explain the steps to be taken for a Capital Budget b Explain the ideas of NPV (Net Present Value). c. Explain the concept of IRR (Internal Rate of Return). d. How do you compare IRR and WACC (Ch11) when you evaluate a new project/investment? II.(12) The following questions are based on the Ch11 Lecture note. From Lecture note #11-7, suppose that the cash flows for year 3 are $90 for L and $30 for S but all other values are the same. Answer the questions below. Show your work 1. Calculate the NPV. a. Use a formula. b. Use Excel or a financial calculator - show the setup. 2. Calculate the NPVs a. Use a formula. b. Use Excel or a financial calculator - show the setup. 3. Calculate the PV (Present Value) of L and S - use the same values calculated for NPV. You can use either a formula, Excel, or calculator (Refer to Chapter 5).

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts