Question: Example Suppose that there are only stocks A, B and C selling at $30, $50 and $80. If the three stocks are purchased, then the

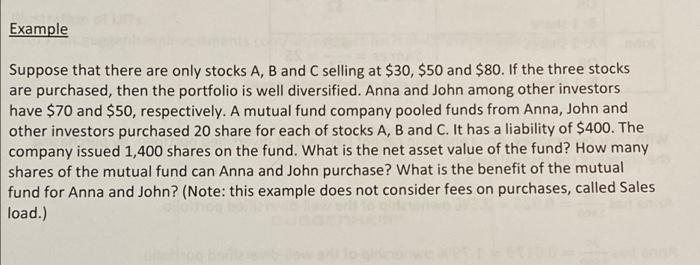

Example Suppose that there are only stocks A, B and C selling at $30, $50 and $80. If the three stocks are purchased, then the portfolio is well diversified. Anna and John among other investors have $70 and $50, respectively. A mutual fund company pooled funds from Anna, John and other investors purchased 20 share for each of stocks A, B and C. It has a liability of $400. The company issued 1,400 shares on the fund. What is the net asset value of the fund? How many shares of the mutual fund can Anna and John purchase? What is the benefit of the mutual fund for Anna and John? (Note: this example does not consider fees on purchases, called Sales load.) He

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts