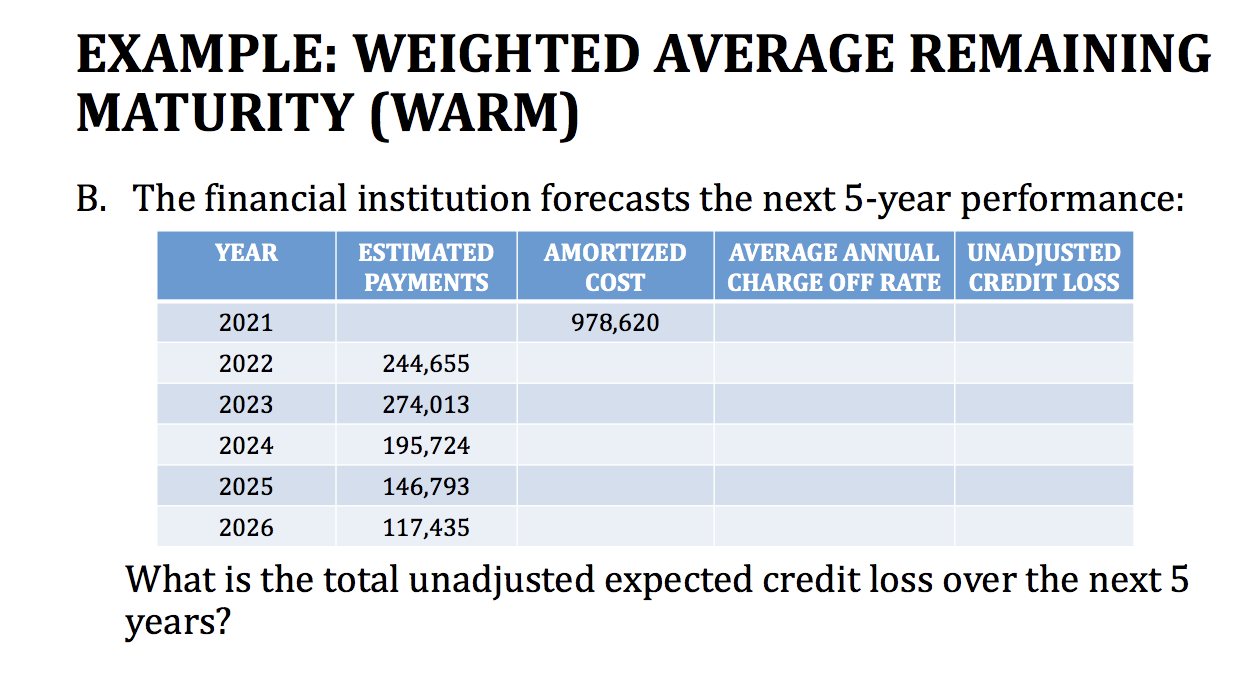

Question: EXAMPLE: WEIGHTED AVERAGE REMAINING MATURITY (WARM) B. The financial institution forecasts the next 5-year performance: YEAR ESTIMATED AMORTIZED PAYMENTS AVERAGE ANNUAL CHARGE OFF RATE UNADJUSTED

EXAMPLE: WEIGHTED AVERAGE REMAINING MATURITY (WARM) B. The financial institution forecasts the next 5-year performance: YEAR ESTIMATED AMORTIZED PAYMENTS AVERAGE ANNUAL CHARGE OFF RATE UNADJUSTED CREDIT LOSS COST 2021 978,620 2022 244,655 2023 274,013 2024 195,724 2025 146,793 2026 117,435 What is the total unadjusted expected credit loss over the next 5 years? EXAMPLE: WEIGHTED AVERAGE REMAINING MATURITY (WARM) B. The financial institution forecasts the next 5-year performance: YEAR ESTIMATED AMORTIZED PAYMENTS AVERAGE ANNUAL CHARGE OFF RATE UNADJUSTED CREDIT LOSS COST 2021 978,620 2022 244,655 2023 274,013 2024 195,724 2025 146,793 2026 117,435 What is the total unadjusted expected credit loss over the next 5 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts