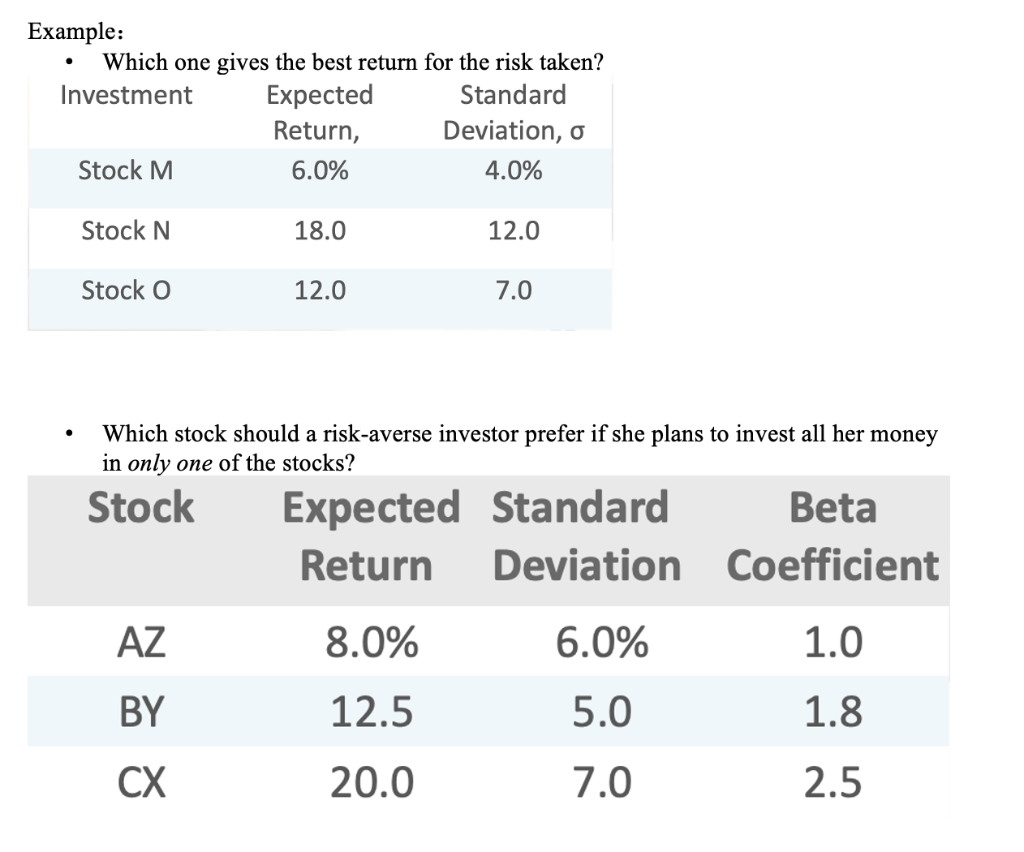

Question: Example: Which one gives the best return for the risk taken? Investment Expected Standard Return, Deviation, o Stock M. 6.0% 4.0% Stock N 18.0 12.0

Example: Which one gives the best return for the risk taken? Investment Expected Standard Return, Deviation, o Stock M. 6.0% 4.0% Stock N 18.0 12.0 Stock O 12.0 7.0 a Which stock should a risk-averse investor prefer if she plans to invest all her money in only one of the stocks Stock Expected Standard Beta Return Deviation coefficient AZ 8.0% 6.0% 1.0 BY 12.5 5.0 1.8 CX 20.0 7.0 2.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts