Question: excel answer only A five-year project has an initial fixed asset investment of $290,000, an initial NWC investment of $25,000, and an annual OCF of

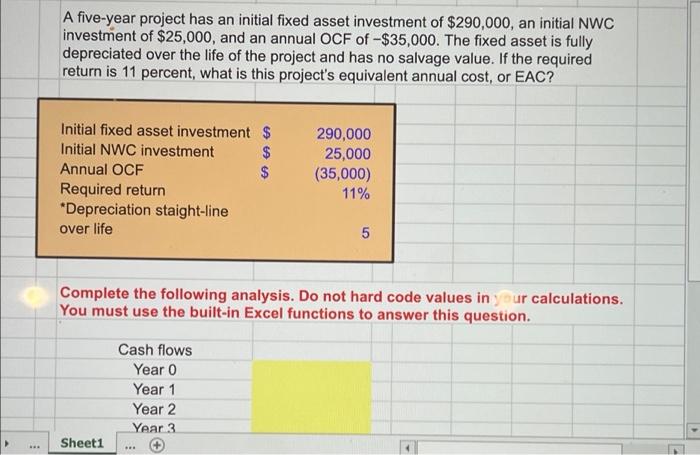

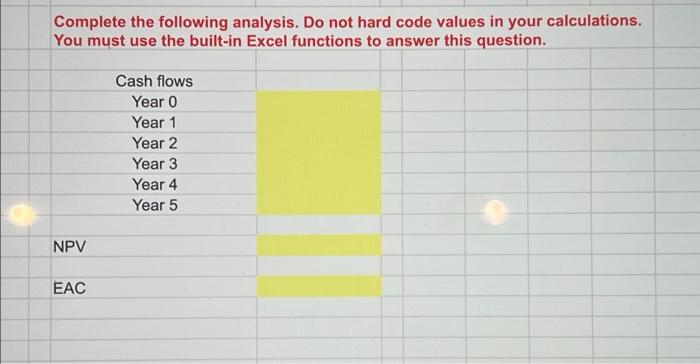

A five-year project has an initial fixed asset investment of $290,000, an initial NWC investment of $25,000, and an annual OCF of -$35,000. The fixed asset is fully depreciated over the life of the project and has no salvage value. If the required return is 11 percent, what is this project's equivalent annual cost, or EAC? A Initial fixed asset investment $ Initial NWC investment $ Annual OCF $ Required return *Depreciation staight-line over life 290,000 25,000 (35,000) 11% 5 Complete the following analysis. Do not hard code values in our calculations. You must use the built-in Excel functions to answer this question. Cash flows Year 0 Year 1 Year 2 Year 3 - Sheet1 Complete the following analysis. Do not hard code values in your calculations. You must use the built-in Excel functions to answer this question. Cash flows Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 NPV EAC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts