Question: Excel Applications A client came to you asking for your advice to create an option strategy that will provide the payoff structure using certain options

Excel Applications A client came to you asking for your advice to create an option strategy that will provide the payoff structure using certain options on Teslas stock. The options should expire in 1 month.

Your task is to create a strategy that meets the clients needs using a combination of the options as specified in the payoff structure .

i) Explain how your client can create the required strategy using options (i.e., what is the mix of options you need for this strategy).

ii) Using a five-step binomial tree approach and showing the inputs you used in your calculation, calculate this strategys cost (or net premium received). Assume the rf is 1.5% with quarterly compounding. Refer to the CME to obtain Teslas implied volatility.

iii) Draw the payoff and profit (loss) diagram.

iv) Based on the prices you calculated for the options, at what price (or prices) of the underlying stock will the strategy breakeven? v) What assumptions did the client make that motivates the creation of this strategy?

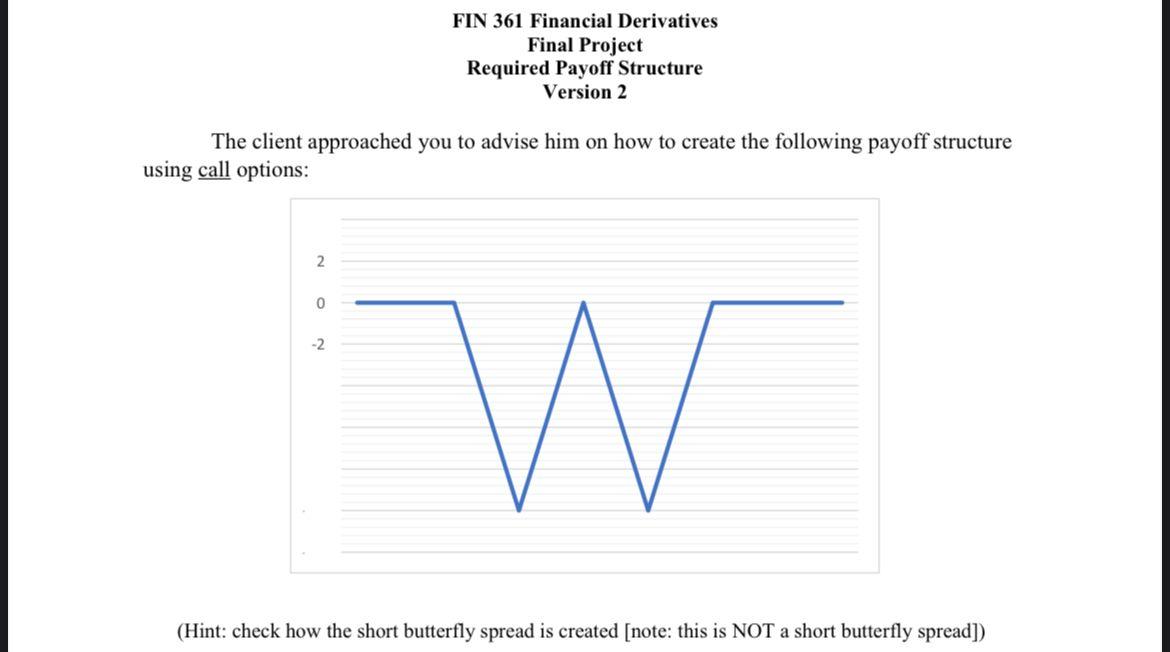

FIN 361 Financial Derivatives Final Project Required Payoff Structure Version 2 The client approached you to advise him on how to create the following payoff structure using call options: 2 0 -2 W (Hint: check how the short butterfly spread is created [note: this is NOT a short butterfly spread]) FIN 361 Financial Derivatives Final Project Required Payoff Structure Version 2 The client approached you to advise him on how to create the following payoff structure using call options: 2 0 -2 W (Hint: check how the short butterfly spread is created [note: this is NOT a short butterfly spread])

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts